If you’re looking to build long-term wealth, investing in the stock market is a great habit to get into. Over the past century, the S&P 500 index has generated average returns of 10.6% annually, showing that patient investors get rewarded in the long term.

Certain companies can go on to outperform the S&P 500 index over long periods of time. Those great businesses tend to produce excellent cash flow and have some distinct advantages over their competition.

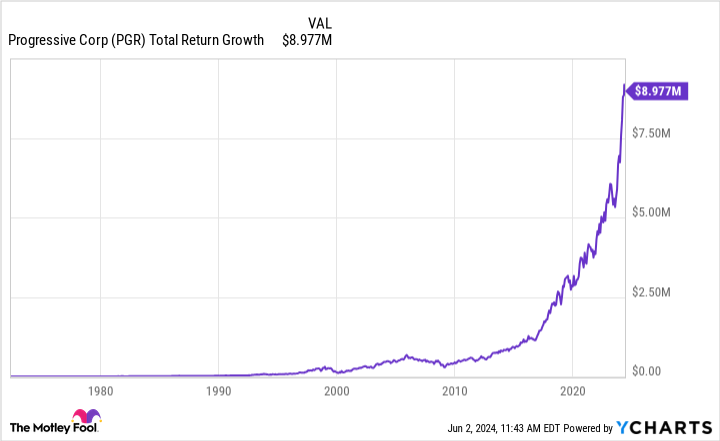

Progressive (NYSE: PGR) is an outstanding example of how quality businesses can provide excellent returns for patient investors. A $1,000 investment in the insurer when it went public in 1971 would be worth $8.7 million today. Here’s why the company has crushed it and has what it takes to keep winning.

How Progressive broke the industry mold

Investing in insurance companies doesn’t seem exciting, but Berkshire Hathaway CEO Warren Buffett loves them, which should be reason enough to pay attention to them. Buffett likes that insurance companies provide steady cash flow, thanks to the consistent demand for insurance products from both consumers and businesses.

Owning insurance is essential for people and businesses to protect themselves from catastrophes, and good insurers can balance the risks of insuring a large pool of policies with the rewards of an underwriting profit. However, insurance is a hypercompetitive industry that can be challenging for companies to stand out in.

When you evaluate the industry on a broad scale, insurers break even when you look at the ratio of premiums paid out to the costs of claims and expenses of running their business. Decades ago, it was commonly accepted that insurers wouldn’t profit from their policies. Instead, they would make money from their large investment portfolios.

Progressive took exception to this commonly accepted doctrine. In 1965, Peter B. Lewis (whose father helped found Progressive) took over as CEO of the insurance company, which was still quite small, with only 40 employees at the time. Lewis pledged that they would achieve growth through consistently underwriting profitable insurance policies. While this meant that customers could go to competitors for lower rates, it also laid the foundation for Progressive long-term success.

In 1971, Progressive went public and set a goal to make $4 in profit for every $100 in premiums it received. This long-term commitment to profitable underwriting has been the foundation for Progressive’s long-term success and is why a $1,000 investment then would be worth over $8.7 million today.

PGR Total Return Level data by YCharts

Progressive overcame a challenging environment for insurers in 2023

Insurance companies tend to break even, showing how hypercompetitive it is for companies to break into the industry. To illustrate this, you’ll have to understand the combined ratio. This profitability measure shows the ratio of a company’s premiums collected to expenses and claims costs it incurs. A ratio around 100% means a company is breaking even, with a lower ratio meaning more profitable underwriting.

Last year, insurers struggled with inflation, which increased the costs of repairs and replacements, raising claims costs and weighing on their underwriting profitability.

In the first quarter of last year, automotive insurers’ loss ratio was the worst for the quarter going back two decades. At the end of the year, the property & casualty industry combined ratio was 103.9%, the highest reading since 2017.

Despite the challenging environment, Progressive adjusted its premiums charged and shaped its insured portfolio to achieve a combined ratio of 94.5%. This marked the 22nd consecutive year the company has reached its goal of 96% or better, which is a testament to Progressive’s commitment to technology and maintaining its edge in the automotive insurance market.

A high-quality stock to own

Progressive is well-positioned if the economy continues to grow, and can also benefit from tailwinds if inflation and interest rates remain higher for longer. The company continues to grow its policies in force, which were up 7% in Q1, despite raising its premiums, showing its pricing power if inflation remains stubbornly high. It also benefits from higher interest rates because it can invest future cash flow into lower-risk U.S. Treasuries at attractive yields.

Progressive continues to outperform its peers, and last year was a great example of it adapting to a challenging operating environment. The insurer continues to make good on its long-term goals and has proven itself as a top underwriter, making it an excellent stock for the long haul.

Should you invest $1,000 in Progressive right now?

Before you buy stock in Progressive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Progressive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Courtney Carlsen has positions in Progressive. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

This Stock Turned $1,000 Into $8.7 Million — and It’s Still a Buy Today was originally published by The Motley Fool

Source Agencies