Tracking what billionaire hedge fund managers are doing is a great way to get ideas for your portfolio. Most of the time, they have a proven track record, but you need to make sure they’re buying stocks for reasons similar to yours. Otherwise, you may get stuck holding a stock with strong short-term movements but a poor long-term outlook.

Bridgewater Associates, run by Ray Dalio, is a massive hedge fund with nearly $175 billion in assets under management. In Q1, it bought many stocks, but among its biggest buys were companies related to artificial intelligence (AI). With AI being such a broad field, looking at what billionaires are buying is a great way to double-check yourself, and you might even find a new idea.

Making a massive bet on AI proliferation

In Q1, Bridgewater Associates increased its positions in the following stocks:

|

Company |

Current Percentage of Portfolio |

Previous Percentage of Portfolio |

|---|---|---|

|

Alphabet |

4.1% |

1.6% |

|

Nvidia |

3.2% |

0.7% |

|

Meta Platforms |

2.4% |

1.3% |

|

Microsoft |

1.2% |

0.4% |

|

Amazon |

1% |

0% |

Data source: WhaleWisdom.

That’s a sizable increase in many of the biggest AI players, pointing to Ray Dalio’s belief that AI will be a massive growth catalyst for these stocks. So far, he’s been right, as these stocks have had a phenomenal performance in 2024.

However, information about which stocks these billionaires have been buying isn’t available to the public until 45 days after Q1 ended, so we’re dealing with two-month-old information right now. So, are these five still worth buying at today’s prices?

These AI stocks are great picks for all investors

Starting with the biggest of these positions, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Bridgewater has made it the third-largest investment overall in his portfolio. This is a turnaround in sentiment, as many believed Alphabet was losing the AI arms race until a few months ago. While it stumbled out of the gate, its latest AI releases have been positively received, and its generative AI model, Gemini, is emerging as a top pick in the space.

This has ignited a run-up in the stock, with Alphabet rising nearly 20% since Q1 ended. Despite its rise, Alphabet remains attractively priced at 23 times forward earnings, making it a strong buy now.

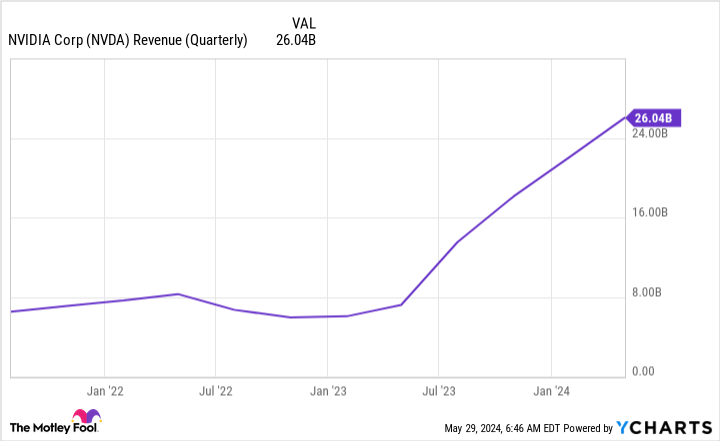

Nvidia (NASDAQ: NVDA), the king of AI hardware, is a much harder stock to assess. It recently reported earnings for its fiscal 2025’s first quarter (ended April 28) and saw revenue rise a jaw-dropping 262%.

This rise was fueled by the massive demand for graphics processing units (GPUs) used in data centers to train AI models. Nvidia has been one of the index’s best performers for two years straight, but this massive growth makes the stock hard to assess.

Currently, Nvidia trades at 42 times forward earnings, making it quite expensive. However, this premium may be worth it if the AI demand persists for many years. Nvidia is a very tough stock to assess, and I wouldn’t fault investors for passing it over right now.

Meta Platforms (NASDAQ: META) is similar to Alphabet because most of its revenue comes from advertising. With dominant properties like Facebook and Instagram under its roof, it generates a lot of money from advertising. However, Meta has also been making substantial AI investments in developing its own generative AI models that are suitable for its uses.

It has integrated its AI model into these platforms and can help create content or understand something about a post. While these technologies have monetizable uses, their primary use right now is to solidify Meta’s place as a company with top-tier social media platforms. At 24 times forward earnings, it’s a great stock to buy.

Microsoft (NASDAQ: MSFT) has partnered with OpenAI to integrate ChatGPT-powered products into its primary offerings. Its Copilot is already integrated into the Microsoft Office suite of products (if you pay the subscription fee) and provides impressive productivity increases. Microsoft also has a strong cloud computing business in Azure, and this division is seeing incredible growth as companies scramble to increase their computing power to create their own in-house AI models. While Microsoft is seeing great success as a business, it’s a very expensive stock.

At 36 times forward earnings, it’s not far off from Nvidia’s valuation despite much slower growth levels. Due to Microsoft’s price, I’ll take a pass on the stock for now.

Lastly, there is Amazon (NASDAQ: AMZN), a company that many may not see as an AI investment. While most of Amazon’s revenue comes from its commerce-related business, 62% of its operating income comes from its cloud computing division, which is benefiting from the same trends as Microsoft Azure. Amazon Web Services (AWS) holds the largest chunk of the cloud computing market share and is growing revenue at a healthy 17% year-over-year pace.

Overall, Amazon is thriving right now, with sales climbing 13% and earnings per share dramatically rising from $0.31 last year to $0.98. Amazon is another tricky company to value, as it’s still working on maximizing its profitability. Although it trades around 40 times forward earnings, I think it’s a fair price to pay because Amazon is still enacting many margin-boosting measures.

Overall, Ray Dalio and Bridgewater Associates’ investments in Q1 are great picks. Although investors shouldn’t blindly follow them into these buys, I think these stocks are a great starting point when searching for top-notch investment ideas.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Ray Dalio Just Bought These 5 Artificial Intelligence (AI) Stocks was originally published by The Motley Fool

Source Agencies