Nvidia (NASDAQ: NVDA) stock has been on a tear on the stock market over the past year and a half, which is not surprising — the company has been delivering phenomenal earnings and revenue growth thanks to the booming demand for its artificial intelligence (AI) chips.

Nvidia commands a dominant position in the AI chip market with a market share of more than 90%. It is leagues ahead of rivals such as Intel and AMD, which are still looking to cut their teeth in this market. For example, Nvidia is expected to sell $87 billion worth of AI chips this year. AMD and Intel, meanwhile, are expecting to generate $4 billion and $500 million, respectively, from AI chip sales this year.

Nvidia is clearly the go-to chipmaker for companies that are looking to train and deploy AI models, as its share of this market illustrates. The stock market has rewarded the company’s dominance handsomely, which is evident from the 507% jump in its share price since the beginning of 2023. This stunning rally has brought Nvidia’s trailing earnings multiple to 74, which is quite rich if you consider that the Nasdaq-100 index has an earnings multiple of 30 (using the index as a proxy for tech stocks).

There is a solid chance that Nvidia can justify this expensive multiple with tremendous growth going forward. But there is an alternative for investors who are looking for a company that could replicate Nvidia’s AI-driven success in a different market and is trading at an attractive valuation right now — Qualcomm (NASDAQ: QCOM).

Let’s look at the reasons why this chipmaker has the potential of becoming the next Nvidia.

Qualcomm’s position in the smartphone market is set to unlock a massive opportunity

Qualcomm is the second-largest manufacturer of application processors used in smartphones. The company controlled 28% of this market at the end of 2023, trailing the top-ranked manufacturer MediaTek by 5 percentage points.

One may argue that Qualcomm isn’t as dominant as Nvidia in its field. However, it wouldn’t be surprising to see Qualcomm eventually capture a bigger share of the smartphone processor market thanks to the proliferation of AI-enabled smartphones. On its May earnings conference call when management was discussing the company’s fiscal 2024 second-quarter results (for the three months ended March 24), CEO Cristiano Amon said:

In premium and high-tier smartphones, our Snapdragon mobile platforms continue to set the bar for performance and on-device gen AI capabilities. Recently launched flagship Android devices powered by Snapdragon 8 Gen 3 are seeing strong demand globally, especially in China.

More specifically, Qualcomm’s revenue from chip sales to Chinese smartphone customers increased more than 40% year over year in the first half of the current fiscal year. This impressive year-over-year increase in Chinese revenue indicates that Qualcomm is making solid headway in a country where MediaTek is the leading player, and is aiming to corner 30% of the flagship smartphone market.

Qualcomm is looking to build upon its growing prominence in the Chinese smartphone market by bringing on-device AI capabilities “to a broader range of flagship and high-tier smartphones with the new Snapdragon 8S Gen3 and Snapdragon 7 Plus Gen 3 mobile platforms, launching in the second half of 2024.”

All this explains why Qualcomm is expecting its growth to accelerate from the current quarter. The company delivered a revenue increase of just 1% in the second quarter of fiscal 2024 to $9.4 billion. It is forecasting $9.2 billion in revenue in the current quarter at the midpoint of its guidance range, which would be a 9% jump over the same period last year.

The company is expecting its earnings to grow at a faster pace of 20% year over year to $2.25 per share in the current quarter. Wall Street would have settled for $2.18 per share in earnings on $9.06 billion in revenue from Qualcomm, but the company is set to go past those expectations thanks to the growing demand for AI-powered smartphones and its improving influence in markets such as China.

That’s not surprising, as the company’s AI-capable smartphone chips are being deployed by leading smartphone OEMs (original equipment manufacturers). Qualcomm is looking to push the envelope in this space by focusing on bringing AI capabilities into mid-range smartphones as well.

In all, Qualcomm is setting itself up to make the most of the bustling market for generative AI smartphones, shipments of which are expected to grow at an eye-popping compound annual growth rate of 65% between 2024 and 2027, according to Counterpoint Research.

The stock’s valuation makes it a no-brainer buy

The generative AI smartphone market is currently in its early phases of growth. Counterpoint estimates that these devices will account for 11% of the overall smartphone market in 2024, and then grow to 43% of the market in 2027. Even then, there will be a lot of room for growth in sales of generative AI smartphones as more companies bring these devices to the market.

So Qualcomm is doing the right thing by bolstering its portfolio of AI-focused smartphone chips, and it is making nice headway in this market, with marquee customers such as Samsung. As a result, there is a good chance of Qualcomm becoming a bigger player in the smartphone chips market and replicating the success that Nvidia has seen in the AI chips market.

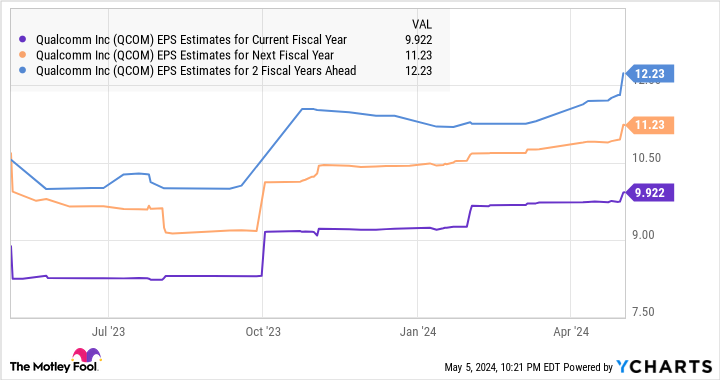

That’s why investors would do well to buy Qualcomm at its current valuation. The stock sports a price-to-earnings ratio of 24, which is well below the multiples that Nvidia and the broader Nasdaq-100 index command. The forward earnings multiple is also attractive at 19. Moreover, as the following chart shows, analysts have been raising their earnings growth expectations from Qualcomm.

All this indicates that Qualcomm is capable of delivering stronger growth in the coming years thanks to lucrative catalysts such as the AI smartphone market, where the company is a key player. That’s why investors looking for the next Nvidia should consider buying Qualcomm before this semiconductor stock steps on the gas.

Should you invest $1,000 in Qualcomm right now?

Before you buy stock in Qualcomm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qualcomm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $554,830!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Qualcomm. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: This Incredibly Cheap Semiconductor Stock Could Become the Next Nvidia was originally published by The Motley Fool

Source Agencies