As global markets exhibit mixed performances and investors navigate through a varied economic landscape, small-cap and value stocks have shown resilience, outpacing large-cap growth shares. In this environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies. A good stock in these conditions is typically characterized by strong fundamentals, stable earnings growth, and a price that does not fully reflect its intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

CMK (TSE:6958) |

¥543.00 |

¥1082.51 |

49.8% |

|

LaserBond (ASX:LBL) |

A$0.68 |

A$1.36 |

49.9% |

|

Atlanticus Holdings (NasdaqGS:ATLC) |

US$35.77 |

US$71.48 |

50% |

|

Medley (TSE:4480) |

¥4060.00 |

¥8109.66 |

49.9% |

|

PSI Software (XTRA:PSAN) |

€21.50 |

€42.87 |

49.8% |

|

Grifols (BME:GRF) |

€9.07 |

€18.14 |

50% |

|

ECA Integrated Solution Berhad (KLSE:ECA) |

MYR0.405 |

MYR0.81 |

49.9% |

|

Silicon Laboratories (NasdaqGS:SLAB) |

US$120.13 |

US$239.85 |

49.9% |

|

Zynex (NasdaqGS:ZYXI) |

US$9.00 |

US$17.96 |

49.9% |

|

SunOpta (NasdaqGS:STKL) |

US$5.30 |

US$10.60 |

50% |

We’ll examine a selection from our screener results.

Overview: Novo Nordisk A/S, with a market cap of DKK3.97 trillion, is involved in the research, development, manufacture, and distribution of pharmaceutical products across Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America and internationally.

Operations: The company’s revenue segments include DKK16.97 billion from Rare Disease and DKK227.27 billion from Diabetes and Obesity Care.

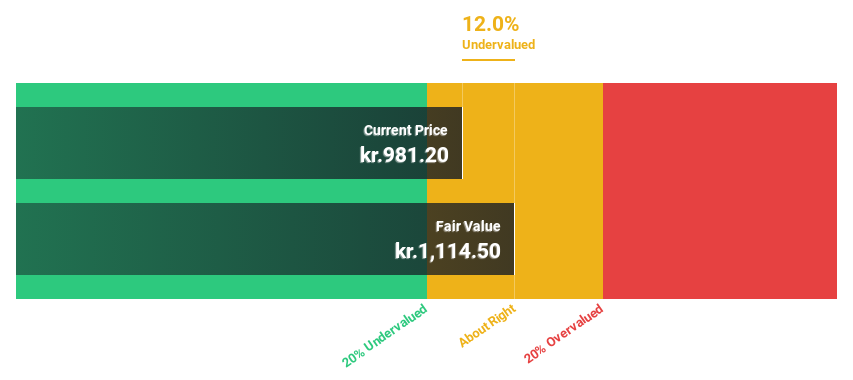

Estimated Discount To Fair Value: 14.5%

Novo Nordisk, trading at DKK 912, is currently undervalued based on discounted cash flow analysis with an estimated fair value of DKK 1066.66. Despite a recent impairment loss of around DKK 5.7 billion and significant insider selling, the company’s revenue and earnings are forecast to grow faster than the Danish market at rates of 13.4% and 13.7% per year respectively. Recent positive developments include EMA’s approval for Wegovy® label update reflecting cardiovascular benefits from the SELECT trial results, potentially bolstering future cash flows.

Overview: Oracle Corporation provides products and services for enterprise information technology environments globally, with a market cap of $384.30 billion.

Operations: Oracle’s revenue segments include Hardware at $3.07 billion, Services at $5.43 billion, and Cloud and License at $44.46 billion.

Estimated Discount To Fair Value: 48.3%

Oracle, trading at US$139.45, is significantly undervalued based on discounted cash flow analysis with an estimated fair value of US$269.93. Despite high debt levels and recent index drops, Oracle’s earnings are forecast to grow at 15.85% annually, outpacing the US market’s growth rate of 15%. Recent client announcements like Advanced Info Service deploying Oracle Alloy highlight strong demand for Oracle’s cloud services, potentially enhancing future cash flows and supporting its undervaluation thesis.

Overview: Daiichi Sankyo Company, Limited manufactures and sells pharmaceutical products in Japan, North America, Europe, and internationally with a market cap of ¥11.74 billion.

Operations: Revenue Segments (in millions of ¥): Prescription Pharmaceuticals: ¥1,027,000; Generic Pharmaceuticals: ¥112,000; Vaccine Business: ¥24,000

Estimated Discount To Fair Value: 20%

Daiichi Sankyo, trading at ¥6148, is undervalued based on discounted cash flow analysis with an estimated fair value of ¥7683.44. The company’s earnings grew by 83.8% last year and are forecast to grow 20.7% annually over the next three years, outpacing the JP market’s growth rate of 8.9%. Recent share buybacks and business expansions in oncology further strengthen its financial position and commitment to long-term growth, despite regulatory setbacks for key drug approvals.

Turning Ideas Into Actions

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CPSE:NOVO B NYSE:ORCL and TSE:4568.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source Agencies