As global markets display a mixed landscape with regions like the U.S. experiencing fluctuating economic signals and Europe adjusting interest rates amidst persistent inflation concerns, investors continue to navigate through a complex financial environment. In this context, high-yield dividend stocks might appear particularly appealing as they offer potential for steady income in an otherwise uncertain market scenario. Understanding what constitutes a robust dividend stock is crucial under these conditions. Ideally, such stocks belong to companies with strong fundamentals, consistent payout histories, and the ability to sustain dividends even when economic conditions are challenging. This resilience makes them an attractive option for those looking to generate reliable income from their investments.

Top 10 Dividend Stocks

|

Name |

Dividend Yield |

Dividend Rating |

|

Allianz (XTRA:ALV) |

5.32% |

★★★★★★ |

|

Guaranty Trust Holding (NGSE:GTCO) |

8.00% |

★★★★★★ |

|

Sonae SGPS (ENXTLS:SON) |

6.16% |

★★★★★★ |

|

Globeride (TSE:7990) |

3.62% |

★★★★★★ |

|

HITO-Communications HoldingsInc (TSE:4433) |

3.54% |

★★★★★★ |

|

FALCO HOLDINGS (TSE:4671) |

6.77% |

★★★★★★ |

|

Banque Cantonale Vaudoise (SWX:BCVN) |

4.49% |

★★★★★★ |

|

Mitsubishi Research Institute (TSE:3636) |

3.42% |

★★★★★★ |

|

GakkyushaLtd (TSE:9769) |

4.12% |

★★★★★★ |

|

Innotech (TSE:9880) |

4.08% |

★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

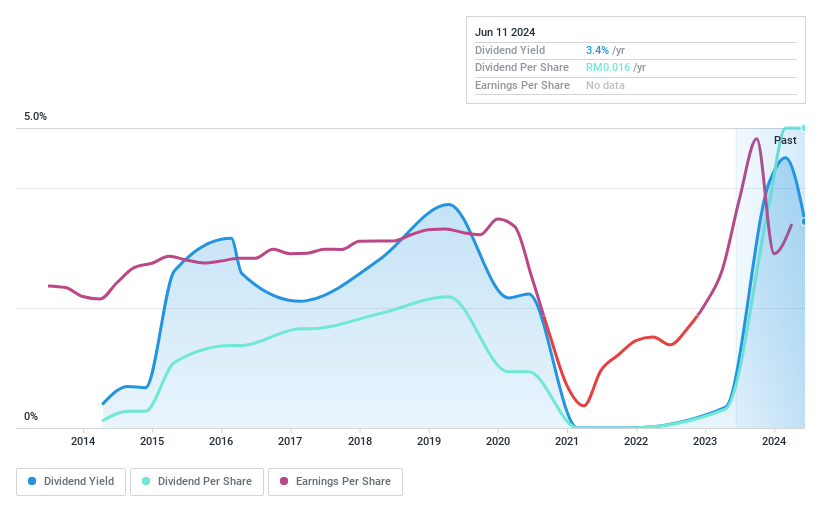

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RGB International Bhd, an investment holding company, specializes in manufacturing, marketing, trading, and selling electronic gaming machines and equipment under the RGBGames brand with a market cap of approximately MYR 701.09 million.

Operations: RGB International Bhd generates its revenue primarily through the production and distribution of electronic gaming machines and equipment.

Dividend Yield: 3.4%

RGB International Bhd. recently declared a dividend of MYR 0.006 per share, payable on July 12, 2024, reflecting a commitment to shareholder returns despite its unstable dividend history. For Q1 2024, RGB reported significant earnings growth with sales doubling to MYR 210.11 million and net income rising to MYR 22.18 million from the previous year. This financial improvement supports their dividends with a payout ratio of 58.2% and cash payout ratio at a manageable 29.2%, although their dividend yield remains modest at 3.44% in comparison to higher market averages.

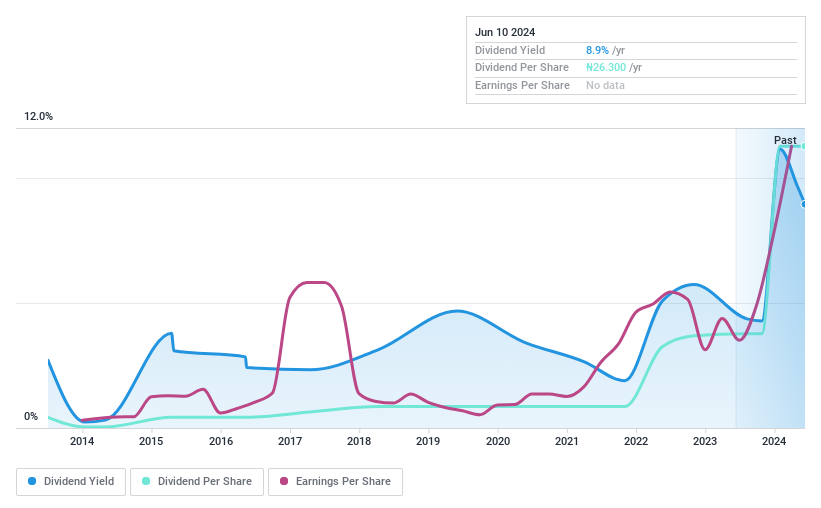

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Presco Plc operates in Nigeria, focusing on oil palm plantations, palm oil milling, palm kernel processing, and vegetable oil refining with a market capitalization of approximately NGN 293.90 billion.

Operations: Presco Plc generates NGN 123.05 billion in revenue primarily from its food processing segment.

Dividend Yield: 8.9%

Presco Plc demonstrated robust financial growth in Q1 2024, with sales and net income more than doubling from the previous year. Despite a high dividend yield of 8.95%, which places it among the top quartile in its market, concerns arise as its dividends are not well supported by cash flows, with a cash payout ratio of 199.5%. Additionally, while the company has increased dividends over the past decade, their payments have shown volatility and inconsistency.

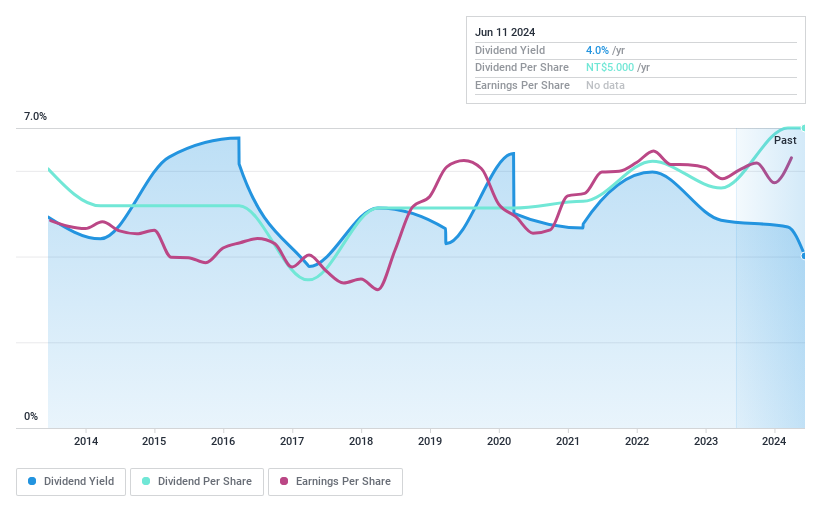

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lumax International Corp., Ltd. operates in the trading of electronic components and process control equipment and systems primarily in Taiwan and China, with a market capitalization of NT$10.91 billion.

Operations: Lumax International Corp., Ltd.’s revenue is primarily derived from its program-controlled instrument segment, which generated NT$2.95 billion, followed by other program control business at NT$1.50 billion, and program-controlled systems at NT$1.73 billion; the company also earns from electronics components and communication and linear transmission systems with revenues of NT$531.78 million and NT$514.70 million respectively.

Dividend Yield: 4%

Lumax International reported a solid Q1 2024, with sales and net income rising to TWD 1.80 billion and TWD 252.29 million respectively. Despite a history of volatile dividends, recent increases signal potential improvement. The company maintains a reasonable payout ratio of 55.5% and cash payout ratio of 54.8%, suggesting dividends are well-covered by earnings and cash flows. However, its dividend yield at 4.02% remains slightly below the top quartile in Taiwan’s market.

Turning Ideas Into Actions

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KLSE:RGB NGSE:PRESCO and TWSE:6192.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source Agencies