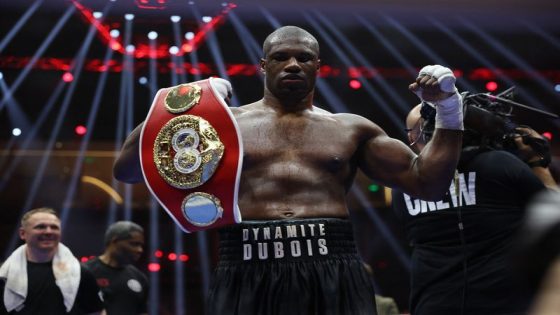

Getty Images

If you’re struggling to keep up with your credit card payments, you may be looking into your debt relief options. And, one popular option — credit card debt forgiveness, also known as credit card debt settlement — may help eliminate a portion of your card balance, helping to reduce the cost of your credit card debt.

That said, you may be wondering if credit card debt forgiveness programs actually work. After all, why would a credit card company be willing to clear a substantial portion of your balance? Here’s what experts have to say about the efficacy of these programs.

Chat with a debt relief expert to start putting your debt behind you today.

Does credit card debt forgiveness really work? Experts weigh in

“Debt settlement is a viable option for people who are drowning in debt and have nowhere else to turn short of bankruptcy,” says Tyler Gray, CFP, managing director at SageOak Financial, a financial planning firm.

“Credit card debt forgiveness can certainly work, although it’s not without its consequences,” says Noah Damsky, CFA, Principal at Marina Wealth Advisors. “You can negotiate with the credit card company or consider working with a reputable debt relief company.”

Still, working with a debt relief company may be more successful than negotiating your debts alone. After all, debt relief companies “can have relationships and credibility to negotiate better terms than you can on your own. Go about it the right way and you can wipe out a portion of your debt,” Damsky says.

And, in certain cases, you won’t seek forgiveness from your credit card companies. Instead, you may work with a debt collector on your debt settlement.

“If there is a clear inability to pay, sometimes credit card companies will sell the debt to a debt collector,” says Michael Broughton, founder and CEO of ALTRO, a credit-building app.

Debt collectors will often “bargain for you to pay just a portion of the debt to ‘zero-out’ the outstanding balance,” Broughton says.

But, there are pros and cons to consider, Damsky says, “so, weighing them according to your situation is critical to arriving at the best outcome.”

If you choose to move forward with debt forgiveness, you may face difficulties accessing new credit in the future.

“Debt forgiveness will lower your credit score and limit your flexibility,” says Damsky. “Some lenders and creditors might not be willing to work with you going forward.”

There may also be tax consequences to consider.

“You could also owe taxes on the forgiven amount, so your savings might be lower than expected after paying taxes,” Damsky says.

“In some cases, even certain jobs or industries will ask, ‘Have you ever made a compromise with creditors?’ on a job or professional licensing application,” says Gray. “So, if you proceed, be sure it is your only option, as that decision may follow you for many years.”

And, if you take the credit card debt forgiveness approach, it’s important to address the spending habits that led to overwhelming debt in the first place. “

From my experience, without a degree of pain, hardship or sacrifice to figure out how to pay off that debt, the person may not truly feel compelled to change their misbehaviors around spending and credit use,” says John Gillet, CEO and founder of Gillet Agency, a financial planning firm. “Self-reflection questions like, ‘How did I get here?’ or ‘What was I thinking?’ are necessary.”

Find out how much relief credit card debt forgiveness can provide today.

Other debt relief options to consider

If you need to get rid of your card debt, debt forgiveness may not be your only option.

“A preferred option to consider before debt settlement is debt consolidation,” says Gray. “In debt consolidation, you typically transfer your debt from one or more lenders to a new lender/creditor with a (hopefully) lower interest rate and/or better payment terms.”

Credit counseling may be another viable option.

“There are also credit counseling agencies that can assist with negotiating with creditors on your behalf,” says Gray. “But again, depending on how those negotiations and relationships are structured, it could impact your credit report or score.”

The bottom line

Credit card debt forgiveness does work for many cardholders, but this option can come with consequences. In particular, it could negatively impact your credit score and may not address the underlying cause of your debt. And, you may have other options that have less of an impact on your overall financial help. So, be sure you’ve considered all your debt relief solutions before signing up for a credit card debt forgiveness service. Chat with an expert about your debt relief options today.

Source Agencies