Josie Dom, 53, was thrilled when she moved into her new home in October.

She bought 30% of it through the shared ownership scheme as an affordable route to home ownership, even if it was only partial ownership.

The idea is to help people who would not be able to buy a home outright get on to the housing ladder earlier by buying a share of a property and paying subsidised rent on the rest – often to a non-profit housing association.

Without it, she says there was no way for her and her two children to stay in Colchester, where they love living and attend school and college.

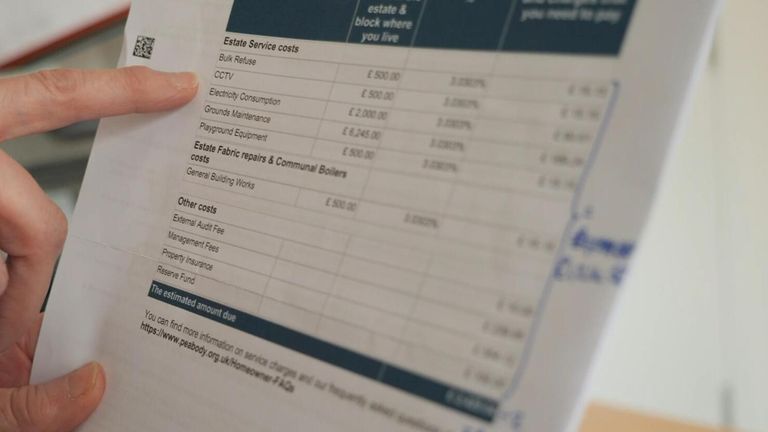

But her enthusiasm started waning when after just six months, the housing association increased the building’s service charges by 138%, from £85 to £202 per month.

While she had anticipated small annual rises, this unexpectedly large jump was unaffordable.

“Obviously the idea of shared ownership is to help people like me that wouldn’t otherwise be able to afford their own home,” said Ms Dom.

“Then suddenly, again, we can’t afford it. It makes a mockery of being shared ownership and having social housing.”

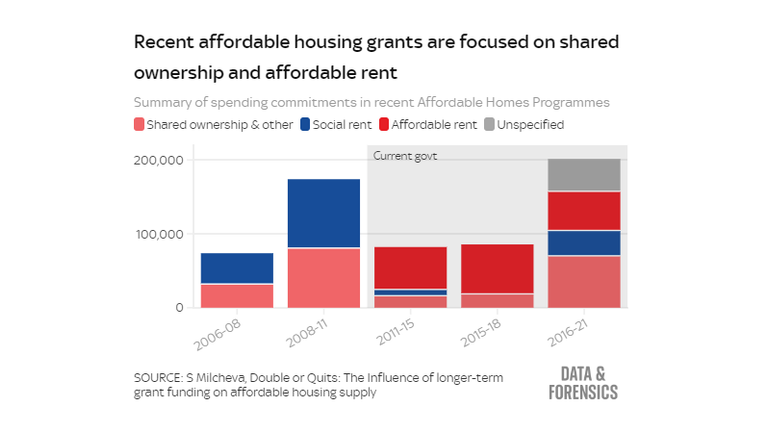

The expanded scheme now makes up half of affordable homes funding.

Sky News has been approached by dozens of other shared owners facing soaring costs and other issues, including difficulty selling.

With rising mortgage costs this relatively cheaper option appears to be increasingly appealing to buyers.

Rightmove, the UK’s largest online property website, told Sky News shared ownership properties are taking 56 days to sell versus 65 days for all other properties on average, as of March 2024.

And interest has increased over time – they said demand is up 37% from a year ago for shared ownership properties.

Initially low costs can be misleading, however.

Barry Gardiner, Labour MP for Brent, was on the government’s shared ownership cross parliamentary report committee.

He told Sky News: “They don’t actually have the rights of control that full ownership ought to give because you are both a tenant and a share in the ownership – and you’re paying the full service charge on the property.

“People just find it a desperate trap.”

Record numbers are seeking legal advice

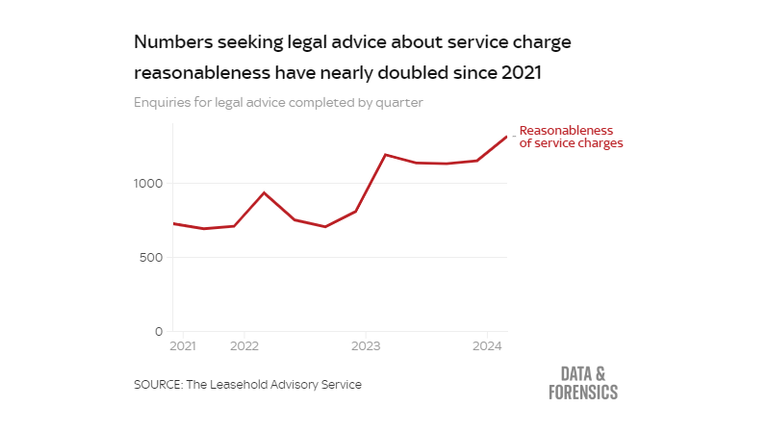

Data from The Leasehold Advisory Service (LEASE) shows the number of leaseholders seeking legal advice about service charges has increased in recent years.

The number of enquiries dealt with about the reasonableness of service charges has nearly doubled compared with 2021.

There were over 1,300 enquiries in the three months to March 2024, the highest number since records beginning in 2018.

LEASE joint CEOs Sally Frazer and Alice Bradley told Sky News they are concerned about the increase, “particularly over the last year”.

“More broadly we know there is still not enough awareness of the service and support our organisation can offer,” they added.

Feeling trapped

Affordability and freedom are typical selling points advertised to buyers, as well as the opportunity to “staircase” towards higher ownership shares while saving money on rent.

But for Alex, who bought 25% of his north London flat in 2019, the very opposite has been true. The dream of home ownership has become a nightmare, leaving him and many others in his building feeling trapped.

In February, residents were told by their property management company James Andrew Residential (JAR) that the service charge would be more than tripling, from £500 to £1,700 per month from April.

His rent and service charge are now over £2,900 per month, and the mortgage is an additional £800.

“My partner and I just got engaged, but we can’t plan the wedding. All our money is going to keeping us in the flat, and now we’re using up our existing savings,” he told Sky News.

“In 2019 it seemed like a great affordable option, but now we would be better off if we were renting and are worried about being able to sell at all.”

In response to residents’ concerns, the property managers JAR told Sky News they were engaging with owners and investigating the matter to see if costs can be mitigated.

Islington and Shoreditch Housing Association, who own the other share of Alex’s flat, told Sky News the service charge increase is “outrageous and not justifiable”.

They said: “We firmly disagree with JAR’s assessment that the residents should bear such major maintenance costs for a six-year-old building”.

“We will be challenging the cost increase on behalf of our residents and will go to tribunal to fight it if we must.”

Leasehold reform is needed

The issue of leasehold charges is not unique to shared owners and has been recognised as a wider industry issue.

“The problem lies in the leasehold structure of the housing market and its application to shared ownership,” said Stanimara Milcheva, Professor in Real Estate Finance at University College London.

Service charges are often dictated by the management company which may also own the freehold.

Prof Milcheva added there should be more transparency, so shared ownership buyers have more access to relevant information about service charges in their region.

The government introduced the Renters Reform Bill to parliament in 2023, a piece of legislation that aims to improve conditions for renters, but which has wider implications for the leasehold sector.

Its proposed measures to regulate service charges include greater transparency and breakdowns of costs, and the exclusion of insurance costs. But it is unclear when, or if, the currently delayed Bill will make it through Parliament in its present form.

These issues do have the potential to cause more financial stress to shared owners, who are typically earning lower incomes than those who buy their first home outright.

From preliminary research, Prof Milcheva and colleagues found that the gross income of the main first-time shared ownership buyer was on average 23% lower, at £42k compared to £55k for those buying outright, between 2015 and 2023.

The most affected region is London

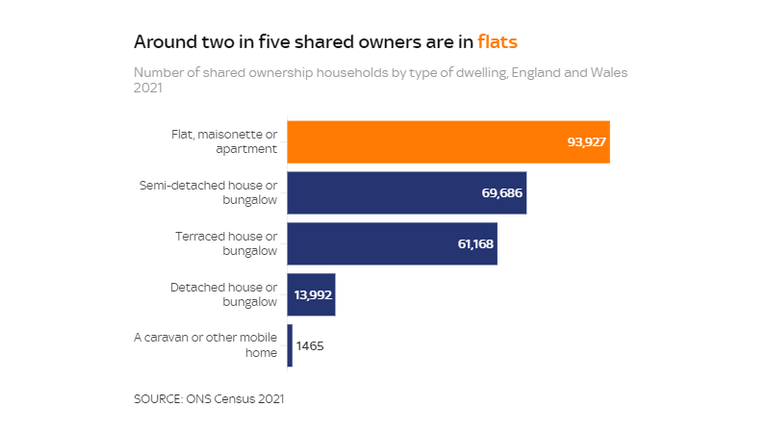

Service charges do not affect all shared owners, as although most are leaseholders the majority live in houses.

Still, close to 94,000 (40%) of shared ownership households are in flats, based on the latest estimates from the 2021 Census.

Nearly half of these (43,000 households) are in London, while outside of London the proportion of those in flats falls to 27%.

“Service charges are more of a problem in London, where pretty much the entire stock of shared ownership are apartments,” said Prof Milcheva.

This has an impact on the relative costs of service charges, which are as much as triple the price in London relative to rent costs, at 30% of rent compared to 10%-13% in other areas, according to their research.

Shared ownership has now overtaken social rent

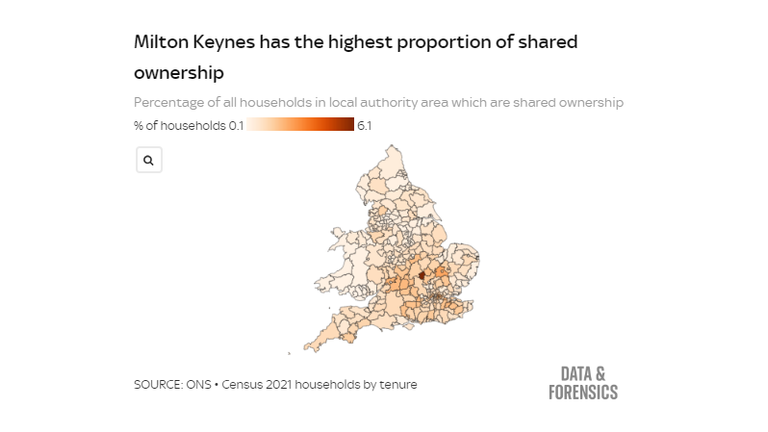

Shared ownership makes up a relatively small percentage of households overall, at around one in 100 according to the latest Census data – with slightly higher concentrations in some areas, mostly in the south of England.

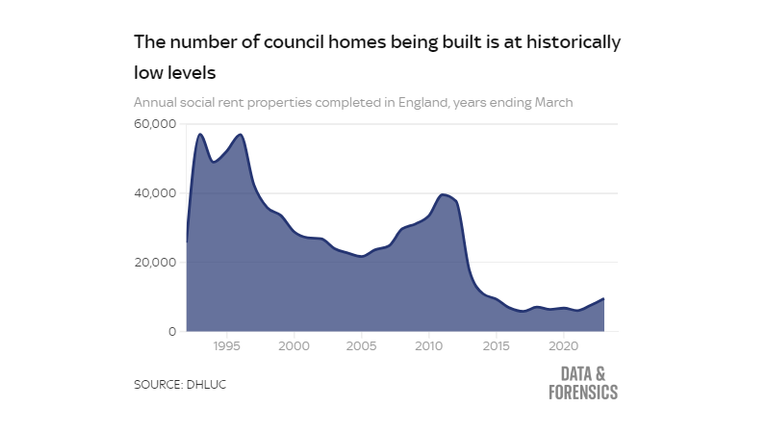

However, it does now make up a half of new funding spent on affordable housing, overtaking social rent as the main type of publicly subsidised housebuilding under the current government.

The main types of affordable housing tenures are social rent, affordable rent (which is less subsidised than social rent, at up to 80% of market rates) and shared ownership.

There has been more incentive for developers – who often have a quota of affordable housing to meet set by local authorities – to build shared ownership or affordable rent properties.

The Affordable Homes Programme, which has been the primary funding source for new affordable homes since 2011, has also switched focus away from social rent towards shared ownership and affordable rent.

This trend continued in the latest funding commitment for 2021-2026, with 50% of the £11.5bn allocated for 162,000 new affordable homes earmarked for shared ownership, with the other 50% split between social rent and affordable rent.

As a result of the lack of incentive to build social rent properties, the number of new builds is at historically very low levels with less than 10,000 completed in 2022/23.

A DLUHC spokesperson said: “Through our long-term plan for housing, we are investing £11.5bn in the Affordable Homes Programme and remain on track to build one million over this Parliament.

“Shared ownership has a vital role to play in helping people onto the property ladder, and since 2010 we have delivered approximately 156,800 new shared ownership homes.”

They said they are taking action to ensure the shared ownership scheme provides the best value for owners, including proposals to give the right to extend leases by 990 years in the Leasehold and Freehold Reform Bill.

“I feel bad pushing the problems onto someone else, but I want to get out”

The Levelling Up, Housing and Communities Committee‘s (LUHCC) cross-parliamentary report noted as well as the issues of rising rents and uncapped service charges, shared owners have “a disproportionate exposure to repair and maintenance costs”.

Despite improvements to shared ownership leases from 2021, with the introduction of a 10-year period for repairs, they say more can be done to make costs proportionate to the size of share owned, including proportional service charges as well maintenance costs.

“Then the housing association will have ‘skin in the game’ and might be incentivised to better scrutinise service charges and property management companies,” said Prof Milcheva.

Meanwhile, owners of earlier contracts remain responsible for 100% of costs, regardless of if the property has changed hands.

This creates a “two tier” system, where older properties become unattractive and harder to sell, according to the report.

Will Eggleston, a 33-year-old metalworker bought 50% of his Southwest London flat in 2019.

His service charge has more than doubled since then, from £200 to over £400 a month, with most of the increase happening in the past year.

“There’s just no visible benefit and no explanation to it. The building is in worse condition than when I moved in. The garden has died, the hall is in a bad state,” he said.

His building is one of many high rises to have been impacted by cladding safety concerns and costs of remediation following the 2017 Grenfell Tower fire tragedy.

“L&Q – who are my head lease, hadn’t mentioned anything about cladding or anything when I was purchasing the flat,” said Mr. Eggleston.

This can be a particular issue for shared owners with covenants that prevent them subletting properties they can no longer afford to live in at market rates.

A spokesperson for L&Q said: “L&Q is a charitable housing association and does not make profits from service charges.”

Kinleigh Folkard & Hayward (KFH), the property managers at Mr Eggleston’s building, said that the doubled service charge is due to increases in general maintenance and cleaning, insurance, electricity, and reserve funds for future works.

They added that they would have made the resident aware of the facts known about cladding at the time he purchased his apartment.

Activist group End Our Cladding Scandal say the government and housing providers have failed to mitigate the impact of the building safety crisis on shared owners.

They said: “This has already led to repossessions and forced shared owners into distressed sales to cash buyers.

“Others have had to become “accidental landlords”, forced into loss-making subletting agreements while their neighbours, who are private leaseholders, can rent out their flats at whatever rate they choose.”

Meanwhile, the high service charges and ongoing cladding issues are getting in the way of Mr Eggleston’s hopes to sell and move out.

“I feel bad pushing the problems onto someone else. But on the other hand, I want to get out,” he said.

Calls for more transparency

Shared ownership can have a positive role for those who do not qualify for other government affordable homes schemes but cannot access full ownership, being on average cheaper than private renting, according to Prof Milcheva and colleagues’ research.

But there are some key data gaps, including on how common it is for people to staircase up to higher shares of ownership, which make it hard to assess the overall success of the scheme.

Rhys Moore, executive director of public impact at the National Housing Federation, said: “Shared ownership remains an important route to home ownership for many households and we support measures to improve residents’ experience through greater transparency around costs and improved access to information, as well as better government data on the product.”

Ann Santry, chair of Shared Ownership Council said: “We acknowledge the need for further reforms of the tenure to help shared ownership fulfil its potential as an affordable home ownership model.”

In Josie Dom’s case, after being contacted by Sky News her building’s Housing Association Peabody said it had made a mistake and would be issuing a correction letter to residents.

A spokesperson for Peabody said: “It’s important to us that service charges are accurate and reasonable. This was an error and we’re really sorry. No one has been overcharged and we’ve written to those affected.”

At the time of publication, the issue remains unresolved, and residents have not yet received this information.

Josie is in rent arrears. “It’s a crazy amount of stress to go through,” she said.

With additional reporting and production by Michelle Inez Simon, visual investigations producer, and Tom Cheshire, Data & Forensics correspondent

Source Agencies