One of the most exciting things to do as an investor is to look at what famed institutional investors are buying and selling. The Securities and Exchange Commission requires large money managers to file a form called a 13F, which breaks down the stocks that hedge funds and other sophisticated investors on Wall Street are trading.

Perhaps the most closely followed 13F comes from Warren Buffett’s Berkshire Hathaway. Over the past several quarters, Berkshire’s 13F filings contained an investment that was anonymous. In other words, investors were aware that Buffett was entering a new position but the specific company was a mystery.

Although seeking confidential treatment is not all that common, this isn’t the first time Buffett has played coy. Nevertheless, the confidentiality surrounding Buffett’s latest new position brought an additional layer of allure to Berkshire’s quarterly filings.

To many investors’ surprise, Buffett’s secret stock was finally revealed in Berkshire’s first-quarter filings. He has initiated a position in Chubb Limited (NYSE: CB), a property and casualty (P&C) insurance and reinsurance underwriter based in Switzerland.

Let’s explore why Buffett’s choice to invest in Chubb shouldn’t come as a surprise. After a close analysis of the insurance industry, you might find inspiration to follow Buffett’s lead and scoop up some shares of Chubb as well.

An key piece to the larger puzzle

Although Berkshire Hathaway owns over 40 individual stocks, there are some key themes in Warren Buffett’s portfolio. In particular, Buffett loves the financial services industry.

Companies such as Bank of America, American Express, Citigroup, Visa, Mastercard, Capital One Financial, and Ally Financial rank among some of Buffett’s holdings.

While each company above is either a bank or payments processor, these positions complement a revered cornerstone among Buffett’s broader financial services portfolio: insurance.

Geico, General Reinsurance Corporation, and CapSpecialty rank among Berkshire’s insurance businesses. Considering insurance companies account for the largest portion of Berkshire’s revenue and earnings, it’s not entirely surprising to see Buffett add Chubb to his roster.

While investing in Chubb is a classic Buffett move, I’d understand if you’re scratching your head as to why he owns so many insurance businesses. After all, there are many other high-growth opportunities in the capital markets.

Why might Buffett like Chubb so much?

Insurance businesses tend to be reliable and predictable. Think about it: From healthcare, to property, to your own vehicle, insurance is a service that’s always in demand.

Although there are many different types of insurers, insurance companies generally make money the same way — charging customers a service fee for coverage. Since insurance businesses have a steady inflow of cash coming through the door, many times these companies allocate some of this capital toward safe investment vehicles such as bonds or stable equities.

The combination of underwriting revenue and investment income provides insurance companies with heaps of cash flow. This is another critical pillar in Buffett’s investment style. Berkshire does not take positions in speculative industries or high-risk stocks. He prefers to acquire large positions in cash-flow-generating businesses.

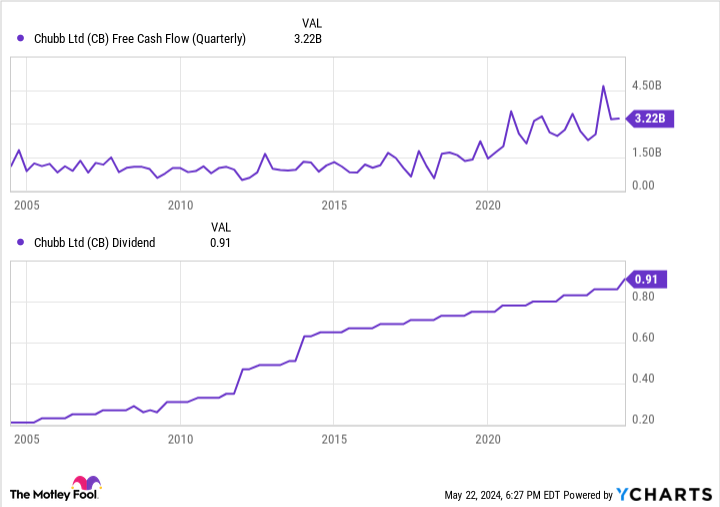

The chart above illustrates Chubb’s free cash flow over the last 20 years. Not only is it clear that the company has steadily grown its excess profits, but it uses cash flow to reward shareholders.

In a similar fashion to its free cash flow, Chubb has also steadily raised its dividend over the last two decades. Enjoying dividend income is another staple of Buffett’s philosophy. The long-term trends above likely make him comfortable that Chubb will continue generating strong profits and have an ability to maintain and raise its dividend for years to come.

Should you follow Buffett’s lead?

Right now, the markets are experiencing some increased buying activity fueled by hype around artificial intelligence, as well as some new breakthrough drugs in the pharmaceutical sector and a robust energy industry.

Considering that the S&P 500 and Nasdaq Composite have already posted double-digit gains this year, I’d say the current sentiment of the market is positive. But with that said, remember that Buffett doesn’t follow the momentum. He is not known to chase stocks that have witnessed dramatic expansion in valuation multiples across a short time frame.

For these reasons, Buffett’s position in Chubb makes a lot of sense. Chubb fits into his affinity for insurance businesses, all while providing Buffett with yet another source of passive income. Furthermore, with a price-to-earnings (P/E) ratio of 11.8, Chubb looks to be trading at a steep discount relative to the broader market. By contrast, the S&P 500 has a P/E ratio of 24.8.

Chubb could be worth examining if you’re an investor looking for some exposure beyond more volatile opportunities in tech, healthcare, and energy. While Chubb might not be the most exciting company, it’s reliable and the shares look cheap right now.

Should you invest $1,000 in Chubb right now?

Before you buy stock in Chubb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chubb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $697,878!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Ally is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

The Secret Is Out: Here’s the Dividend Stock That Warren Buffett Just Dumped $6.7 Billion Into was originally published by The Motley Fool

Source Agencies