A leading Chinese chip design software start-up is slashing as much as half of its workforce, casting a shadow over Beijing’s efforts to achieve tech self-sufficiency, according to three people familiar with the matter.

X-Epic, established in 2020 with a mission to develop indigenous electronic design automation (EDA) tools to break the monopoly of US firms, started cutting jobs this week across different departments, including its core research and development unit, according to sources familiar with the situation who declined to be identified as they are not authorised to talk to media.

The company, which is privately owned, did not immediately respond to a request for comment on Wednesday. While it does not disclose details of its business operations, Pitchbook data showed that the firm had a workforce of about 400 working in offices in Nanjing, Beijing, Shanghai, Chengdu and Shenzhen, as of March 2023.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

The start-up was founded in March 2020 by Wang Libin, a former engineer from US EDA giant Cadence Design Systems. X-Epic, which stands for “accelerating EDA pioneer innovation centre”, had raised US$121.7 million as of March 2023, according to PitchBook. It counts HongShan (formerly Sequoia Capital China), Matrix Partners China, China Information and Communication Technology Group as investors.

Wang Libin, the founder X-Epic. Photo: Handout alt=Wang Libin, the founder X-Epic. Photo: Handout>

The firm is a rising star among local EDA firms, and was included on the provincial Nanjing government’s list of favoured innovative start-ups in May. X-Epic and other Chinese EDA firms like Empyrean Technology are working to develop software tools for complicated chip designs, a field long dominated by Cadence, Synopsys and Mentor Graphics – three US companies, although Mentor is now owned by European giant Siemens.

The reliance on imported EDA software and intellectual property constitutes one of China’s biggest vulnerabilities in the semiconductor value chain, along with hardware bottlenecks in the area of lithography machines.

US tech sanctions, imposed over national security concerns, encompass both hardware and software aspects of EDA. Washington first restricted China’s access to the technology in August 2022, when it prohibited gate all-around, or GAA-capable, EDA software from being exported to countries including China. This posed long-term challenges for Chinese chip makers in adopting more advanced processes such as the 3-nanometre node, and in the development of high-performance computing or AI chips.

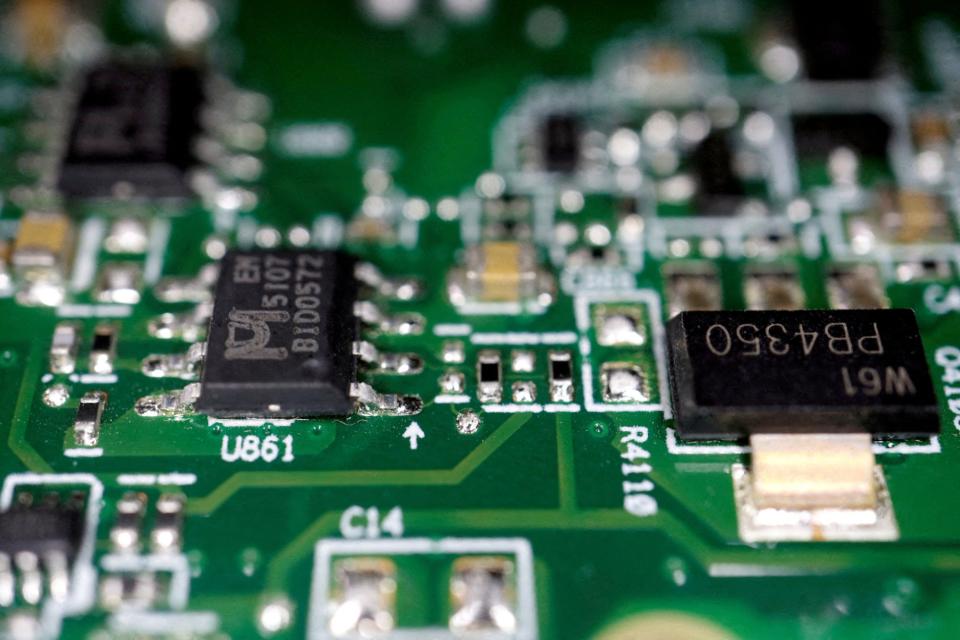

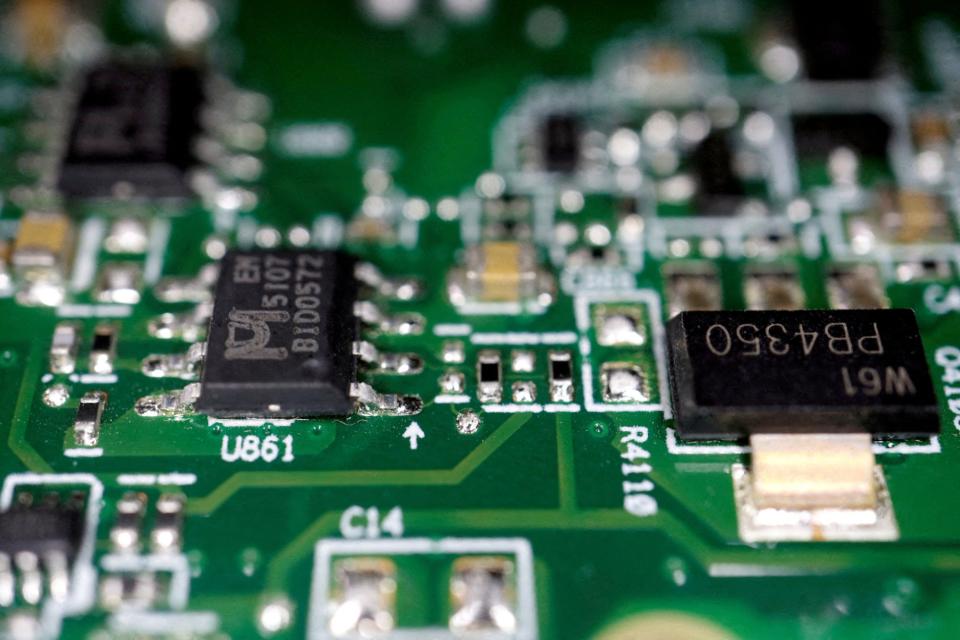

Semiconductors are seen on a printed circuit board in this illustration picture taken February 17, 2023. Photo: Reuters alt=Semiconductors are seen on a printed circuit board in this illustration picture taken February 17, 2023. Photo: Reuters>

However, mastering EDA technology at home has seen slow progress. The big three foreign vendors together control about 70 per cent of China’s EDA market, with Beijing-based Empyrean Technology, the biggest Chinese player, trailing with a 7 per cent market share, according to data from consultancy JW Insights.

Chinese EDA firms saw their business slow in the first quarter amid broader market headwinds after China’s semiconductor sales fell 14 per cent last year, the steepest decline of all markets in the world. Empyrean saw its first-quarter net profits drop 64 per cent year on year to 7.7 million yuan (US$1.1 million) due to increased research and development spending, according to the company’s financial reports issued in April.

The value of China’s EDA market is expected to reach 18.5 billion yuan next year, up from 9.3 billion yuan in 2020, according to the China Semiconductor Industry Association.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Source Agencies