Oil prices have slumped nearly 4pc despite Opec production cuts amid signs that Saudi Arabia will struggle to maintain caps on future supply.

The price of Brent crude dropped by more than $3 on Monday, falling to a four-month low of $78.33 per barrel, even after the Saudi-led cartel announced it would extend voluntary production cuts for another three months.

This was because, although the Organisation for Petroleum Exporting Countries and its allies (Opec+) announced on Sunday that it would extend all three tranches of its production cuts for significantly longer than expected, it also laid out a schedule for how the cuts would be unwound, which analysts said was “surprisingly detailed”.

Daan Struyven, head of oil research at Goldman Sachs, said that this means it will now be more difficult for Opec+ to continue low levels of production if demand is lower than expected.

Opec+ said it would extend extra voluntary cuts of 2.2m barrels of oil per day for three months longer than planned, until the end of September, as well as extending two other layers of group and voluntary cuts for an extra year until the end of 2025.

But it also said that the 2.2mb/d in extra voluntary cuts “will be gradually phased out on a monthly basis until the end of September 2025 to support market stability” and that “this monthly increase can be paused or reversed subject to market conditions”.

Mr Struyven said: “The communication of a surprisingly detailed default plan to unwind extra cuts makes it harder to maintain low production if the market turns out softer than bullish Opec expectations.”

Opec expects demand will grow by 2.2mb/d this year, far higher than the 1.5mb/d forecast by Goldman Sachs.

Mr Struyven added: “The communication of this gradual unwind from 2024Q4 reflects a strong desire to bring back production of several members as a result of high spare capacity.”

Callum Macpherson, head of commodities at Investec, said Opec+’s power over market pricing is diminishing.

Only eight of Opec+’s 18 members have agreed to the 2.2mb/d in extra voluntary supply cuts and these countries combined (Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman) make up just 30pc of world output.

Mr Macpherson said: “It is becoming ever harder for Opec+ to convince markets that it is able to support price stability when the proportion of output it has effective control over is limited.”

Just as oil prices fell, European gas prices jumped by 13pc to the highest level seen this year after an outage at a gas processing plant in Norway, Europe’s largest supplier.

The European benchmark TTF surpassed €38 per megawatt hour before falling back to €36.80.

06:16 PM BST

That’s all for today

Thanks for joining me this afternoon. Signing off with Melissa Lawford’s report on Opec’s planned production cuts:

The price of Brent crude dropped by more than $3 on Monday, falling to a four-month low of $78.33 per barrel, even after the Saudi-led cartel announced it would extend voluntary production cuts for another three months.

This was because, although the Organisation for Petroleum Exporting Countries and its allies (Opec+) announced on Sunday that it would extend all three tranches of its production cuts for significantly longer than expected, it also laid out a schedule for how the cuts would be unwound, which analysts said was “surprisingly detailed”.

Daan Struyven, head of oil research at Goldman Sachs, said that this means it will now be more difficult for Opec+ to continue low levels of production if demand is lower than expected.

05:44 PM BST

FTSE 100 closes down

London’s blue chips ended the day in the red with GSK down over 9pc and leading the fallers on the FTSE 100. The index was down around 0.15pc to 8,262. The FTSE 250 ended up 0.8pc.

05:05 PM BST

Pret abandons plans to open in Israel

Sandwich chain Pret A Manger has dropped plans to launch in Israel, blaming travel restrictions resulting from the war between Israel and Hamas.

Pret had signed a deal in December 2022 with Israel’s Fox Group and food business Yarzin Sella to bring the company’s brand to Israel.

However, a spokesman confirmed it had pulled out of the deal. “We have taken the difficult decision to end our current agreement with Fox Group and Yarzin Sella Group,” a Pret spokesperson said.

“The significant ongoing travel restrictions have meant that our teams have not been able to conduct the checks and training needed to set up Pret in a new market. Under the terms of Pret’s travel insurance, any colleagues travelling to Israel would not be insured.”

Reuters first reported the decision.

04:30 PM BST

Stock market glitch shows Berkshire Hathaway down 99pc

A stock market glitch showed Berkshire Hathaway down 99pc on the New York Stock Exchange, forcing it to pause trading.

Shares in Warren Buffett’s conglomerate were displayed as much as 100pc down from its previous price of $620,000 per share, while other businesses also showed dramatic falls.

The NYSE’s website suggested it had paused trading in dozens of stocks on Monday morning. “NYSE Equities continues to investigate a reported technical issue,” the exchange said at 10am local time.

03:58 PM BST

Paramount close to agreeing $8bn merger with Skydance

Shares in Paramount have climbed 7pc amid reports the studio behind The Godfather has agreed to an $8bn merger.

A special merger committee for the media giant, which is controlled by Shari Redstone, agreed to terms with David Ellison’s Skydance as well as private equity firms KKR and Redbird Capital.

CNBC reported that Redstone will receive $2bn for its holdings, smaller shareholders will get $4.5bn and equity in the new company, while a further $1.5bn will be injected to pay down debts.

The agreement follows a competing offer from private equity giant Apollo and rivals Sony, which had bid to takeover and break-up Paramount.

03:31 PM BST

US manufacturing sector shrinks as bosses ‘unwilling to invest’

The US manufacturing sector contracted for the second consecutive month in May, a closely-watched survey shows, in a sign the American economy is weakening in the face of high interest rates.

The ISM manufacturing PMI came in at 48.7pc in May, which was lower than analyst expectations of 49.5pc and the 18th time in the last 19 months that it has been below the 50 mark separating growth from contraction.

Timothy R Fiore, chairman of the ISM, said:

Demand remains elusive as companies demonstrate an unwillingness to invest due to current monetary policy and other conditions.

These investments include supplier order commitments, inventory building and capital expenditures.

Production execution continued to expand but was essentially flat compared to the previous month.

I will duck out at this point and leave you in the hands of Matthew Field, who will keep the live updates coming until the evening.

03:25 PM BST

First transgender judge hits out at ‘trans-hostile’ conspiracy theories

Britain’s first transgender judge has hit out at conspiracy theories held by “trans-hostile” gay and bisexual people, after choosing to step down from her role at the High Court.

Our reporter Adam Mawardi has the details:

In an interview with Financial News, Victoria McCloud claimed that the workplace was becoming more hostile to trans people and warned that employers must do more to combat prejudice against them.

Ms McCloud – who decided to quit her job in April amid fears that she risked politicising the courts by remaining in post – said: “Even some apparently sensible people in the LGBTQIA+ community hold to the conspiracy theory that trans people secretly want to convert gay and lesbian people to straight or to mutilate children, with no basis.”

The lawyer, who transitioned in the 1990s, said that professionals used to be more “tolerant and kind” towards trans people than they are today.

03:00 PM BST

Oil falls below $80 a barrel

The price of Brent crude oil briefly slipped below $80 a barrel for the first time since February after an Opec+ meeting in which members agreed that countries could starting phasing out voluntary output cuts starting in October.

The drop to as low as $79.35 came despite the the Opec cartel agreeing to extend its present production cuts to the end of the third quarter.

Goldman Sachs analysts said Daan Struyven said the reduction in output into the third quarter was “bearish,” meaning it would likely mean prices fall.

He blamed this on the group’s decision to return supply despite a recent surprise increase to inventories.

UBS strategist Giovanni Staunovo said near-term price volatility is expected.

02:48 PM BST

GameStop surges after social media post

GameStop soared 64pc as trading began in the US in a move reminiscent of its rocket ride that shook Wall Street three years ago.

It jumped after a Reddit account associated with a central character in the 2021 escapade said it had built a position of five million shares, along with options to buy more.

Shares of GameStop soared by as much as 103pc in premarket trading following speculation that Keith Gill, who goes by “Roaring Kitty” on social media platforms, holds shares worth $115.7m as of the closing price Friday.

02:35 PM BST

Wall Street opens higher amid rate cut hopes

Stocks on Wall Street opened higher as investors increased bets on a September start to interest rate cuts by the Federal Reserve.

The tech-heavy Nasdaq Composite jumped 130.69 points, or by 0.8pc, to 16,865.70, while the S&P 500 rose 19.64 points, or by 0.4pc, to 5,297.15.

The Dow Jones Industrial Average began the week up 23.67 points, or 0.1pc, to 38,709.99.

02:24 PM BST

Pound steady after strongest month of 2024

The pound was little changed after its best monthly performance against the dollar this year as investors await key data this week.

Sterling, which rose 2pc against the dollar last month, was flat at $1.273. It was down 0.1pc against the euro, which is worth 85p.

The main event this week will be the meeting of the European Central Bank, when it is all but certain to deliver its first interest rate cut since 2019.

Markets currently expect around 57 basis points’ worth of easing from the ECB in 2024, compared with around 33 basis points from the Bank of England.

Two-year gilts command a premium of around 130 bps to German two-year Schatz yields, the smallest in about six weeks.

In the United States, monthly employment data throughout the week dominates the macro calendar, culminating in Friday’s nonfarm payrolls report.

02:03 PM BST

Tui shares up 8pc after rival files for insolvency

Tui shares have climbed as much as 8pc after a German rival filed for insolvency.

German tour operator FTI said that it is filing for insolvency protection from creditors, and trips that have not yet started will be cancelled or scaled back.

FTI Group, which describes itself as Europe’s third-biggest tour operator, said parent company FTI Touristik GmbH, was filing an application for the opening of insolvency proceedings at a Munich court.

Since an announcement in April that a consortium of investors would come on board, the company said that “booking figures have fallen well short of expectations despite the positive news”.

It added: “As a result, there was an increased need for liquidity, which could no longer be bridged until the closing of the investor process.”

The operator, which has over 11,000 employees, said it is working to ensure that trips that have already started can be completed as planned, but “trips that have not yet begun will probably no longer be possible or only partially possible from Tuesday.”

Shareholders in rival Tui, which is the largest travel and tourism company in the world, enjoyed a boost after the news.

They voted in February to leave the London Stock Exchange in favour of listing its shares solely in Germany.

01:43 PM BST

Hotel industry hit by rising minimum wage

Hotel operators are feeling the pinch after workers were boosted by a rise in the minimum wage earlier this year, according to a study.

Cost pressures including the minimum wage increase have hit the profits of UK hotels, despite a surge in the price of rooms since the pandemic, according to research by consultancy RSM.

Labour costs per available room rose to £16.62 in April, up from £15.32 in March. But operating profits as a percentage of overall turnover remained flat, pointing to a direct impact of the rise in minimum wage, RSM said.

In April, workers’ groups welcomed a 9.8pc rise in the national living wage (NLW) to £11.44, bringing lower paid workers relief after steep increases in the cost of living over the last two years.

The rise also brought the NLW to equivalent to two-thirds of median earnings, lifting it above the Organisation for Economic Co-operation and Development’s threshold for what qualifies as low pay.

But for hoteliers – already squeezed by the impact of Brexit, Covid lockdowns and the cost-of-living crisis – it has piled yet more pressure onto an already struggling business model.

Operators have responded by hiking the cost of hotel rooms since the pandemic, with average daily rates of occupied rooms measuring £139.51 in April, up from £110.24 before lockdowns hit in 2020.

Occupancy was flat year-on-year in the UK at 74.5pc in April, compared to pre-pandemic levels of 77.6pc.

01:29 PM BST

Arm aiming to capture half of Windows PC market in five years, says boss

Arm aims to gain more than 50pc of the Windows PC market in five years as Microsoft and its hardware partners prepare to launch a new batch of computers based on the British company’s technology.

The Cambridge-based technology company’s US-listed shares climbed 2.6pc in pre-market trading after the confident projection from chief executive Rene Haas.

It comes as Microsoft unveiled ambitious plans last month to launch a new breed of PCs with artificial intelligence features to compete with Alphabet and Apple.

Its flagship Windows operating system will now run on chips designed by Arm, whose technology powered the rise of smartphones.

Chips made by Intel have dominated the PC industry for decades and if the Arm push succeeds, it would reorder the market.

Mr Haas told Reuters: “Arm’s market share in Windows – I think, truly, in the next five years, it could be better than 50pc.”

01:13 PM BST

Ford staff launch industrial action in row over pay

Ford managers will take industrial action this month in a dispute over pay, union bosses have said.

Workers at sites including Dunton, Stratford, Dagenham, Daventry and Halewood will refuse to work overtime on June 14 and have begun “working to rule”, whereby they follow official working rules and hours exactly.

It comes after they rejected Ford’s pay offer of only a performance-related merit award, which they are not guaranteed to receive.

Unite general secretary Sharon Graham said:

Not content with making billions in profits, Ford has decided to try and attack our members’ pay out of sheer corporate greed.

Performance related payments give no guarantee of an actual pay rise and leave these workers in danger of facing cuts to their wages.

They are absolutely right to take industrial action and they have the full support of Unite in doing so.

Unite warned that strike action may be scheduled if the dispute is not resolved.

01:05 PM BST

Fifth of first-time buyers’ mortgages longer than 35 years

Around one in five new first-time buyers took out mortgage terms stretching beyond 35 years in the first quarter of this year, according to a trade association.

Some 21pc of people taking their first step on the property ladder had home loans lasting for more than 35 years, UK Finance said.

The trend of longer-term mortgages is “further evidence of the ongoing affordability crunch”, as costs and house prices remain high relative to incomes.

The UK Finance review added:

Although the proportion of borrowing at up to 40-year terms eased slightly in (quarter one), it remains far higher than we have seen in the past.

This is the case for all types of borrower, but most significantly amongst first-time buyers.

UK Finance said most first-time buyers typically do not keep their mortgage over the full term because they move house or remortgage.

12:50 PM BST

Wall Street boosted by rate cut hopes

The Nasdaq is expected to lead Wall Street when trading begins amid increasing bets on interest rate cuts.

Apple, Meta and Alphabet gained between 0.2pc and 0.4pc in premarket trading as they were buoyed by a slight dip in US Treasury bond yields.

Artificial intelligence leader Nvidia jumped 2.9pc after chief executive Jensen Huang said on Sunday the company’s next-generation AI chip platform would be rolled out in 2026.

The technology sector closed slightly lower on Friday as investors rebalanced their portfolios at the month end.

However, despite the S&P 500 and the Nasdaq snapping their five-week winning streaks, all three of Wall Street’s main indexes ended May with strong gains.

The S&P 500 rose 4.8pc, the Dow climbed 2.3pc and the tech-heavy Nasdaq rose nearly 7pc last month, as strong earnings and hopes of easing monetary policy buoyed Wall Street’s biggest stocks.

Investors increased bets on a September start to interest rate cuts by the Federal Reserve on Friday, after inflation indicated a potential cooling of price pressures as measured by the Personal Consumption Expenditures Price Index.

In premarket trading, the Dow Jones Industrial Average was down 0.1pc, the S&P 500 was up 0.1pc, and the Nasdaq 100 had gained 0.4pc.

12:38 PM BST

Pakistan inflation lowest in two years

Inflation in Pakistan fell in May to its lowest level in 29 months after the sharpest drop since an economic crisis sent food prices soaring, according to government data.

The Pakistan Bureau of Statistics said that consumer prices rose 11.8pc, compared to a peak of 38pc in May 2023.

In April, inflation fell to under 20pc year-on-year for the first time since the country’s economy began to spiral in early 2022 as a political crisis gripped the country.

Mohammed Sohail, the CEO of Karachi-based investment house Topline Securities, said: “On the ground we have seen prices of wheat, vegetables, oil coming down.”

He called the reading “better than our expectations”.

Cash-strapped Pakistan narrowly avoided default last year, as the value of the rupee plummeted and the country’s foreign exchange reserves dwindled so low that imports were heavily restricted.

12:02 PM BST

£7bn wiped off GlaxoSmithKline as it faces 70,000 lawsuits

Ongoing concerns over the risk of Zantac litigation have weighed on GSK’s share price, as nearly £7bn has been wiped off the company today.

Our retail editor Hannah Boland has the details:

The latest share price slump wiped out around half of GSK’s gain since the start of the year.

It follows years of legal wrangling over Zantac, which drugmakers pulled from sale in 2019 after US watchdogs said they discovered “unacceptable levels” of probable cancer-causing ingredients in the medicine. It had been available over the counter in the US. In the UK, GSK recalled four prescription-only Zantac medicines.

GSK and other companies that sold Zantac have been battling lawsuits over the treatment since the middle of 2022, rejecting claims that its ingredients cause cancer.

Other court cases have been found in their favour, with a jury in Chicago last month finding that Zantac did not cause an individual to develop colon cancer. Meanwhile, GSK reached an out-of-court settlement in a case filed in California last October.

GSK has maintained that it will fight any cases. It said on Monday that it will “continue to vigorously defend itself against all claims” and was immediately seeking an appeal to the Delaware ruling. GSK said it was also filing motions for dismissal.

A spokesman said the litigation in Delaware “remains at an early stage” and only addressed the question over whether the expert evidence was “sufficiently reliable to allow them to present their evidence at trial”.

“The ruling does not mean that the court agrees with plaintiffs’ experts’ scientific conclusions, and it does not determine liability.”

11:50 AM BST

Virgin Atlantic to resume flights to Israel

Virgin Atlantic Airways will resume services to Israel at the end of the summer after putting operations on hold following the October 11 attacks by Hamas.

Our transport industry editor Christopher Jasper has the details:

Flights will operate daily to Tel Aviv starting in September, Virgin revealed. The services will connect with transatlantic flights offered by the UK airline and its US partner Delta at Heathrow to provide onward links to 14 American cities.

As well as resuming its own flights to Israel, Virgin will seek to bolster ticket sales through a new partnership with the country’s national carrier El Al starting on June 10, giving travellers a choice of four services a day.

British Airways, EasyJet and Wizz Air have already resumed flights to Israel that were paused with the start of the conflict in Gaza. Virgin Atlantic operates Airbus A330 wide-body jets on the Tel Avis route it first launched in 2019 that are harder to fill than the single-aisle planes deployed by its rivals.

EL Al has maintained London flights throughout the war and was even permitted to suspend a decades-long ban on flights on the Jewish sabbath in order to repatriate army reservists who were called up after the Hamas attacks.

Virgin also launched a codeshare deal with Saudi Arabian flag carrier Saudia, a member of the SkyTeam global alliance it joined last year, and said it’s working toward a partnership with Scandinavian airlines, the latest recruit to the grouping.

11:48 AM BST

Canada hits strike for Hollywood Bowl

Hollywood Bowl has reported a jump in profits and hiked its dividend payouts after it was boosted by growth in Canada.

The ten-pin bowling operator, which has 71 centres in the UK and 11 in Canada, posted a pre-tax profit of £29.5m for the six months to March, up 10.5pc on the previous year.

It came on the back of an 8.1pc increase in revenues to £119.2m for the year. However, shares were down 2.6pc.

Its UK business – its largest division – saw like-for-like sales grow by 1.3pc, with 8pc growth across its Splitsville brand in Canada.

Hollywood Bowl said it was boosted by investment across its portfolio of sites, including a major refurbishment programme which “remain on track and is delivering returns”.

The company said it has acquired and rebranded a new site in Lincoln in recent months and opened a new Dundee centre last month. It said it is also opening another new site in Canada over the current half-year.

The firm declared an interim dividend of 3.98p per share following the “strong earnings growth”, up 21.7pc on the same period a year earlier.

11:26 AM BST

British Airways passengers to get Amazon-style booking app

British Airways passengers are to get Amazon-style app booking where flights can be secured in just a few clicks in an overhaul of the company’s decades-old website.

Our transport industry editor Christopher Jasper has the latest:

The company’s app and website are to be relaunched as part of a £7bn revamp under BA’s chief executive Sean Doyle as he scrambles to modernise the flag carrier.

Changes will also include new planes, revamped seats and refurbished airport lounges.

The replacement website is already being trialled by people wishing to fly from London Gatwick to three Italian cities – Bari, Cagliari and Catania – plus Montpellier in France and Antalya, Turkey.

Feedback has been positive, giving BA confidence to go ahead with a full rollout, Mr Doyle told The Telegraph at the International Air Transport Association airline summit in Dubai.

Read how the airline is overhauling its website.

10:56 AM BST

Gas prices surge as Norwegian plant goes down

Natural gas prices have leapt to their highest level in five months after an unexpected outage at a Norwegian plant.

Dutch front-month futures, the benchmark contract for European gas, jumped more than 11pc today after the unplanned stoppage at the Nyhamma processing site.

It meant that gas flows to one the UK’s six main gas terminals has plunged to zero. The terminal in Easington in East Yorkshire receive’s a third of Britain’s total supply.

Gassco, which operates the pipeline from Norway to Britain, said that operator Equinor is investigating the source of the issue at the Norwegian plant.

The increase in prices today – which was the sharpest rise this year – means Europe’s benchmark contract has risen 18pc in May to more than €38 per megawatt hour, the highest level since December.

The UK’s equivalent contract was up as much as 10.3pc, which was the most since October.

Ole Hansen, head of commodity strategy at Saxo Bank, said: “The unplanned Norwegian outage is once again highlighting Europe’s dependency on imports.”

10:43 AM BST

Harley-Davidson demands Next destroys ‘copycat’ logo T-shirts

Next has been struck by a High Court row over claims it copied Harley-Davidson’s logo with “motorbike-inspired” graphics on children’s t-shirts.

Our retail editor Hannah Boland has the details:

The US motorcycle company has demanded Next destroys a range of long-sleeve T-shirts featuring biker angel wings with flames, which it argued “essentially replicates” its logo.

In court documents, seen by the Financial Times, Harley-Davidson argues that the T-shirts include “graphic material and text which is…commonly seen in the context of a motorcycle-based branding and more specifically the claimants’ branding”.

The T-shirts, which are still on sale at Next for children aged between 3 and 16, are described on the British retailer’s website as using a “motorbike-inspired graphic with flame sleeve prints”.

Read what Harley-Davidson said about the design.

10:25 AM BST

Oil prices edge up as Opec cartel extends production cuts

Oil prices have edged upwards after the Opec cartel agreed to extend most of its deep cuts to production into the third quarter of the year.

Brent crude, the international benchmark, was up 0.3pc to more than $81 a barrel, while US-produced West Texas Intermediate was up by 0.3pc to more than $77.

The Saudi Energy Ministry said that Opec’s production cuts will continue in full in the third quarter and then be gradually phased out over the following 12 months.

The move initially led to a fall in prices after several days of declines, Goldman Sachs analyst Daan Struyven said was because the “gradual unwind reflects a strong desire to bring back production of several members”.

Kim Fustier, head of European oil and gas research at HSBC, added: “How Opec+ unwinds its multiple, complex set of cuts – totalling 5.8mbd in aggregate – remains one of the biggest questions for the oil market.”

Bill Weatherburn, senior climate and commodities economist at Capital Economics, said:

The agreement by Opec+ to rollover voluntary production cuts for another quarter will, in our view, push the crude oil market into a sizeable deficit in Q3.

Oil supply will be more constrained than we had expected and we now forecast that the Brent oil price will end Q4 at $80 per barrel (previously $75 per barrel).

10:02 AM BST

GameStop shares double as Reddit account returns

Shares in video game retailer GameStop have surged by as much as 103pc in premarket trading after the return of an account on Reddit which fuelled the so-called memestock craze during the pandemic.

The account run by Keith Gill posted what appeared to be a $116m position in the company, triggering the latest surge in its valuation.

GameStop shares have swung wildly in recent weeks since the return to social media of Mr Gill, who is portrayed by Paul Dano in the 2023 film Dumb Money.

09:49 AM BST

UK manufacturing grows at fastest pace in two years

UK manufacturers are enjoying a “solid revival” as production and new business grew at their fastest pace in two years, a closely-watched survey showed.

The S&P Global UK manufacturing purchasing managers’ index (PMI) rose to 51.2 in May, up from 49.1 in April and back above the 50 mark separating growth for contraction.

The strong showing meant bosses were their most optimistic in 27 months.

Rob Dobson, director at S&P Global, said:

While the latest upturn was dependent on a strengthening domestic market, there were signs of overseas demand also moving closer to stabilisation.

Business optimism rose in tandem with the improvement in current conditions, with 63pc of manufacturers forecasting their output to be higher one year from now.

09:36 AM BST

Monzo reveals first ever annual profit

Monzo has reported its first ever annual profit despite soaring credit card losses.

The UK’s largest digital bank, which serves more than nine million customers, revealed a pre-tax profit of £15.4m for the 13 months to March, compared to a £116.3m loss a year earlier.

Revenues more than tripled to £880m as it lent £1.4bn to customers during the year, an increase of 84pc.

However, it also increased credit loss expenses by 75pc to £177m. Chief executive TS Anil said:

This was a landmark year of record growth for Monzo. We surpassed 9m personal customers and 400,000 business customers, launched game-changing new products, closed a £500m capital raise and, as planned, reported our first year of profitability.

I’ve never believed in the idea that a company has to choose between either being mission-oriented or focused on business outcomes.

2024 proved Monzo is doing both – and that our strategy of placing the customer at the heart of everything we do is working at scale.

09:09 AM BST

Eurozone manufacturing downturn nears two years

The downturn in eurozone manufacturing has lasted nearly two years, according to a closely-watched survey, although it may have turned a corner last month.

HCOB’s final eurozone manufacturing purchasing managers’ index (PMI) showed new orders declined at their slowest pace in two years, leading to improved business confidence.

The PMI rose to 47.3 in May from April’s 45.7, below the 50 mark which separates growth from contraction in activity for a 23rd month. It was just shy of a 47.4 preliminary estimate.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said:

This could be the turning point for the manufacturing sector. The industry is on the verge of halting the production decline that has persisted since April 2023.

Encouragingly, business confidence regarding future production is at its highest level since early 2022.

08:52 AM BST

UK stocks rise ahead of expected interest rate cuts

The London stock market kicked off the week on a positive note as investors anticipate interest rate cuts in Europe and the US.

The FTSE 100 jumped as much as 1.1pc as trading began but was last up 0.2pc. The mid-cap FTSE 250 gained 0.6pc.

The European Central Bank (ECB) will meet later this week, where investors expect it to reduce interest rates from their record highs of 4pc.

Analysts predict the Bank of England to closely shadow the ECB’s movements in two weeks’ time, while US inflation data on Friday raised hopes that the US Federal Reserve will also be able to reduce borrowing costs later this year.

Among individual stocks, Hipgnosis Songs Fund gained as much as 1pc after Blackstone sweetened its offer for the music rights investor by a cent to $1.31 from $1.30 as part of a revised bid.

GSK was last down 9.6pc after a court ruling in the US state of Delaware meant it will face trials over its discontinued heartburn drug Zantac.

St James’s Place rose 5pc after JP Morgan upgraded its rating on the stock to “overweight” from “neutral”.

08:36 AM BST

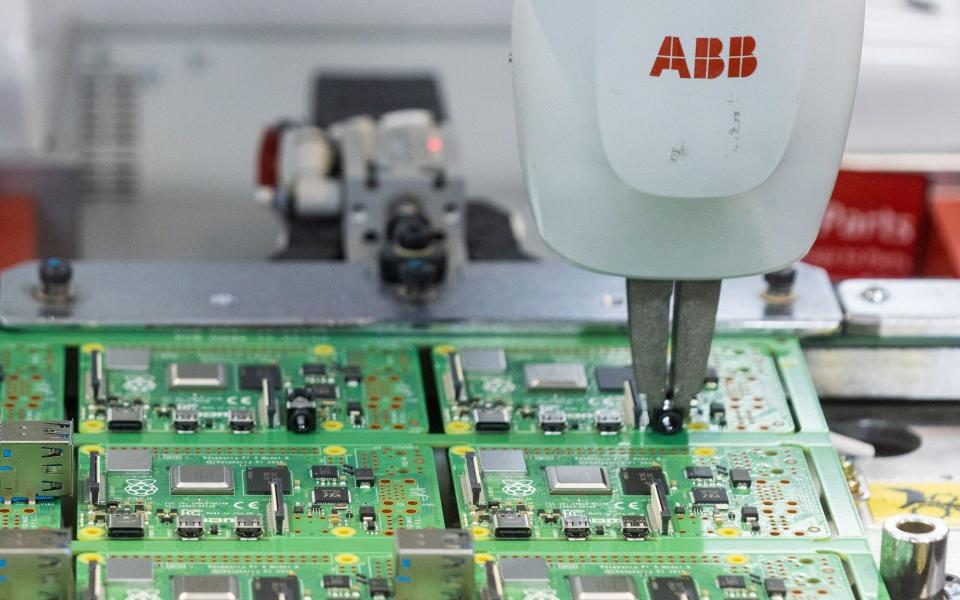

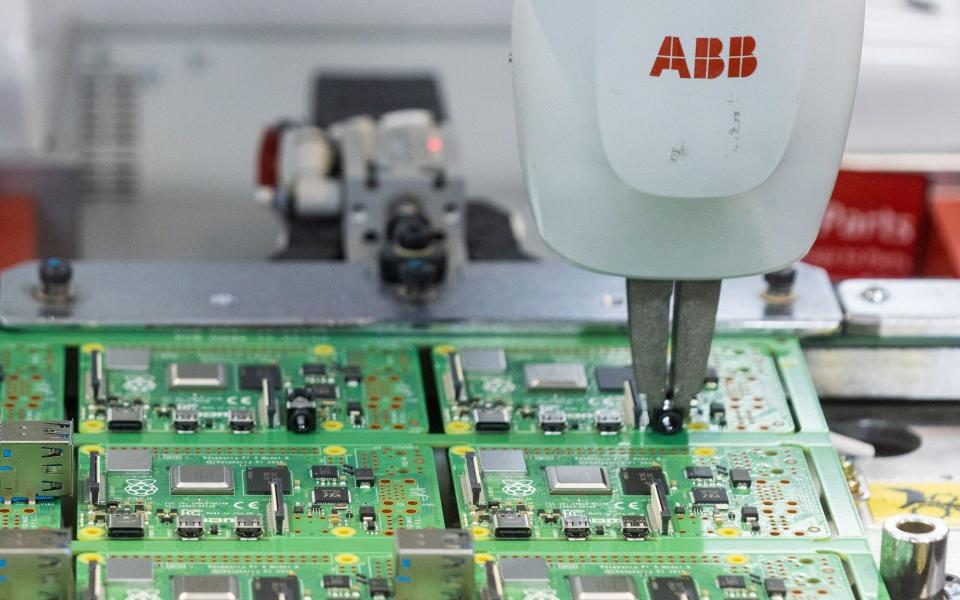

Raspberry Pi seeks £157m in UK listing

Micro computer maker Raspberry Pi and its shareholders are looking to raise £157m in a float on the London Stock Exchange.

The Cambridge-based company plans to sell shares at £2.60 to £2.80 each until June 10, with the start of conditional trading on June 11, according to Bloomberg News.

Although it is a relatively small initial public offering, it is symbolically a boost for London after a dearth of listings in recent years.

Raspberry Pi is best known for its tiny computers that have a devoted following of hobbyists and amateur coders, but has a growing business selling to corporate customers for use in industrial facilities.

08:30 AM BST

GSK plunges after Zantac court ruling

GSK has plunged to the bottom of the FTSE 100 after a court ruling that it must face trials over whether its Zantac drug causes cancer.

Shares in the pharmaceutical giant dropped by as much as 9.8pc in early trading after a judge ruled that juries in Delaware can hear evidence about the treatment.

In 2022, a federal judge in Florida had rejected such evidence, but on Friday Superior Court Judge Vivian Mednilla concluded that it was not based on flawed science and could be used to support allegations that Zantac causes a variety of cancers.

08:15 AM BST

Turkey’s inflation nears 76pc

Turkish inflation rose to 75.45pc last month in what is expected to be the peak of its period of runaway prices.

The country’s consumer prices index rose from just under 70pc in April and comes as interest rates have been raised to 50pc to tackle the soaring cost of living.

Analysts think Turkey’s inflation will fall to 38pc by the end of the year, which would still be the sixth-fastest pace in the world, according to the IMF.

08:04 AM BST

FTSE 100 jumps at the open

UK stock markets leapt higher at the start of the week after data from the US indicated that inflation may be easing after a persistent first three months of the year.

The FTSE 100 rose 1.1pc to 8,361.99 while the midcap FTSE 250 gained 0.5pc to 20,823.64.

07:58 AM BST

Saudi oil giant plans UK events to drum up demand for $12bn share sale

Saudi Aramco’s top executives are expected to hold a series of events in Britain and the US as they seek to drum up interest for a $12bn share sale.

Saudi Arabia’s state-owned oil giant scrapped an international roadshow for its $29.4bn initial public offering five years ago after overseas investors turned their noses up at its valuation expectations, leaving the government reliant on local buyers.

However, its secondary listing plans were oversubscribed within hours of the deal opening on Sunday.

As a result, the Aramco is planning events to attract investors in London this week, at least one of which will be attended chief executive Amin Nasser, according to Bloomberg News.

The Saudi government owns about 82pc of Aramco, while the kingdom’s wealth fund holds a further 16pc stake.

07:43 AM BST

US private equity giant Blackstone sweetens offer for Hipgnosis

US private equity giant Blackstone has improved its offer for Hipgnosis as it seeks to win approval from the music rights owner’s shareholders.

Blackstone has raised its offer from $1.30 to $1.31 a share – or 105p – which puts a $1.6bn (£1.2bn) valuation on the company, which owns the rights to songs by artists including Shakira and Neil Young.

Hipgnosis had already agreed to a $1.30 per share bid from Blackstone – an increase on the company’s original proposal of $1.24 per share.

The process had been complicated by tensions between the London-listed fund and its founder Mr Mercuriadis, who runs advisory firm Hipgnosis Songs Management (HSM).

Blackstone, which owns a majority stake in HSM, is expected to retain the founder in his advisory role should its takeover offer be accepted.

Mr Mercuriadis, a former manager of Beyonce and Elton John, has threatened to trigger a call option that would give him the right to buy the company’s entire catalogue of songs if his contract is terminated.

07:28 AM BST

Shein to file for £50bn blockbuster London float

Fashion behemoth Shein is expected to file documents with regulators in the coming weeks which will take it a step closer to a £50bn float in London.

The China-founded retailer, which is headquartered in Singapore, is likely to spark controversy with a listing in Britain.

High street leaders are understood to be lobbying ministers over Shein’s alleged use of tax loopholes, while the company is thought to be listing in the UK rather than New York amid US regulatory hurdles for companies with links to China.

Shein, which owns British fashion brand Missguided, is preparing to file a prospectus to the Financial Conduct Authority as soon as this week, according to Sky News.

The company would become one of the largest members of the FTSE 100 if the listing goes ahead.

Shein is expected to file documents with UK regulators as soon as this week, although it could take place later this month, according to Sky News.

Such a move could open the door to a summer or autumn listing on the London Stock Exchange, which has been struggling to attract listings from major companies in recent years.

Jeremy Hunt met with Shein’s executive chairman Donald Tang earlier this year, during which the Chancellor urged the business to list in the UK.

07:18 AM BST

Good morning

Thanks for joining me. We begin the week with a potentially huge boost for the London Stock Exchange.

China-founded fast fashion retailer Shein is preparing to file documents with regulators that will take it a step closer to a blockbuster float that would make it one of the largest members of the FTSE 100.

5 things to start your day

1) Cash-strapped councils to recoup record £1.4bn to avoid collapse | Experts warn that last resort sales will only worsen local government’s fiscal squeeze

2) Rolex increases watch prices in UK as gold rallies | Surge in value of gold comes as investors look for safe haven assets amid uncertainty

3) HSBC owed £143m by Barclay family’s collapsed logistics company | Restructuring experts overseeing administration warn the bank ‘will not be repaid in full’

4) Opec cartel to extend cuts to oil output in bid to prop up prices | Saudi Arabia and Russia are driving efforts as they seek to bolster their balance sheets

5) Britain’s real life ‘Q-branch’ joins US war on fentanyl with blimp fleet | QinetiQ is to take over network of airship-like craft monitoring American borders

What happened overnight

Asian shares began June with big gains after a report showing that inflation in the US is not worsening drove a rally on Wall Street.

Tokyo stocks closed higher amid gains for major bank shares, with the benchmark Nikkei 225 index climbing 1.1pc, or 435.13 points, to end at 38,923.03, while the broader Topix index added 0.9pc, or 25.58 points, to 2,798.07.

Hong Kong’s Hang Seng led the region’s gain, jumping 2.7pc to 18,560.98 and the Shanghai Composite index rose 0.3pc, to 3,095.63.

The Kospi in Seoul surged 1.9pc to 2,687.11. Australia’s S&P/ASX 200 climbed 0.7pc to 7,756.80. In Taiwan, the Taiex was up 1.9pc.

On Friday, the S&P 500 rose 0.8pc to close its sixth winning month in the last seven, ending at 5,277.51. The Dow leaped 1.5pc to 38,686.32, and the Nasdaq slipped less than 0.1pc to 16,735.02.

Source Agencies