Share prices of CrowdStrike (NASDAQ: CRWD) have taken off since the beginning of June, with impressive gains of 22% as of this writing. There are a couple of reasons behind the cybersecurity specialist’s robust rally that helped it outpace one of the hottest stocks on the market during this period: Nvidia (NASDAQ: NVDA).

It’s worth noting that CrowdStrike’s gains over the past month are almost double the 11% jump that Nvidia stock has registered. Much of the jump can be attributed to the cybersecurity company delivering impressive fiscal 2025 first-quarter results (for the three months ended April 30) at the start of June. CrowdStrike beat Wall Street’s expectations and raised its fiscal 2025 guidance.

The company’s impressive results were followed by news that it would join the S&P 500 index, and that gave the stock another shot in the arm. These positive developments go a long way to explaining why CrowdStrike stock is up nearly 50% in 2024.

Should investors consider buying this cybersecurity stock in anticipation of more upside? Let’s find out.

CrowdStrike’s AI-powered growth is here to stay

CrowdStrike’s revenue in fiscal Q1 increased 33% year over year to $921 million. The revenue jump was driven by customers’ increased spending on cybersecurity offerings. CrowdStrike reported that more than 65% of its subscription customers now use five or more of its cybersecurity modules. That was up from 62% a year ago.

Even better, CrowdStrike reported a 95% year-over-year increase in clients using eight or more cybersecurity modules (thanks to the growing demand for its Falcon cybersecurity platform). CrowdStrike has been integrating AI tools and functionalities into the Falcon platform, such as a generative AI-powered security assistant known as Charlotte AI, to help companies shorten response times to cyber threats.

Going forward, CrowdStrike plans to push the envelope in the AI-enabled cybersecurity market by partnering with companies like Nvidia. The cybersecurity specialist will allow customers to use Nvidia’s hardware to train custom cybersecurity large language models so that they can “improve threat hunting, detect supply chain attacks, identify anomalies in user behavior, and proactively defend against emerging exploits and vulnerabilities.”

Such moves could help CrowdStrike capture a bigger share of the AI-enabled cybersecurity market, which is forecast to grow at a compound annual growth rate of 22% through 2031 and generate annual revenue of $114 billion at the end of the forecast period. The growing adoption of the company’s AI-enabled cybersecurity platform will allow it to build a solid future revenue pipeline.

CrowdStrike’s remaining performance obligations (RPO) increased 42% year over year in the previous quarter to $4.7 billion. The metric’s growth outpaced the improvement in the company’s revenue, which bodes well for the future as the RPO refers to the total value of a company’s future contracts that are yet to be fulfilled.

The improving revenue pipeline also explains why CrowdStrike raised its fiscal 2025 revenue forecast to $3.99 billion at the midpoint from the earlier estimate of $3.95 billion. The updated forecast points toward a potential year-over-year jump of 31% in the company’s revenue. But don’t be surprised to see CrowdStrike ending the year with stronger growth on the back of its solid RPO.

But is the stock worth buying right now?

CrowdStrike’s better-than-expected results and improved full-year guidance have no doubt stoked investors’ enthusiasm, but they have also made the stock quite expensive. CrowdStrike currently trades at 28 times sales, which is significantly higher than the U.S. technology sector’s average of 8.3.

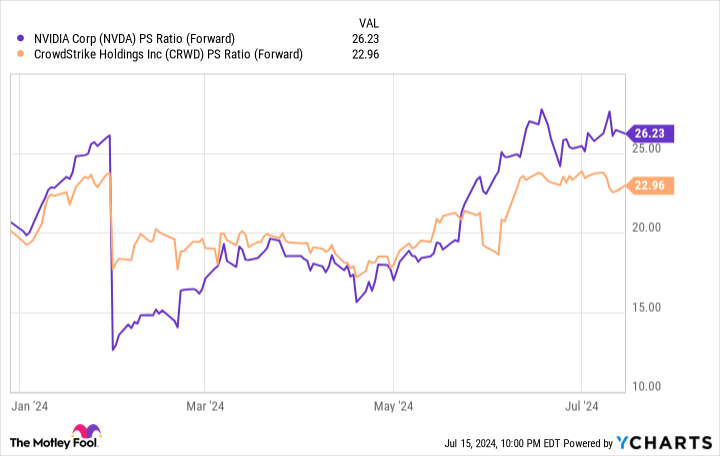

Piper Sandler analyst Rob Owens points out that CrowdStrike stock has the highest sales multiple of any public software company with a market cap of more than $75 billion. Chip designer Nvidia, for comparison, has a price-to-sales ratio of 40, but it is growing at a much faster pace than CrowdStrike. Moreover, a closer look at the forward sales multiples indicates that Nvidia is expected to keep growing at a faster pace as its forward reading is much lower than the trailing sales multiple (its P/S is expected to fall from 40 down to 26 while CrowdStrike is expected to go from 28 down to 23).

Given that Nvidia is the dominant player in the AI chip market and has a brighter growth outlook, investors would be tempted to put their money into the semiconductor giant instead of CrowdStrike. After all, CrowdStrike’s valuation is the reason Piper Sandler downgraded the stock from overweight to neutral.

Also, CrowdStrike’s 12-month median price target of $400 (as per 48 analysts covering the stock), points toward almost no upside from current levels. That’s why investors who have missed this cybersecurity stock’s impressive run-up in 2024 would do well to keep it on their watchlists and look for a better entry point before adding CrowdStrike to their portfolios.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,281!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and Nvidia. The Motley Fool has a disclosure policy.

This Artificial Intelligence (AI) Stock Is Outperforming Nvidia. Can It Keep Doing So? was originally published by The Motley Fool

Source Agencies