(Bloomberg) — A Federal Reserve interest rate cut could be a signal of trouble for the economy, according to Bank of America Corp. strategists.

Most Read from Bloomberg

US equities have been rallying since October as the economy and company earnings held up despite the higher-for-longer rates environment. Investors are hoping the US central bank will start to ease policy before economic growth is significantly harmed.

But Bank of America’s Michael Hartnett said a Fed rate cut would be the “first hint of trouble,” with the chance of a hard landing increasing if the market grows more confident of lower rates in the second half of 2024.

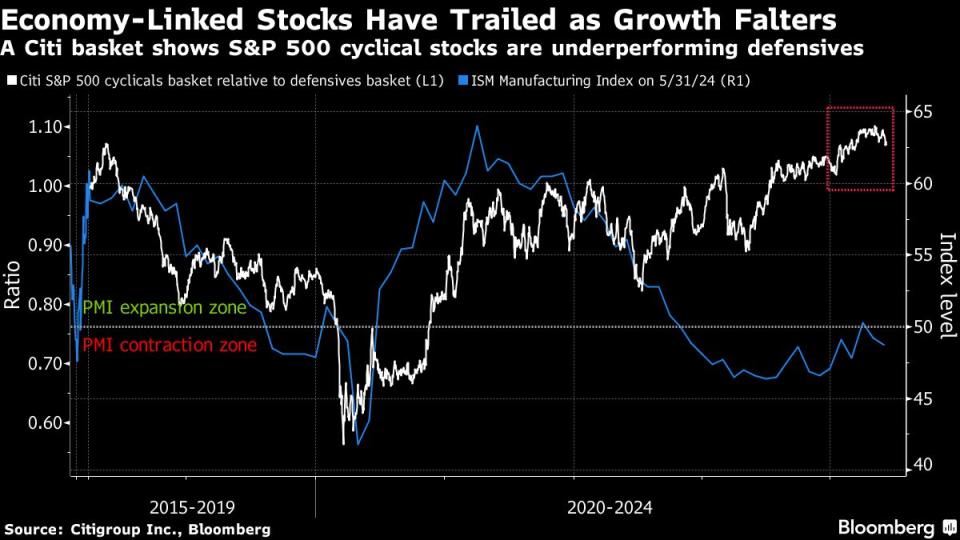

Traders have consistently pushed back expectations of a Fed cut through this year, and now see the first one coming in September. If traders boost bets on a rate reduction and economically sensitive cyclical stocks fail to rally, bonds will outperform as the fear of a significant slowdown rises, Hartnett said.

Jobs data due on Friday will provide fresh insight into the health of the US economy. The expectation is for a modest acceleration in May from the prior month. That would produce a cooling in average job growth over the most recent three months, adding to evidence that labor demand is softening.

Any sign that the labor market is still running hot could spook the market and push backs odds of a cut even further.

For now, investors continue to pour money into stocks, with US equity funds getting $4.6 billion in the seventh week of inflows, according to the BofA note citing EPFR Global data. Investment-grade bonds received $5.8 billion, the 32nd week of inflows.

—With assistance from Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source Agencies