Key Points

- During the month of Ramadan, Muslims worldwide tend to give more to charity.

- Afghan community members often direct their charitable efforts towards vulnerable people in Afghanistan.

- There are many different methods which are used by people to transfer money overseas, such as bank transfer and remittance services.

During this holy month of Ramadan, Muslims often engage in various forms of charity, such as Zakat, which is the third Pillar of Islam.

Individuals are also encouraged to set aside a proportion of their yearly wealth for charity or to make an additional voluntary donation, called Sadaqah.

Helping Needy Afghans (HNA) is a registered, non-profit charitable organisation, that collects donations from Australian-based Afghans.

HNA founder Khalid Janbaz said the group aimed to, help those living in “extremely hard circumstances” in Afghanistan which is grappling with an “unprecedented” humanitarian crisis.

The group places extra significance on assisting those experiencing extreme poverty, orphans, widows, and people with disabilities, he explained.

“In 2023, a staggering 28.3 million people – or two-thirds of Afghanistan’s population – required urgent humanitarian assistance to survive,” he said.

“Afghanistan is currently facing a rapid economic decline, hunger and risk of malnutrition, inflation driven by global commodity shocks, drastic rises in urban and rural poverty, a near-collapse of the national public health system and almost total exclusion of half the population – women and girls from public life.”

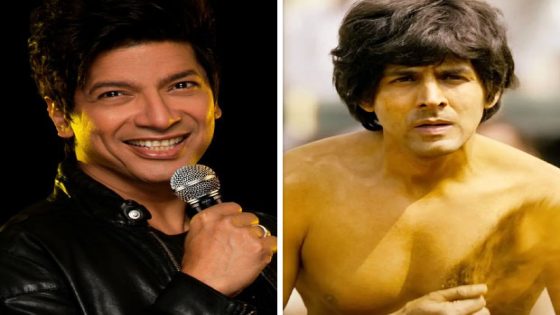

Khalid Janbaz is the founder of Australia-based registered charitable organisation, Helping Needy Afghans (HNA).

Muslims noticeably donate more during Ramadan and this year, the funds were helping to facilitate five projects in Afghanistan, including providing food packs, hot meals, clothes for Eid for orphaned children, wheelchairs, and sewing machines for women, Janbaz explained.

He said the act of giving during Ramadan was not only a means of fulfilling religious obligations but also a way to “purify” one’s wealth and seek spiritual rewards.

“During this month, Muslims around the globe paid their Zakat Al Fitr, Zakat Al Maal, Fidya, Sadaqa and donations are on average between $60,000 and $100,000,” Janbaz said.

‘Everything gets expensive’ during Ramadan

Shamsurahman Mamond is a former Australian Defence Forces (ADF) interpreter and cultural advisor in Afghanistan, who has lived in Newcastle with his family for the past nearly nine years.

He has been financially supporting his parents and siblings overseas and also sends money to his homeland to support those in need during Ramadan.

“I’m sending more financial support than I normally do because, during the holy month of Ramadan, everything gets expensive,” he said.

“It’s so hard for me when people send me messages and ask for some help, (and) unfortunately I can’t help everyone, but I try my best as much as I can.”

Shamsurahman Mamond, former Australian Defence Forces (ADF) interpreter and cultural advisor in Afghanistan. Credit: Facebook/Shamsurahman Mamond

Remittance and Hawala services

It’s common among Australian Afghans to transfer money overseas via remittance services or an alternative money-transferring method called , according to Sydney-based remitter and mortgage broker, Asif Barez.

He claimed to have introduced the “remitter business” in the form of Hawala to the Afghan community in Australia in 1998.

“Hawala, sometimes referred to as ‘underground banking’, is a method of transferring money without any physical currency movement. It’s essentially a money transfer without money movement or based on trust. Today, Hawala serves as an alternative remittance channel existing outside traditional banking systems,” he said.

Initially, the only requirement to enter the Hawala business was registration. However, now we must also register with the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a remitter, and every International Funds Transfer Instruction (IFTI) must be reported to AUSTRAC within 10 business days, he explained.

“Afghans prefer remittance services over bank transfers due to several reasons, including lower fees, faster service, lack of active banks in Afghanistan, higher bank fees, and better exchange rates.”

Asif Barez is a remitter and mortgage broker in Sydney. Credit: Supplied

Money transfers surge during Ramadan

During Ramadan, as Muslims increase charitable giving, there’s a corresponding uptick in money transfers overseas, Barez said.

“The month of Ramadan sees an increase in Hawala transfers, attributed to increased charitable giving, rising product prices, and preparations for Eid celebrations. Typically, Hawala transfers surge by 25 to 35 per cent during Ramadan,” he said.

“Since the Taliban’s takeover, Afghanistan has faced humanitarian crises, leading to increased Hawala transfers from Australia to Afghanistan to support families and friends struggling with poverty and displacement.”

Data from the Global Knowledge Partnership on Migration and Development (KNOMAD), which is an initiative of the World Bank, reveals that in 2022, the remittance outflow from Australia was $6.546 million, while the remittance inflow was $1.298 million in the same period.

Registered remittance services provider

AUSTRAC works closely with the remittance sector to continually raise awareness of its responsibilities and to support them in fulfilling their compliance and reporting requirements.

An AUSTRAC spokesperson told SBS Pashto that individuals had the option to, use either a remittance provider or a financial institution for sending money abroad.

“It is a legal requirement under the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Act, for all remittance service providers to register with AUSTRAC. It’s important that remittance customers check they are using a registered remittance service provider by searching our online register,” the spokesperson said.

“AUSTRAC’s role is to ensure that all regulated entities comply with their obligations under the AML/CTF Act.

“Reporting entities are required to identify, mitigate and manage their risk, including having appropriate systems, controls and governance in place, and reporting financial information and suspicious matters to AUSTRAC.”

The spokesperson added that financial institutions and other regulated businesses including remittance providers, had to submit reports to AUSTRAC, including reports of international funds transfer instructions (IFTIs).

“IFTIs are a key source of information to AUSTRAC and are used to protect Australia’s financial system and community from harm,” the spokesperson added.