Advanced Micro Devices (NASDAQ: AMD) hasn’t received much love on Wall Street of late, which is evident from the 23% decline in the company’s stock price since it posted a 52-week high in early March.

The stock has been punished on account of weaker-than-expected growth in the artificial intelligence (AI) business in the first quarter of 2024, as a result of which the company missed the market’s growth expectations. Additionally, the stock was recently downgraded by Morgan Stanley to neutral from overweight, with the investment bank pointing out that investors’ expectations of growth from its AI business are on the higher side.

The bank added that it sees limited upside in shares of AMD despite a recovery in the company’s key business segments. However, it may be too early to write off this semiconductor stock for a few simple reasons. Let’s take a closer look at two of them.

1. AMD is in a terrific position to capitalize on the growing sales of AI-enabled computers

According to Mercury Research, AMD’s market share in desktop central processing units (CPUs) stood at 23.9% in the first quarter of 2024, an increase of 4.7 percentage points from the year-ago period. Meanwhile, its share of notebook CPUs increased by 3.1 percentage points to 19.3%. Intel controls the rest of this market, but it is worth noting that AMD has been rapidly making a dent in Intel’s market share.

The good part is that AMD has set its sights on the AI PC market via its new generation of Ryzen processors equipped with dedicated hardware to enable AI applications. Its new Ryzen AI 300 processors deliver 3 times the performance of the previous generation offering on laptops. More importantly, AMD estimates that its processors could power more than 150 AI software experiences by the end of 2024, as a result of which its CPUs could keep gaining market share.

So, there is a good chance that AMD will be able to sustain the impressive growth momentum that it is witnessing in the client processor business right now. The company’s revenue from selling CPUs deployed in laptops and desktops increased 85% year over year in the first quarter to $1.4 billion.

AMD is the smaller player in the client CPU market. So, if it continues to take market share away from Intel and makes the most of the opportunity in AI-enabled PCs, shipments of which are forecast to increase at an annual rate of 44% over the next four years, its client revenue could continue improving at a healthy rate.

2. The data center business has a couple of solid catalysts

AMD’s data center business is benefiting from the proliferation of AI in a couple of ways.

First, the company’s data center graphics processing unit (GPU) business is now gaining traction thanks to the massive demand for AI accelerators. This year, AMD is forecasting $4 billion in revenue from sales of data center GPUs. The company has been raising its revenue expectations from sales of data center GPUs over the past few quarters as more customers have been lining up to buy its chips.

Given that AMD generated a total of $6.5 billion in revenue from its data center segment last year, it is easy to see that this segment is on track to deliver robust growth in 2024. It is also worth noting that AMD sold $400 million worth of data center GPUs in the fourth quarter of 2023, which means that it is on track to clock a much faster quarterly revenue run rate in this business this year.

AMD’s data center GPU revenue could keep growing at a nice pace over the long run because of the massive revenue opportunity available in the AI chip market, as well as the company’s moves to make a bigger dent in this space by accelerating its product development.

However, there is another AI-related opportunity for AMD in the data center market thanks to AI in the form of server processors. The company’s Epyc server CPUs are being deployed for AI inference applications, and they are driving solid growth in data center revenue along with GPUs. More specifically, AMD’s overall data center revenue increased 80% year over year in Q1 to $2.3 billion.

Considering that AMD has been gaining market share in server processors, investors can expect this terrific growth to continue in the future. AMD’s server CPU unit market share increased 5.6 percentage points year over year to 23.6%, while its revenue share increased to 33%. This, again, is happening at Intel’s expense and bodes well for AMD as the global server market is expected to grow at more than 12% a year for the next five years.

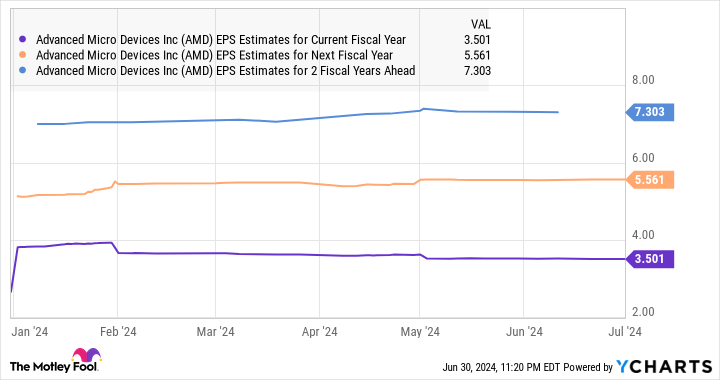

These catalysts explain why AMD’s growth is forecast to improve.

So, investors would do well to take advantage of the pullback in AMD as the stock market could reward its stronger growth with more upside in the future.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $751,670!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Wall Street May Be Underestimating This Artificial Intelligence (AI) Stock: 2 Reasons Why You Should Consider Buying While It Remains Beaten-Down was originally published by The Motley Fool

Source Agencies