In the current climate of market volatility and economic uncertainty, investors are seeking stability and reliable income streams. Dividend stocks, known for their consistent payouts, can offer a dependable source of returns even when markets fluctuate.

Top 10 Dividend Stocks

|

Name |

Dividend Yield |

Dividend Rating |

|

Tsubakimoto Chain (TSE:6371) |

4.04% |

★★★★★★ |

|

Allianz (XTRA:ALV) |

5.33% |

★★★★★★ |

|

Business Brain Showa-Ota (TSE:9658) |

4.00% |

★★★★★★ |

|

Guaranty Trust Holding (NGSE:GTCO) |

7.03% |

★★★★★★ |

|

Huntington Bancshares (NasdaqGS:HBAN) |

4.60% |

★★★★★★ |

|

China South Publishing & Media Group (SHSE:601098) |

4.25% |

★★★★★★ |

|

Premier Financial (NasdaqGS:PFC) |

5.39% |

★★★★★★ |

|

KurimotoLtd (TSE:5602) |

5.12% |

★★★★★★ |

|

James Latham (AIM:LTHM) |

5.85% |

★★★★★★ |

|

Banque Cantonale Vaudoise (SWX:BCVN) |

4.63% |

★★★★★★ |

Click here to see the full list of 2082 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Macro S.A. offers a range of banking products and services to retail and corporate customers in Argentina, with a market cap of ARS4.34 trillion.

Operations: Banco Macro S.A. generates ARS3.81 billion in revenue from its banking business segment, serving both retail and corporate clients in Argentina.

Dividend Yield: 8.8%

Banco Macro’s dividend yield of 8.76% ranks in the top 25% of Argentine market payers, supported by a low payout ratio of 48.7%, indicating sustainability. Despite recent earnings growth and good relative value, its dividend history is marked by volatility and unreliability over the past decade. Recent affirmations confirm continued cash dividends with notable payouts scheduled through July 2024, though future earnings are forecasted to decline slightly over the next three years.

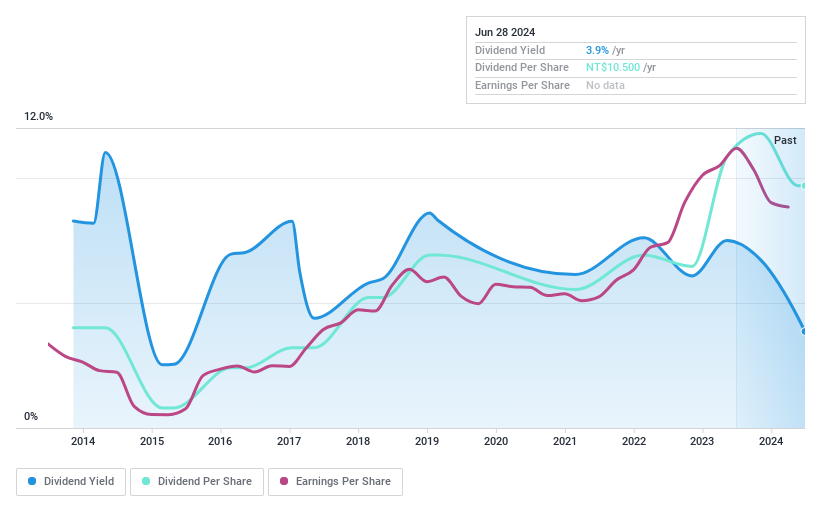

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acter Group Corporation Limited offers engineering services across Taiwan, Mainland China, and other Asian countries with a market cap of NT$34.74 billion.

Operations: Acter Group Corporation Limited’s revenue segments are derived from engineering services provided in Taiwan, Mainland China, and other Asian countries.

Dividend Yield: 3.7%

Acter Group’s dividend payments are well covered by earnings (payout ratio: 35.5%) and cash flows (cash payout ratio: 38.8%), indicating sustainability despite a volatile dividend history over the past decade. Recent news includes a confirmed cash dividend of TWD 744.49 million for H2 2023, payable on July 26, 2024. Additionally, Acter Group is trading at a significant discount to its estimated fair value, enhancing its appeal for value-focused investors.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ferrotec Holdings Corporation operates in semiconductor equipment-related and electronic device businesses both in Japan and internationally, with a market cap of ¥102.08 billion.

Operations: Ferrotec Holdings Corporation’s revenue segments include ¥67.60 billion from electronic devices and ¥130.07 billion from semiconductor equipment-related business.

Dividend Yield: 4.2%

Ferrotec Holdings’ dividend yield of 4.17% is among the top 25% in the JP market, but its payments have been volatile over the past decade. While dividends are well covered by earnings (payout ratio: 31%), they are not supported by free cash flows, raising concerns about sustainability. The company’s valuation appears attractive with a P/E ratio of 7.4x compared to the market’s 13x, though recent profit margins have declined from last year’s figures.

Seize The Opportunity

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BASE:BMA TPEX:5536 and TSE:6890.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source Agencies