As global markets navigate through a mix of trade tensions and shifting investment trends, investors are increasingly looking for stable returns amidst the volatility. Dividend stocks, known for their potential to provide steady income, can be particularly appealing in such uncertain times, offering yields that enhance an investor’s portfolio resilience against market swings.

Top 10 Dividend Stocks

|

Name |

Dividend Yield |

Dividend Rating |

|

Yamato Kogyo (TSE:5444) |

3.91% |

★★★★★★ |

|

Allianz (XTRA:ALV) |

5.31% |

★★★★★★ |

|

Premier Financial (NasdaqGS:PFC) |

4.87% |

★★★★★★ |

|

Business Brain Showa-Ota (TSE:9658) |

3.66% |

★★★★★★ |

|

Guaranty Trust Holding (NGSE:GTCO) |

7.11% |

★★★★★★ |

|

KurimotoLtd (TSE:5602) |

4.43% |

★★★★★★ |

|

Kwong Lung Enterprise (TPEX:8916) |

5.85% |

★★★★★★ |

|

James Latham (AIM:LTHM) |

5.81% |

★★★★★★ |

|

Banque Cantonale Vaudoise (SWX:BCVN) |

4.58% |

★★★★★★ |

|

GakkyushaLtd (TSE:9769) |

4.18% |

★★★★★★ |

Click here to see the full list of 2006 stocks from our Top Dividend Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tien Phong Plastic Joint Stock Company, operating in Vietnam, specializes in the manufacturing and trading of plastic pipes for civil and industrial uses, with a market capitalization of approximately ₫8.69 billion.

Operations: Tien Phong Plastic Joint Stock Company generates revenue primarily from the manufacture and sale of plastic products, totaling approximately ₫5.28 billion.

Dividend Yield: 3.7%

Tien Phong Plastic has demonstrated robust earnings growth, with a 70.8% increase over the past year and recent quarterly net income rising to VND 238.23 billion from VND 128.19 billion. Despite this, its dividend yield at 3.7% remains low compared to the top quartile of Vietnamese market payers at 8.45%. The dividends are well-covered by both earnings (payout ratio: 21.4%) and cash flows (cash payout ratio: 16.8%), but the dividend history has been marked by volatility and unreliability over the last decade, indicating potential concerns for those seeking stable income streams from dividends.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Woori Financial Group Inc. operates as a commercial bank in Korea, offering a variety of financial services to individual, business, and institutional customers, with a market capitalization of approximately ₩10.79 billion.

Operations: Woori Financial Group Inc. generates its revenue primarily through banking (₩7.04 billion), followed by credit card services (₩0.42 billion) and capital markets activities (₩0.26 billion).

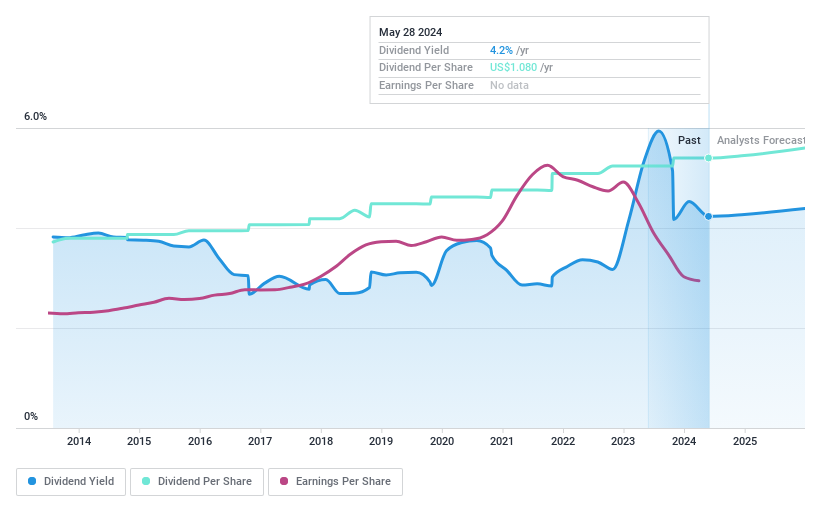

Dividend Yield: 4.4%

Woori Financial Group’s recent dividend of KRW 180 reflects a commitment to shareholder returns, despite a backdrop of fluctuating earnings, with net income down from KRW 913.69 million to KRW 824.49 million in Q1 2024. The company’s dividends are supported by a low payout ratio (38.3%), suggesting sustainability, yet its history shows volatility in dividend payments over the past nine years. Trading at significant undervaluation, its yield stands strong at 4.45% in Korea’s top quartile, but the short track record and erratic dividends may concern long-term investors seeking stability.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arrow Financial Corporation operates as a bank holding company, offering commercial and consumer banking alongside various financial products and services, with a market capitalization of approximately $518.14 million.

Operations: Arrow Financial Corporation generates its revenue primarily through community banking, which amounted to $131.05 million.

Dividend Yield: 3.3%

Arrow Financial’s recent earnings show a positive trajectory with net income rising to US$8.6 million from US$6.05 million in the previous year, supporting its dividend sustainability. The company declared a consistent quarterly dividend of $0.27 per share, underpinned by a reasonable payout ratio of 62%, indicating that dividends are well-covered by earnings. However, Arrow’s yield at 3.33% remains below the top quartile benchmark of 4.43%, suggesting modest attractiveness to high-yield seekers.

Taking Advantage

-

Unlock our comprehensive list of 2006 Top Dividend Stocks by clicking here.

-

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

-

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include HNX:NTP KOSE:A316140 and NasdaqGS:AROW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source Agencies