The chief executive of British Gas has said every household should be forced to have a smart energy meter to help hit net zero targets, despite widespread resistance to the devices.

Chris O’Shea has urged ministers to make it “mandatory” to have a smart meter in order to help hit the government’s target of getting the devices into 100pc of homes.

Mr O’Shea, the chief executive of British Gas-owner Centrica, told MPs on the Commons energy select committee: “We think that in order to have the proper smart grid that’s required to keep costs low in the future, everybody should have a smart meter.

“One of the things we should consider as to whether this is a voluntary programme, or whether it should be mandatory.”

Smart meters measure gas and power use and transmit the data to home digital display units, so consumers can monitor consumption. They also send the data to energy suppliers so there is no need to send somebody to read the meter.

Proponents argue that smart meters can help manage energy wastage, helping to keep fuel consumption to a minimum and so help the environment.

The programme to install them was initiated in 2009 by Ed Miliband, the then energy secretary. About 35m are now installed in homes and small businesses but this represents only 61pc of all meters. The rest are old-style analogue meters.

Additionally, about 4m of those 35m smart meters have since failed, meaning that only 31m are actually operating in smart mode, according to the government’s latest data.

The energy industry is obligated to hit annual targets for the installation of smart meters as part of licence requirements and companies can face enforcement action, including fines, for failing to meet their goals.

However, many operators have struggled amid public apathy, and in some cases outright resistance to, the devices.

Mr O’Shae said 36pc of his 7.5m customers have ignored multiple offers to install a smart meter and around 600,000 had actively told British Gas they would never accept the devices.

He told MPs: “I have customers that write to me saying please stop bothering me. I don’t want a smart meter.

“We found that 44pc of our customers don’t have them, of whom 600,000, or about 8pc, have said they don’t want one. So for 36pc of customers we are not sure whether they will take one or not.”

The conversion of all meters was meant to be complete by 2020 when first envisaged by Mr Miliband but civil servants underestimated the time needed to install electricity and gas meters, display monitors and wireless networks, a job that requires around 104m pieces of new equipment for the whole country.

Mr O’Shea said the most efficient approach would be to install them “street by street rather than customer by customer”.

He added: “If you mandated it then we could have that programme completed within the next five years.”

Mr O’Shea, who was paid £8.2m last year, said resistance to smart meters was misguided.

He told MPs: “Gas consumption falls by 3.5pc and electricity consumption falls by 3pc if you have a smart meter.

“It means those customers who don’t have smart meters will, on average, be paying more because they’ll be consuming more energy.”

06:03 PM BST

Signing off…

Thanks for joining us today. Chris Price will be back bright and early tomorrow morning to keep you informed with the latest markets news. In the meantime, I’ll leave you with our report that Tesla is ‘under investigation for fraud’ over self-driving claims.

05:36 PM BST

Sky turns to streaming to shore up sports subscriptions

Sky is to launch a new sports streaming service in an attempt to shore up subscriptions amid fierce competition for viewers. James Warrington has the details:

The media giant is to show up to 100 events across sports including football, tennis and golf simultaneously on the service, Sky Sports+.

Customers will be able to access it via live streams and a mobile app, as well as through a new dedicated channel.

The service, which will be embedded in Sky’s existing TV products and streaming service NOW, underscores a renewed focus on sports as broadcasters and US tech giants battle for prominence in an increasingly crowded market.

Sky last year struck a record £935m deal with the English Football League (EFL) to broadcast more than 1,000 matches per season.

The Comcast-owned business also acquired the largest ever package of Premier League football rights in a £6.7bn deal at the latest auction.

05:30 PM BST

Used car dealer Cazoo poised to enter administration

The online car supermarket Cazoo is on the brink of insolvency after failing to secure emergency funding. Matthew Field reports:

The digital used car business, founded by former Zoopla boss Alex Chesterman, has filed a notice that it intends to appoint administrators at the High Court.

It marks a dramatic fall from grace for the British car dealer, which was valued at over $8bn (£6.4bn) after floating on the New York Stock Exchange in 2021.

Cazoo’s share price later plunged and it was forced into a series of restructurings and refinancings in an effort to survive, including a $630m debt-for-equity swap completed in December.

Cazoo admitted last week that it needed to raise further cash, but added that there were no offers to provide outside capital and it was burning around £30m every three months. Bosses said they were exploring alternative solutions, including selling parts of the company.

Read the full story…

05:27 PM BST

FTSE 100 at records highs as a weak pound gives its ‘a bit of a kicker’

The FTSE 100 hit a new record high today after reaching 8,354.05 points at the close, a day before the Bank of England has another interest rate meeting. Russ Mould, investment director at AJ Bell, said:

The FTSE 100 continues to forge to new all-time highs with sterling weakness providing the index with a bit of a kicker.

A fall in the domestic currency is typically helpful to the FTSE 100 because it boosts the relative value of its dominant overseas earnings.

Currency traders are betting against the pound ahead of the Bank of England’s latest meeting tomorrow, amid a growing expectation it will cut rates earlier than counterparts at the US Federal Reserve.

It’s extremely unlikely there will be any action tomorrow but the market will be watching the surrounding commentary for any clues on when the Bank of England might take the plunge on rates.

Other top European markets also rose. Germany’s Dax rose 0.31pc, while France’s Cac 40 was up 0.69pc at close.

05:09 PM BST

Heathrow says schedules will remain as normal even if strikes return

Heathrow Airport has released a statement this afternoon after progress in its talks with Unite. It said:

Unite has suspended more strike dates after we repeated our assurances that we have no further planned changes to operational teams.

The changes announced earlier this year will continue as planned and those colleagues are being supported through the process, with a guaranteed job at Heathrow.

While Unite has recommended its members accept these assurances and end the dispute, passengers can be assured we will keep schedules operating as normal if strikes were to return.

04:55 PM BST

Footsie closes up

The FTSE 100 closed up 0.5pc today. The biggest riser was IAG, up 3.7pc, followed by insurer Beazley, up 3pc. The biggest faller was Ocado, down 3.9pc, followed by pensions group Phoenix, up 1.7pc.

The FTSE 250 rose 0.4pc. The biggest riser was John Wood, up 16.9pc, followed by Wizz Air, up 5.3pc. The biggest faller was property company Tritax EuroBox, down 6.9pc, followed by North Atlantic Smaller Companies Investment Trust, down 5pc.

04:52 PM BST

US to set new rules limiting investment in China by end of the year

US Commerce Secretary Gina Raimondo said this afternoon that she expects that rules implementing US outbound investment restrictions on China will be completed by the end of the year.

President Joe Biden in August issued an executive order authorising allowing the US Treasury Secretary, currently Janet Yellen, to prohibit or restrict US investments in Chinese entities in three sectors: semiconductors and microelectronics, quantum information technologies and certain artificial intelligence systems.

Ms Raimondo said she expects the Treasury to complete the rules by the end of 2024. Her department is “helping them to figure out which pieces of AI should we be most worried about, which kinds of companies should we be most worried about?”

Mr Biden’s order aims to prevent American money and expertise from helping China develop technologies that could support its military modernisation. “We can’t let them have our money and know-how,” Ms Raimondo said.

04:39 PM BST

Shell sells Singapore’s oldest oil refinery

Shell is selling a refinery and chemicals manufacturing business in Singapore to a joint venture run by Glencore and Indonesia’s PT Chandra Asri Pacific.

The business being sold, known as the Shell Energy and Chemicals Park Singapore, involves a 237,000 barrels-per-day refinery and a 1.1 million tonnes-a-year ethylene cracker. It was Singapore’s first refinery, and opened in 1961.

It is also selling a chemicals manufacturing business taking up 60 acres of Jurong Island in Singapore. Shell said it is currently the oil company’s largest petrochemical production and export centre in the Asia Pacific region.

The company said that it was “a testament to our commitment to deliver more value with less emissions”.

04:29 PM BST

Drug development could be faster after AI upgrade

Google Deepmind has unveiled the third major version of its “AlphaFold” artificial intelligence model, designed to help scientists design drugs and target disease more effectively.

In 2020, the company made a significant advance in molecular biology by using AI to successfully predict the behaviour of microscopic proteins.

With the latest incarnation of AlphaFold, researchers at DeepMind and sister company Isomorphic Labs – both overseen by co-founder Demis Hassabis – have mapped the behaviour for all of life’s molecules, including human DNA.

The interactions of proteins – from enzymes crucial to the human metabolism, to the antibodies that fight infectious diseases – with other molecules is key to drug discovery and development.

DeepMind said its latest findings, published in research journal Nature on Wednesday, would reduce the time and money needed to develop potentially life-changing treatments.

Mr Demis Hassabis said:

With these new capabilities, we can design a molecule that will bind to a specific place on a protein, and we can predict how strongly it will bind.

Dr Nicole Wheeler, an expert in microbiology at the University of Birmingham, said AlphaFold 3 could significantly speed up the drug discovery pipeline, as “physically producing and testing biological designs is a big bottleneck in biotechnology at the moment”.

04:19 PM BST

US official says Chinese seizure of TSMC in Taiwan would be ‘absolutely devastating’

US Commerce Secretary Gina Raimondo has said that a Chinese invasion of Taiwan and seizure of chips producer TSMC would be “absolutely devastating” to the American economy.

Asked at a US House of Representativeshearing about the impact, Ms Raimondo said “it would be absolutely devastating,” declining to comment on how or if it will happen, adding: “Right now, the United States buys 92pc of its leading edge chips from TSMC in Taiwan.”

She noted that TSMC has announced it will build more advanced chips in Arizona.

04:16 PM BST

China criticises US for further tightening chip exports

The American government yesterday revoked some licences for exports to Chinese tech giant Huawei, drawing opposition from Beijing today.

Reuters has named Intel and Qualcomm as companies affected.

The move came after criticism last month by Republican lawmakers, who urged President Joe Biden’s administration to block all export licences to the company after it released a new laptop powered by a processor by US chip giant Intel.

The Commerce Department told AFP:

We are not commenting on any specific licences, but we can confirm that we have revoked certain licences for exports to Huawei.

Sanctions in 2019 restricting Huawei’s access to US-made components dealt a major blow to its production of smartphones – and meant that suppliers need a licence before shipping to the company.

China’s commerce ministry accused the US government today of a “typical practice of economic coercion”. It added:

The U.S. has generalised the concept of national security, politicised economic and trade issues, abused export control measures … China is firmly opposed to this.

Intel declined to comment. Qualcomm told The Telegraph:

The Commerce Department has revoked certain export licenses for Huawei in our industry, including one of our licenses. We will continue to comply with all applicable export control regulations.

03:59 PM BST

Private equity group takes stake in Farrow & Ball’s owner

A private equity house is buying a stake in the owner of the wallpaper and paint business Farrow & Ball, the FT has reported.

CVC Capital Partners is buying a minority stake of the Danish coatings and paints group Hempel, which has owned Farrow & Ball since 2021.

Hempel is itself owned by the Hempel Foundation, which will remain the group’s biggest shareholder.

Richard Sand, chairman of the Hempel Foundation, told the FT:

“The Hempel Foundation has been the sole owner of Hempel for 75 years. After careful consideration, the Hempel Foundation has decided to welcome a minority investor that brings both unique experience and capital to support Hempel’s accelerated growth journey.”

Farrow & Ball was founded in 1946 by John Farrow and Richard Maurice Ball in Dorset.

03:44 PM BST

Mike Ashley’s Frasers Group in pole position to buy Ted Baker UK

The retail group controlled by billionaire Mike Ashley is closed to buying Ted Baker’s UK licensing partner, according to a report.

Sky said that Frasers Group could reach an agreement with the administrators of No Ordinary Designer Label, which runs Ted Baker’s UK operations, within the coming days. The broadcaster cited retail industry sources.

The Telegraph has approached No Ordinary Designer Label for comment. Frasers declined to comment.

03:31 PM BST

Handing over

I’m heading off now and I’ll pass the blog reins over to my perennial evening colleague Alex Singleton.

On the subject of evergreens, here is a picture taken today of salads being grown in Turkey’s first commercial vertical farm, dubbed Plant Factory.

The site has begun shipping vertically grown greens to supermarkets and restaurants in Istanbul over the past year.

03:07 PM BST

ECB not necessarily in race to cut rates, insists policymaker

The European Central Bank will not necessarily race to cut interest rates in June, one of the eurozone’s monetary policymakers has said.

Governing Council member Robert Holzmann, who is one of the most “hawkish” members of the group of rate setters, warned against any rushed action at the bank’s next meeting.

The ECB is expected to cut interest rates by a quarter of a point from its record high of 4pc on June 6, in a move which will put it a step ahead pf the US Federal Reserve, and most likely the Bank of England.

Mr Holzmann told Bloomberg:

First of all, the basic prerequisite for the first rate cut must be met, namely that there is a high probability that we will reach our inflation target by mid-2025.

If that time comes in June, further steps will certainly follow. But I see no reason at all for us to cut key rates too much too quickly.

Every step we take is dependent on the data available at that time. We will have a lot of new data and forecasts in September and December. However that’s hardly the case in July.

He added: “To a certain extent, our data and decisions are naturally influenced by the Fed. We don’t operate in a vacuum. The Fed with the dollar is, figuratively speaking, the gorilla in the room.”

02:54 PM BST

Wincanton takeover to be investigated by competition regulator

The UK competition watchdog has opened an investigation into the £762m takeover of road haulage operator Wincanton.

Our reporter Michael Bow has the details:

The Competition and Markets Authority will examine GXO Logistics’ acquisition of the FTSE 250 haulage group to detect if the merger leads to higher prices for businesses.

Wincanton moves goods around the country for supermarkets including Sainsbury’s and Asda. They are likely to be asked to give their verdict on the deal as part of the CMA investigation.

GXO, which also owns Clipper Logistics, snapped up Wincanton in a £762m deal earlier this year.

It had fought off competition for Wincanton from French suitor CMA CGM, paying a knock-out 100pc premium to Wincanton’s share price to win the deal.

Regulators at the CMA can clear the deal after eight weeks or push for an in-depth inquiry lasting four months.

The watchdog has already taken aim at GXO after investigating its takeover of Clipper Logistics in 2022. That takeover was ultimately cleared by the regulator.

02:35 PM BST

Wall Street slumps amid uncertainty over rate cuts

US stock indexes opened lower as investors seek more clarity on the Federal Reserve’s plans for interest rate cuts – and as megacap stocks fell.

The Dow Jones Industrial Average fell 65.4 points, or 0.2pc, at the open to 38,818.9.

The S&P 500 fell 18.7 points, or 0.4pc, at the open to 5,168.98​, while the Nasdaq Composite dropped 106.5 points, or 0.7pc, to 16,226.067 at the opening bell.

02:23 PM BST

Spanish bank refuses to raise £10bn bid for TSB owner

The owner of TSB Bank has said a rival Spanish bank has refused to raise its offer to buy the business, after revealing it rejected a takeover bid worth about €12bn (£10.3bn).

Banco Sabadell published a letter it received from the chairman of Banco Bilbao Vizcaya Argentaria (BBVA) about its proposal.

BBVA, which is also based in Spain, said it had “no room” to improve its offer for Sabadell which already values itself more highly than its share price value at the end of April.

It also partly blamed it on the fact that BBVA’s own market capitalisation has fallen by more than €6bn (£5.2bn) since speculation of the takeover bid first emerged.

“This situation absolutely prevents us from being able to pay more premium than we are already offering, because if we were to do so it is foreseeable that our value would fall again,” the statement read.

It comes as TSB announced it would close 36 branches and axe 250 jobs as part of cost cutting measures.

02:02 PM BST

Snoop Dogg-backed cannabis biotech startup to quit ‘turbulent’ London stock market

A British biotech start-up backed by Snoop Dogg has unveiled plans to ditch the “turbulent” London stock market, dealing a fresh blow to the beleaguered exchange.

Our retail editor Hannah Boland has the details:

Oxford Cannabinoid Technologies said it was delisting from London following a “continuous, irrational and regressive pressure” on its share price.

The company claimed it would be much better valued as a private company and would also not have to bear the “substantial cost” of maintaining a public listing.

Clarissa Sowemimo-Coker, chief executive of Oxford Cannabinoid Technologies, said: “The UK capital markets are facing particularly challenging times and many biopharma businesses like ours are re-evaluating whether it is the right home for them.”

This chart illustrates London’s shrinking stock market.

01:45 PM BST

Gas prices to remain steady this summer, says Goldman Sachs

Gas prices declined for a second day amid signs that the mild winter left stockpiles much higher than usual.

Europe’s benchmark contract has fallen as much as 3.4pc today to about €30 per megawatt hour, where Goldman Sachs expects prices to remain throughout the summer.

Analyst Samantha Dart said:

Record-high gas storage in North West Europe continues to incentivise European gas markets not to compete with Asia for LNG supplies.

This is also illustrated by how European gas prices have remained fully below coal generation costs throughout the period, indicating gas balances remain comfortable this summer.

01:23 PM BST

Wall Street poised to fall as Uber skids

US stocks are on track to decline when markets open later following a weak forecast from Uber and a rebound in bond yields.

Uber lost 7pc in premarket trading after the ride-hailing platform forecast second-quarter gross bookings below expectations.

Megacap stocks also fell, with Tesla, Amazon and Alphabet down between 0.6pc and 1.7pc, following a rise in the 10-year Treasury yield after five days of declines.

This comes after the S&P 500 closed higher for a fourth straight session on Tuesday, its best winning run since March, while the blue-chip Dow scored a fifth session of gain in its longest positive run since December 2023.

Markets have mostly traded higher so far in May, as investors took comfort from an upbeat earnings season.

The mood has also been lifted by a recent weaker-than-expected jobs market report, which tempered concerns about the Fed keeping interest rates higher for longer.

Traders are pricing in a 65pc chance of the US central bank cutting interest rates by at least 25 basis points in September, according to the CME Group’s Fedwatch tool, up from about 54pc a week ago.

In premarket trading, the Dow Jones Industrial Average was down 0.1pc, the S&P 500 had fallen 0.2pc and Nasdaq 100 futures were down 0.3pc.

01:10 PM BST

Europe leaves London behind in $12bn stock market boom

Europe’s stock markets are leaving London trailing in their wake as they attract a greater share of companies looking to pitch shares to investors.

The UK has secured just 2pc of the $11.9bn (£9.5bn) raised via company flotations – or initial public offerings (IPOs) – in Europe this year, according to data compiled by Bloomberg.

London’s share of the IPO market is the lowest in decades and compares to an average of 31pc between 2012 and 2023.

It comes as UK stocks trade at a significant discount to major overseas markets, meaning companies are likely to attract higher valuations when they list elsewhere.

It has made many companies the target of takeover bids, with the engineering group Wood today rejecting a £1.4bn takeover bid by rival Sidara.

Charles Hall, head of research at Peel Hunt, said: “The UK has become relatively unattractive as a listing venue.

“The level of fund outflows has impacted both valuations and capital available for IPOs.”

Mr Hall has previously warned that the FTSE small cap index could cease to exist by 2028 at the current pace of takeovers.

There were 160 companies in the small cap index in 2018 but this is expected to fall to only 100 by the end of the year.

However, the FTSE 100 has been making a comeback, hitting a series of record highs since April 22, and rising by 3.8pc since then. The index is up 7.8pc so far this year.

01:04 PM BST

City bosses fear ‘punishment beatings’ from watchdog

City firms are fearful of attacking the Financial Conduct Authority in public due to concerns they will be targeted with a “punishment beating”, the head of lobby group CityUK said.

Our reporter Michael Bow has the details:

Chief executive Miles Celic said companies were pulling their punches with the FCA in public due to fears of retribution later.

“There is a concern that, as one person put it to me, being critical of the regulator publicly will later on result in an enforcement punishment beating,” Mr Celic told peers in the House of Lords.

“You may find that the next time a supervisory team comes into your firm, you feel that the atmosphere, the temperature, is just slightly chillier than it was [and there are] maybe one or two more pointed questions than would have been the case.

“I don’t think that there is a sort of sense that companies that speak out of turn are singled out but it is reflective of the importance of having the right regulatory relationship. There is a concern about what the risk might be of putting regulators or supervisors nose out of joint.”

He added the issue was seen as pervading the FCA rank and file rather than the board or leadership of the agency.

The FCA, led by chief executive Nikhil Rathi, is under mounting pressure over plans to “name and shame” companies and force businesses to disclose gender and diversity statistics.

12:52 PM BST

Shopify plunges as amid weak forecasts

Canadian e-commerce company Shopify dropped sharply in premarket trading as it warned its margins would decrease after the sale of its logistics business.

The company warned that gross margins would fall by about 50 basis points in the second quarter, compared to the first three months of the year.

It also said revenues would grow in the “low-to-mid-twenties” on a percentage basis when adjusting for the sale of its logistics business to Flexport last year.

Its US-traded shares plunged by 19pc ahead of the opening bell in New York.

12:38 PM BST

Wood rejects £1.4bn takeover offer

Engineering group Wood has rejected a takeover offer from rival Sidara which would have valued the company at more than £1.4bn.

The Scottish consultancy said the cash offer of 205p per share “fundamentally undervalued Wood and its future prospects”.

Its shares were valued at 163.8p shortly before news of a potential takeover bid emerged. The offer represented a 24pc premium on its closing price on Tuesday.

Wood shares were last up 13pc today to 186.4p.

Sidara, which was formerly known as Dar Group, has until 5pm on June 5 to submit an improved offer under takeover rules.

12:29 PM BST

Shell to sell Singapore chemicals division as it focuses on oil and gas

Shell is selling off its refining and chemicals plants in Singapore as it focuses on its more profitable businesses of producing and trading oil and gas.

Our energy editor Jonathan Leake has the details:

The energy giant has agreed to sell its ageing Bukom refinery in Asia’s main oil hub. It comes as Singapore plans sharp increases in its carbon tax, which could have hit Shell’s operations there with extra costs.

The estimated $1bn deal will see the refinery and associated petrochemical works sold to CAPGC, a joint venture between Indonesian chemicals firm Chandra Asri and Swiss miner and commodities trader Glencore.

The sale is part of Shell chief Wael Sawan’s plan to reduce the company’s carbon footprint and focus its operations on its most profitable activities.

The deal will give CAPGC a foothold in one of the world’s top oil refining and trading centres. However, the company will face competition from newer refineries in China and must bear the cost of Singapore’s rising carbon tax.

Shell’s assets include a refinery on Bukom island, just south of Singapore, capable of processing 237,000 barrels per day (bpd) of oil and a 1-million-metric-ton-per-year (tpy) of ethylene, as well as a plant that produces mono-ethylene glycol on Jurong island to the Southeast Asian city-state’s west.

The Bukom facility opened in 1961.

12:01 PM BST

Wood shares surge amid takeover speculation

Shares in engineering group Wood have surged after family-owned rival Sidara was reported to be in talks about a potential takeover.

The London-listed consultancy – which is one of the North Sea’s biggest services companies – was up as much as 22pc about a year after private equity giant Apollo walked away from a deal to take the Scottish company private.

Wood’s stock has fallen by about a quarter so far this year, giving it a market value of about £1.1bn.

Sidara, which was formerly known as Dar Group, has been studying a possible deal for Wood and its deliberations are in the early stages, according to Bloomberg News.

11:49 AM BST

TSB to close 36 branches and axe 250 jobs

Banking group TSB has said it is closing 36 branches and cutting 250 jobs across the business.

The job losses will take place in the fraud departments and across its branches, according to the Unite union, which called the decision “a grave mistake”.

A spokesman for TSB said:

The decision to close a branch is never taken lightly, but our customers are now doing most of their banking digitally and we need to move to a better balance of digital and face-to-face services.

We remain committed to a national branch network and through innovation and integration with video, telephone, digital, branch and other face-to-face services TSB customers have more ways to bank with us than ever before.

Unite regional officer Andy Case said:

These workers perform essential work in the fraud departments and across the branch network.

At a time when customers are increasingly concerned about financial fraud and often need support from a local bank branch this is the wrong course of action.

11:44 AM BST

Direct Line sheds customers as it increases premiums

Direct Line has revealed it shed more than 430,000 motor insurance customers after increasing the cost of cover by nearly 40pc.

The insurance group’s first quarter trading update revealed a steep year-on-year drop in the number of direct own-brand motor policies, down 434,000 to 3.2m.

It follows a 35pc surge year-on-year in the cost of motor insurance to £599 on average, with existing customers facing a 38pc jump to £515.

The group – which was recently the subject of an ill-fated £3.1bn takeover attempt by Belgian rival Ageas – saw a 1.8pc drop in overall in-force policies to 9.3m in the first quarter of 2024.

Its home insurance division proved less impacted by moves to increase prices, with the number of policies edging only slightly lower to 2.45m from 2.5m a year earlier.

This came despite a 27pc year-on-year rise in average premiums for new customers and a 13pc increase for existing policyholders.

Overall, gross written premiums increased by 10.7pc to £892.2m in the first three months of the year.

11:23 AM BST

BMW tells EU not to be ‘afraid’ of Chinese electric cars

BMW has urged the European Union not to be “so afraid” of Chinese electric vehicles (EVs) amid a rift between Germany and France over how to tackle a wave of cheap exports.

Our industry editor Matt Oliver has the details:

Oliver Zipse, chairman of BMW Group, claimed fears about an onslaught of Chinese EV arriving on the Continent were overblown and that imposing restrictions flew in the face of free trade.

He pointed to the operations of foreign car makers in China, which is BMW’s biggest market, and warned that getting into a tit-for-tat trade war would “harm German industry much more than the other way around”.

His comments come as an EU investigation into alleged subsidies provided to Chinese manufacturers rumbles on, raising the prospect that the bloc could hit their cars with import tariffs.

Read how European capitals remain split on the prospect of tariffs.

11:01 AM BST

Watch: Boeing plane skids on runway as landing gear fails

A cargo aircraft made an emergency landing at Istanbul Airport today after its front landing gear failed.

A video on social media showed the Boeing 767 belonging to FedEx Express using the back landing gear and then dipping its nose with the front portion of the fuselage.

The plane was on the last leg of its flight from Paris to Istanbul when the pilots realised the front landing gear failed to open, state-run Anadolu Agency said.

Read on for details and watch the incident below, which comes as Boeing grapples with the fallout from a midair blowout on one of its aircraft earlier this year.

10:57 AM BST

Oil falls amid pressure on Israel to accept ceasefire

Oil prices have close to its lowest level since mid-March amid hopes for a ceasefire in Gaza.

Global benchmark Brent crude has dropped 1.4pc towards $82 a barrel, while US-produced West Texas Intermediate declined 1.54pc towards $77.

It comes as the US has piled pressure on Benjamin Netanyahu to agree a ceasefire deal with Hamas, arguing the two sides should be able to “close the remaining gaps” in negotiations “very soon”.

Oil has been on a downtrend since early April, posting losses in three of the past four weeks.

A stronger dollar is an added headwind as the commodity becomes more expensive for many investors.

10:29 AM BST

Pound falls ahead of Bank of England rate decision

The pound has declined ahead of the Bank of England’s next decision on interest rates amid speculation that borrowing costs could fall in Britain before the US.

Sterling has dropped 0.2pc against the dollar to $1.248 and was down 0.2pc versus the euro, which is worth 86p.

The Bank of England makes its next interest rate decision on Thursday. Markets think it will likely cut rates in June or August, while the Federal Reserve is not expected to make its first move until after the summer.

Jessica Shuman, senior investment specialist at Insight Investment, said:

Although we haven’t heard from many members of the Monetary Policy Committee it is highly unlikely that the Bank of England will adjust its policy rate this week but, with the start of the easing cycle rapidly approaching, all eyes will be on the signalling that comes from both the voting patterns and accompanying statement.

Ultimately, April’s inflation data, released later in the month, is likely to prove critical in any decision.

A better than expected number could see July come into play, but if inflation proves stickier than expected there is no rush to cut.

We have long held the view that this easing cycle will be later and shallower than many people expect, with inflation likely to be structurally higher in the decade ahead.

10:16 AM BST

BrewDog founder calls time after 17 years

BrewDog boss James Watt is stepping down from the top job 17 years after he co-founded the Scottish brewer and pub group.

Mr Watt will hand over the reins to chief operating officer James Arrow, but will remain with the group as a non-executive director on the board and continue to advise the group on strategy.

The group said it had put in place succession plans after Mr Watt first told the board last year he wanted to step away to focus on his other projects and interests.

Mr Watt will take on the newly created non-executive role of “captain and co-founder” and retains his 21pc shareholding in the company.

In a Linkedin post, Mr Watt said:

After 17 fantastic years as chief executive, I have decided to transition into a new role in the business, one of ‘captain and co-Founder’ – and James Arrow will pick up the reins as chief executive as our business pushes forward into our next phase of growth.

In my new role I will remain as a board member, a director and I will also be part time strategic adviser to the business and our to leadership team.

10:04 AM BST

Milei’s Argentina is fast becoming the Texas of Latin America

Javier Milei has started his libertarian economic experiment to transform Argentina.

In a series of dispatches, The Telegraph’s World Economy Editor, Ambrose Evans-Pritchard, travels through what used to be one of the world’s richest nations to examine whether “shock therapy” can work:

President Javier Milei has flawless timing. Argentina’s shale boom has reached industrial take-off just as he embarks on his extreme libertarian experiment: a Hayekian free market assault on the delinquent Peronist state and all its works.

The long-suffering nation is swinging very fast from a costly dependence on energy imports, and a chronic leakage of hard currency, to the happier condition of net hydrocarbon exports. The prolific shale basin of Vaca Muerta is finally delivering.

After years of talk and many dropped balls, this arid expanse of northern Patagonia is suddenly starting to look like the next Texas, promising to draw in the serious dollars needed to stabilise the ruined peso and make all else possible.

09:53 AM BST

Burberry finance boss undergoes ‘unscheduled surgery’

Fashion group Burberry has announced its chief financial officer will take a short leave of absence after undergoing “unscheduled surgery”.

Kate Ferry is expected to resume her normal duties in June.

09:40 AM BST

German factory output shrinks for first time this year

German industrial production fell in March but less than expected, official data showed, as Europe’s biggest economy struggles to recover following a turbulent period.

Output slipped 0.4pc month-on-month, federal statistics agency Destatis said, following strong increases in January and February.

But analysts surveyed by financial data firm FactSet had forecast a drop of 1pc for March.

Despite the weak data, the economy ministry said that recent improvements in business climate and activity surveys pointed to “a further recovery in industrial production over the course of the year”.

The German economy was hit hard in 2023 by high inflation, a manufacturing slowdown and weakness in key trading partners, and contracted slightly.

However, slowing inflation and a string of other positive signs had suggested in recent times it was making a recovery, albeit slowly.

Good morning from #Germany, where industrial production shrinks for 1st time this year. In March, industrial production shrank by 0.4%, not quite as much as the expected -0.7%. But the previous month was revised downwards significantly. pic.twitter.com/FVqetoEiD0

— Holger Zschaepitz (@Schuldensuehner) May 8, 2024

09:33 AM BST

Sustainable fuel flight saves equivalent of 54 cars’ emissions

The first-ever transatlantic flight powered solely by a special new type of low-emissions fuel saved the equivalent of a year’s worth of emissions from 54 cars, according to Virgin.

Our transport industry editor Christopher Jasper has the details:

Virgin Atlantic, which operated the flight last November between London Heathrow airport and New York JFK, said subsequent analysis showed the crossing using sustainable aviation fuel (SAF) produced 64pc less carbon dioxide than the same trip using traditional kerosene.

Output of particulates was cut by two-fifths, something which could help limit the production of aircraft vapour trails, Virgin said.

The so-called contrails, which form at high levels as moisture condenses around soot, can trap heat that would otherwise have escaped Earth’s atmosphere, making a bigger contribution to warming than CO2 itself, according to some studies.

The flight, which was part-funded by the Department for Transport and the Civil Aviation Authority and performed by a Boeing 787 equipped with Rolls-Royce Trent 1000 engines, also confirmed the 1pc higher energy density of SAF when compared with jet fuel.

Sustainable aviation fuel can be derived from a number of sources, including used cooking oil and agricultural waste, and can be manufactured synthetically using renewable energy.

SAF prices remain high, however, partly because production volumes are so low, with total industry uptake currently representing less than 1pc of all fuel used.

09:01 AM BST

Sweden cuts interest rates as Europe moves before US

Sweden’s central bank has cut interest rates in a sign that European central banks are confident to make moves before the US Federal Reserve.

The Rikbsank cut borrowing costs by a quarter of a percentage point to 3.75pc and follows an interest rate cut by the Swiss National Bank in March.

The reduction comes as Sweden’s economy remains in recession, with rising unemployment and inflation lower than expected.

Policymakers said “the policy rate is expected to be cut two more times during the second half of the year”.

The Bank of England makes its next interest rate decision on Thursday. Markets think it will likely cut rates in June or August and certainly by September.

The European Central Bank is widely expected to cut rates in June, while the Federal Reserve is not expected to make its first move until after the summer.

08:42 AM BST

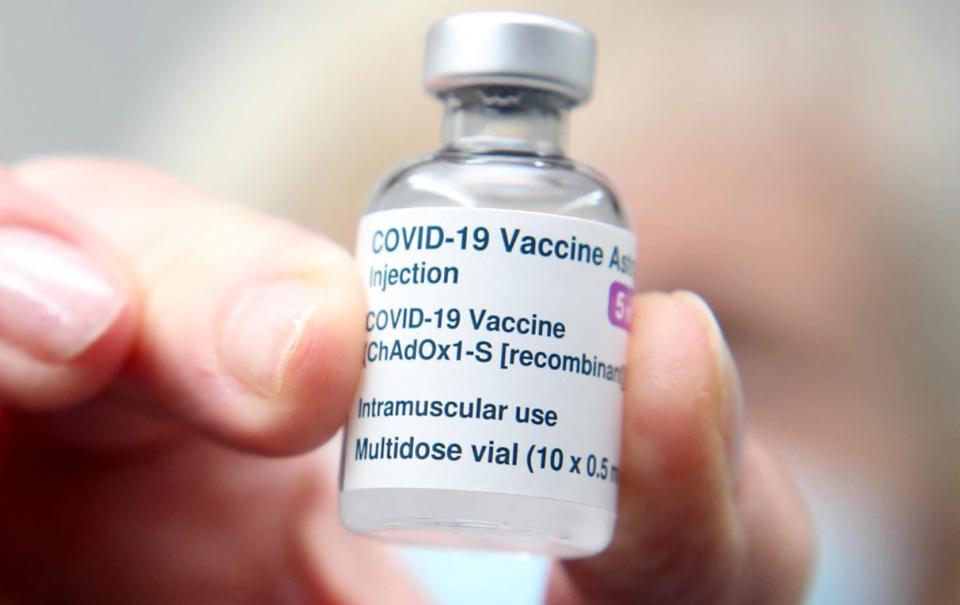

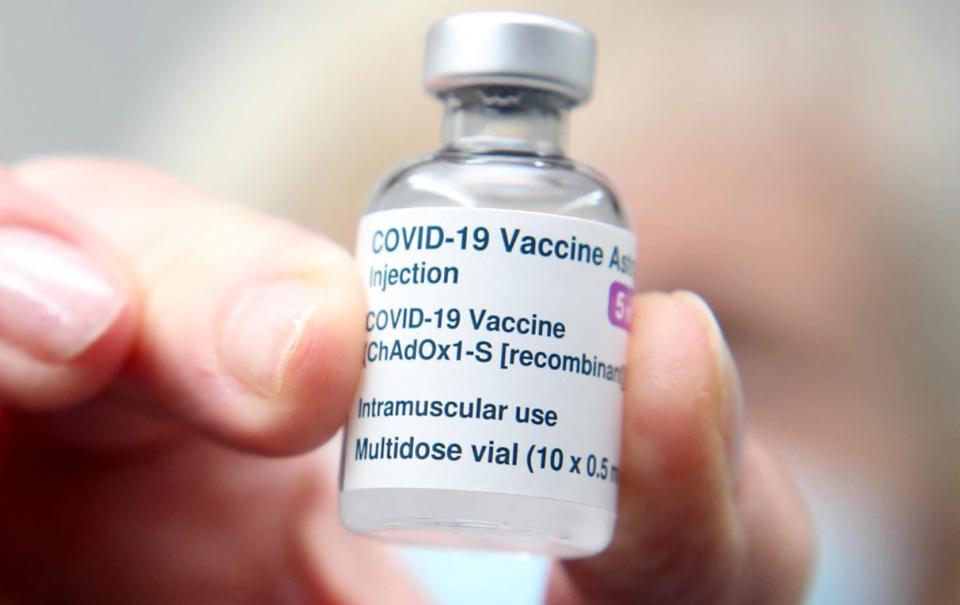

FTSE 100 hits new record as AstraZeneca begins withdrawing Covid vaccine

The FTSE 100 opened at a record high following a boost for AstraZeneca shares after the drugmaker said it would begin withdrawing its Covid vaccine worldwide.

The blue-chip FTSE 100 gained 0.5pc to another all-time peak of more than 8,350.

The mid-cap FTSE 250 gained 0.1pc and is on track to rise for a third straight session. Both indexes have recorded consistent gains on a weaker pound that slipped 0.2pc against the dollar.

AstraZeneca advanced 1.2pc after the drugmaker said it initiated a worldwide withdrawal of its Covid vaccine due to a “surplus of available updated vaccines” since the pandemic.

It comes months after the pharmaceutical giant admitted for the first time in court documents that it can cause a rare and dangerous side effect.

All eyes will be on the Bank of England’s interest rate decision on Thursday, where it is widely expected to keep rates unchanged. However, markets are pricing in a first rate cut in August.

Shell inched 0.2pc higher after the energy giant agreed to sell its refinery and petrochemical assets in Singapore to a joint venture between Indonesia’s PT Chandra Asri Pacific and Glencore

JD Wetherspoon was up 3.6pc as the pub group forecast profit to be towards the upper end of market expectations after it posted higher sales in third quarter.

08:29 AM BST

SoftBank ‘in takeover talks’ with British AI champion

SoftBank has been named as the suitor of a troubled UK semiconductor start-up once valued at $2.8bn (£2.3bn).

The British microchip champion began exploring a sale to foreign owners in February after struggling to cash in on the artificial intelligence boom.

Industry sources said Graphcore had been discussing a potential deal with major tech companies as it seeks to raise new funding to cover heavy losses.

SoftBank has been holding discussions with the Bristol-based company for months but talks have recently become more advanced, according to Bloomberg News.

Senior investors in Graphcore had significantly marked up the value of their stakes in the company in February in a potential indication of a deal that could be worth more than $500m (£400m).

Graphcore, which has sought to challenge giants such as Nvidia with microchips specialising in AI software, said last year that it needed to secure new funding after revenues fell by 46pc and losses widened.

08:23 AM BST

AB InBev sales rebound after trans backlash

The world’s biggest brewer revealed an increase in sales as the backlash over Bud Light’s work with a transgender influencer began to subside.

AB InBev, which makes beers including Stella, Budweiser, Corona and Becks, reported a 2.6pc rise in sales in the first quarter, which was in line with analyst expectations.

Volumes were slightly better than anticipated, helped by sales of other products such as spirits-based drinks in cans.

This week, Jason Warner, president of brewery giant AB InBev in Northern Europe, said the company would keep contested political and societal issues separate from its beers after consumers boycotted Bud Light for working with Dylan Mulvaney.

08:07 AM BST

AstraZeneca gets £3bn boost after withdrawing Covid vaccine

AstraZeneca added more than £3bn to its valuation after it announced its Covid vaccine is being withdrawn worldwide.

The Anglo-Swedish drugs maker’s shares jumped by as much as 1.6pc – helping push the FTSE 100 to a new record high – after it said the vaccine was being removed from markets for commercial reasons.

It said the vaccine was no longer being manufactured or supplied, having been superseded by updated vaccines that tackle new variants.

However, it comes months after the pharmaceutical giant admitted for the first time in court documents that it can cause a rare and dangerous side effect.

The vaccine can no longer be used in the European Union after the company voluntarily withdrew its “marketing authorisation”.

The application to withdraw the vaccine was made on March 5 and came into effect on Tuesday.

The FTSE 100 has opened higher amid growing bets that the pound will fall in value against the dollar, boosting the exporter heavy index.

The UK’s flagship stock index gained 0.4pc to 8,343.83 after trading began, while the domestically-focused FTSE 250 rose by 0.2pc to 20,443.40.

08:05 AM BST

Alstom plans €1bn share sale to cut debt

Train maker Alstom is planning to raise about €1bn (£860m) in capital to shore up its finances and cut its debt after issuing a cash flow warning last year that wiped billions of the value of the company.

The French group, which is the world’s second-biggest train maker after China’s CRRC, plans the rights issue alongside a new €750m hybrid bond.

The debt reduction plan comes after it issued a warning in October that its free cash flow for the year to March would be negative by about €500m to €750m, spooking markets.

Alstom, which is responsible for France’s high-speed TGV trains, also reported an underlying loss of €309m for its latest financial year. The company does not plan to pay a dividend for the year.

The company’s plant in Derby, which employs 3,000 people and completed its last remaining trains in March, was saved from closure following crisis talks with ministers last month.

07:50 AM BST

Wetherspoons sales grow as young drinkers switch to Guinness

Pub giant JD Wetherspoon has hailed soaring demand for Guinness from younger punters and recovering ale sales as it reported growth over the past three months.

Wetherspoons, which runs 809 pubs across the UK, said like-for-like sales increased by 5.2pc over the 13 weeks to April 28 compared with a year earlier, with total sales up 3.3pc.

As a result, the company said it expects annual profits to be “towards the top of market expectations”.

Chairman Tim Martin said:

Sales in the period continued the steady recovery from the pandemic.

Traditional ales, which were very slow in the aftermath of the lockdowns, are increasing momentum, with Abbot Ale, Ruddles Bitter and Doom Bar showing good growth, as indeed are ales from the many small and micro brewers with which we trade.

The gods of fashion have smiled upon Guinness, previously consumed by blokes my age, but now widely adopted by younger generations.

The company expects profits in the current financial year to be towards the top of market expectations.

07:44 AM BST

Boohoo losses deepen but bosses insist it is ‘well positioned’

Fast fashion retailer Boohoo has insisted it is “well positioned” to return to growth after revealing a steep jump in annual losses as sales fell.

The group reported pre-tax losses of £159.9m for the year to February 29, against losses of £90.7m the previous year.

Revenues tumbled 17pc to £1.5bn, which the company blamed on its “increased focus on profitability and difficult market conditions”.

The group said it saw improved trading of its core brands – boohoo, boohooMAN, PLT, Karen Millen and Debenhams – with declines in sales by gross merchandise value (GMV) paring back from 9pc in the first half to 4pc in the final six months.

The group said it is aiming for GMV growth in 2024-25 and is on track for annual cost savings of £125m.

Chief executive John Lyttle said: “The group is now well positioned to return to growth and we are focused on ensuring that growth is both sustainable and profitable.”

It comes as Boohoo, co-founded by chairman Mahmud Kamani, faces a series of pressures that have wiped more than 90pc off its share price compared to its pandemic peak. Aim-listed Boohoo was valued at £4bn but it is now worth just £446.8m.

Boohoo’s business is now being challenged by the rising Chinese giant Shein, as well as the cost of living crisis and inflation in its supply chain.

07:36 AM BST

Toyota warns of falling sales after safety scandal

Toyota has warned of an impending drop in income after it was forced to trim production to address a safety scandal.

The world’s largest carmaker by sales enjoyed a record net profit of 4.94 trillion yen (£25.5bn) in the year to March after recording revenues of 45.1 trillion yen (£232.6bn), which was also an all-time high.

However, the company has been trying to recover from revelations of fraud at suppliers, which prompted it to reduce production targets while it reviewed business practices throughout the group.

It warned net income would fall 27.8pc this financial year to 3.57 trillion yen because of investments.

Last month Toyota said it sold 11.1 million vehicles across all brands in the 2023-24 fiscal year, up five percent and the first time they have exceeded 10 million.

A big factor was a 31-percent jump to 3.7 million in sales of hybrid vehicles – combining internal combustion engines and batteries – like the Corolla compact car and the RAV4 sports utility vehicle.

Sales of purely electric car sales were a much more modest 116,500.

07:13 AM BST

Good morning

Thanks for joining me today. Traders are ramping up bets that the pound will fall in the coming months amid a growing conviction that the Bank of England will cut interest rates before the US.

The level of wagers placed by investors against sterling has hit a 16-month high, according to data from the US Commodity Futures Trading Commission, first reported by the Financial Times.

Meanwhile, asset managers have not been more pessimistic about the future strength of the pound since March last year, according to State Street, one of the world’s largest custodian banks.

The pound has fallen 1.5pc against the dollar this year, although that has still made it the strongest performer among the G10 group of major currencies.

However, traders expect the Bank of England, which announces its next interest rate decision tomorrow, will cut borrowing costs earlier and faster than the US Federal Reserve.

Derivatives trades indicate that a first interest rate cut will happen in Britain by September at the latest, while money markets suggest it could be as late as November in America.

On Tuesday, Minneapolis Fed President Neel Kashkari, who does not have a vote on rates this year, suggested the Federal Reserve may need to forgo reductions in borrowing costs this year due to stubborn inflation.

5 things to start your day

1) Relaxing listing rules won’t fix City, warn British investment giants | Pension funds raise concerns over stock market’s call for weaker UK governance standards

2) Saudi oil giant pays out £100bn to fund crown prince’s desert mirror city | Mega project needs more funds as lower oil prices pressure the kingdom’s economy

3) Global debt surges to new record high in blow for world economy | Borrowing by China and India fuels increases

4) Disney to cut production of Marvel films and TV shows amid superhero fatigue | Waning demand for franchise comes as share price slumps and subscriber numbers slow

5) Royal family’s crockery supplier taken to court over unpaid bill | Tax office hits Thomas Goode with winding-up petition after ‘difficult few years’

What happened overnight

Asian stocks slipped and the dollar climbed as markets assessed mixed signals from US policymakers and economic data on the path for Federal Reserve interest rates.

The yen sank even with the threat of currency intervention from Japanese authorities to support it.

Crude oil wallowed near two-month lows amid signs of easing supply pressure and continued hopes for a Middle East ceasefire.

MSCI’s broadest index of Asia-Pacific shares outside Japan slid 0.4pc, with mainland Chinese blue chips and Hong Kong’s Hang Seng each down about 0.6pc.

Japan’s Nikkei slumped about 1.4pc as traders took profits following the previous session’s 1.6pc surge. The tech-heavy index also succumbed to pressure from a sell-off in US chip stocks on Tuesday.

In America, the Dow Jones Industrial Average of 30 leading US companies edged up 0.1pc to 38,884.26. The broader S&P 500 gained 0.2pc to 5,187.70, while the tech-rich Nasdaq Composite index dipped 0.1pc to 16,332.56.

Minneapolis Fed President Neel Kashkari suggested the Federal Reserve may need to forgo interest rate cuts this year due to stubborn inflation.

The yield on 10-year US Treasury bonds fell to 4.45pc from 4.49pc late on Monday.

Source Agencies