Despite a recent dip, Nvidia (NASDAQ: NVDA) stock has been on a tear with a gain of more than 600% since the start of 2023. Its market capitalization soared from $360 billion to $2.5 trillion over that period, the fastest pace of value creation in stock market history.

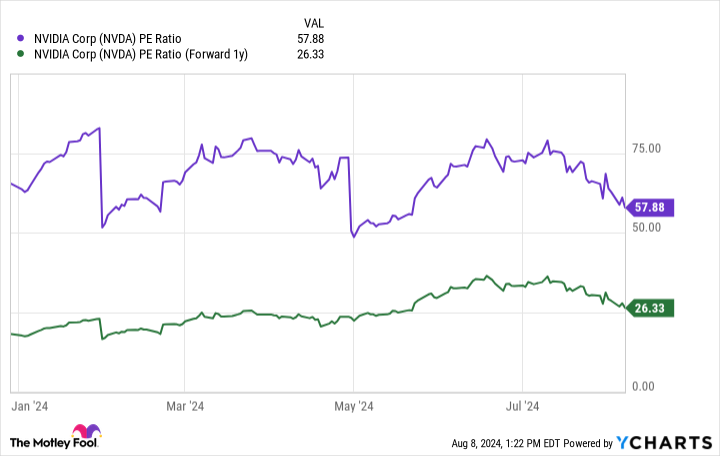

But is it justified? Some analysts on Wall Street think Nvidia stock is overvalued, and they might be right in the short term based on its price-to-earnings (P/E) ratio. The P/E ratio is calculated by dividing a company’s share price by its earnings per share (EPS), and it’s one of the most widely-used valuation metrics among investors.

The Nasdaq-100 index, which includes Nvidia and all of its big-tech peers, trades at a P/E ratio of 30.7. Nvidia stock trades at a P/E ratio of around 58 based on its trailing-12-month EPS of $1.80, making it nearly twice as expensive as the index.

Based on those numbers alone, Nvidia stock is unquestionably expensive. However, the company is growing so quickly the situation completely changes if you look just one year into the future. Wall Street estimates Nvidia will generate $3.74 in EPS in its fiscal 2026 (which will begin Jan. 30, 2025), which means its stock is even cheaper than the Nasdaq-100 on a forward-looking basis:

Nvidia’s data center chips are critical to the development of artificial intelligence (AI), and while competition is gradually emerging, the company has built a significant technological lead. Its data center revenue surged 427% in the most recent quarter, and demand isn’t forecast to slow anytime soon.

So, for investors with a time horizon of at least several years, Nvidia stock might actually be a bargain right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $643,212!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Think Nvidia Stock Is Expensive? This Chart Might Change Your Mind. was originally published by The Motley Fool

Source Agencies