I love collecting passive income. It’s nice to get paid for work you didn’t have to do. I like generating passive income so much that my top financial goal is to eventually make enough each year to cover my recurring expenses. That way, I won’t have to work to live.

I’ve got quite a ways to go. However, I get a little bit closer to my goal each month as I grow my passive income. I focus on investing in companies and funds that offer higher-yielding payments that should steadily rise over time. One of my more recent income-focused additions is the JPMorgan Nasdaq Equity Premium ETF (NASDAQ: JEPQ). I plan to buy more of that high-yielding exchange-traded fund (ETF) in June. Here’s why I’m excited to add to my position this month.

A high-yielding income stream

The JPMorgan Nasdaq Equity Premium ETF’s goal is rather straightforward: It aims to deliver monthly income to investors and exposure to the Nasdaq-100 index with less volatility.

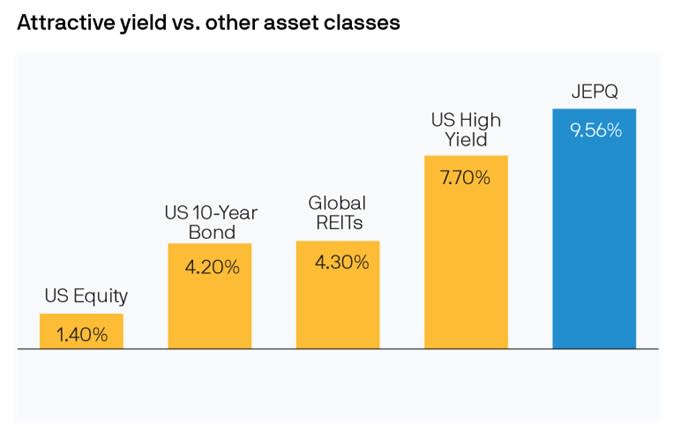

The fund generates income by writing out-of-the-money call options on the Nasdaq-100 index, which holds the 100 largest nonfinancial stocks listed on the growth-focused Nasdaq stock exchange. That strategy enables it to earn lucrative options premium income, which it distributes to investors each month. Its most recent payment had a dividend yield of around 9.6%. That’s a much higher yield than other asset classes:

Over the past year, the yield has been even higher (the 12-month rolling dividend yield is 10.1%).

However, one drawback is that the fund’s distribution payments fluctuate from month to month. They’re higher in months following periods of elevated volatility (more volatility typically yields higher options premiums).

This ETF should be able to continue generating an attractive income yield, with its monthly payments likely rising over the long term as the fund’s value increases.

High growth (with less volatility)

JPMorgan Nasdaq Equity Premium ETF offers more than an enticing passive income stream. The ETF also provides equity upside to companies in the Nasdaq-100 index. Companies listed in that index have historically outperformed the S&P 500 over the long term (18.8% average annual total return over the past 10 years compared to 12.8% for the S&P 500). The fund holds a portfolio of stocks listed in that index, picked using a combination of applied data science and fundamental research.

The fund doesn’t hold every stock in the Nasdaq-100 index nor aim to match that index’s weighting. Here’s a look at how its top 10 stock holdings compare to the Invesco QQQ Trust, an ETF focused on the Nasdaq-100 index:

|

JEPQ (% of net assets) |

Invesco QQQ Trust (% of holdings) |

|---|---|

|

Microsoft (7.4%) |

Microsoft (8.7%) |

|

Nvidia (6.3%) |

Apple (8%) |

|

Apple (6.2%) |

Nvidia (7.2%) |

|

Alphabet (4.6%) |

Amazon (5.1%) |

|

Amazon (4.5%) |

Broadcom (4.6%) |

|

Meta Platforms (4%) |

Meta Platforms (4.5%) |

|

Broadcom (3.1%) |

Alphabet Class A (2.8%) |

|

Advanced Micro Devices (2%) |

Alphabet Class C (2.7%) |

|

Netflix (1.9%) |

Costco Wholesale (2.5%) |

|

Tesla (1.8%) |

Tesla (2.4%) |

Data source: JPMorgan and Invesco.

The fund’s allocation strategy could pay off for investors. For example, the JPMorgan Equity Premium Income ETF outperformed the Nasdaq-100 index in the first quarter (10.1% total return to 8.7%). It benefited from having a higher weighting to Nvidia (which delivered a strong performance) and an underweighting to Intel (which underperformed in the period).

The ETF’s managers believe their strategy will enable the fund to deliver strong returns with less volatility than the Nasdaq-100 over the longer term. The fund will benefit from volatility because it can generate more options premium income. Meanwhile, its underlying portfolio of high-quality, faster-growing companies should deliver strong appreciation in the fund’s net asset value (NAV) over the long term.

Growing my income and my wealth

The JPMorgan Nasdaq Equity Premium Income ETF produces a very attractive monthly income stream from selling call options on the Nasdaq-100 index. It also offers compelling capital gains potential by actively managing a portfolio of stocks based on that index. These features should enable the ETF to help me achieve my passive income goals while growing my wealth. That wealth-building combination is why I can’t wait to add to my position this month.

Should you invest $1,000 in J.p. Morgan Exchange-Traded Fund Trust – JPMorgan Nasdaq Equity Premium Income ETF right now?

Before you buy stock in J.p. Morgan Exchange-Traded Fund Trust – JPMorgan Nasdaq Equity Premium Income ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and J.p. Morgan Exchange-Traded Fund Trust – JPMorgan Nasdaq Equity Premium Income ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Matt DiLallo has positions in Alphabet, Amazon, Apple, Broadcom, Intel, J.p. Morgan Exchange-Traded Fund Trust-JPMorgan Nasdaq Equity Premium Income ETF, JPMorgan Chase, Meta Platforms, Netflix, and Tesla and has the following options: long January 2025 $30 calls on Intel, short January 2025 $30 puts on Intel, and short June 2024 $50 calls on Intel. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Costco Wholesale, JPMorgan Chase, Meta Platforms, Microsoft, Netflix, Nvidia, and Tesla. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Ultra-High-Yielding ETF I Can’t Wait to Buy More of in June was originally published by The Motley Fool

Source Agencies