Eli Lilly (NYSE: LLY) is hogging the headlines as its market capitalization marches toward $1 trillion. But even as the market continues to evaluate the growing demand for anti-obesity drugs and bids up businesses in the weight-loss space, it could be ignoring other businesses in the pharma industry.

As a result, quite a few pharmaceutical stocks are currently flying under the market’s radar, and investors could be looking at solid opportunities to buy some high-quality businesses at discounted valuations, thanks to the recent market trends.

One such business that could eventually be in the trillion-dollar club in its own right is Johnson & Johnson (NYSE: JNJ).

The trillion-dollar club

Only a handful of companies have achieved a $1 trillion valuation, most of them being tech stocks. That list, howver, is bound to expand over time, and pharma stocks aren’t too far away. Lilly’s share price has ballooned this year thanks to optimism around its portfolio of weight loss and obesity treatments. The company’s current market cap is $850 billion, and it seems certain to cross the $1 trillion threshold sometime soon.

Unfortunately, the valuation and speculation tied to Lilly’s rise might be off-putting to some investors. Volatility is on the table now that its forward P/E ratio is above 40.

Johnson & Johnson offers a compelling alternative that’s also on track to hit $1 trillion for investors who have a long-enough time horizon. The drugmaker was the global leader in pharmaceutical sales last year by a large margin. Its revenue of $85 billion in 2023 was 30% higher than Roche‘s, the next biggest rival.

Johnson & Johnson has an investor-friendly valuation

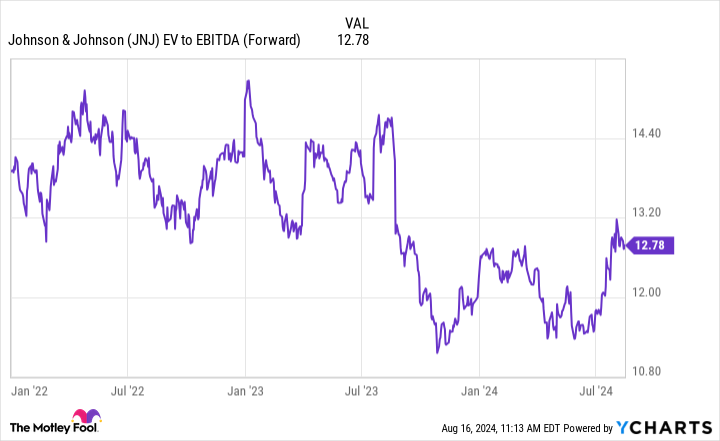

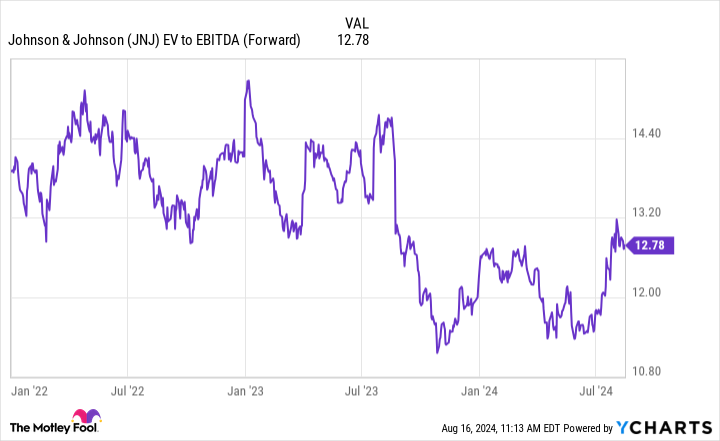

Johnson & Johnson’s valuation isn’t incredibly cheap — it’s unusual for high-profile stocks to trade at irrational prices. That said, the valuation is a discount to certain peers and the stock’s own historical levels.

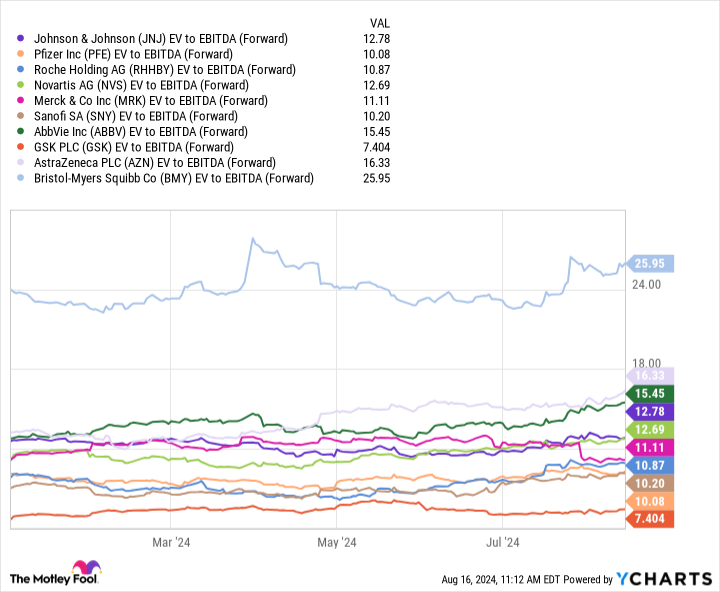

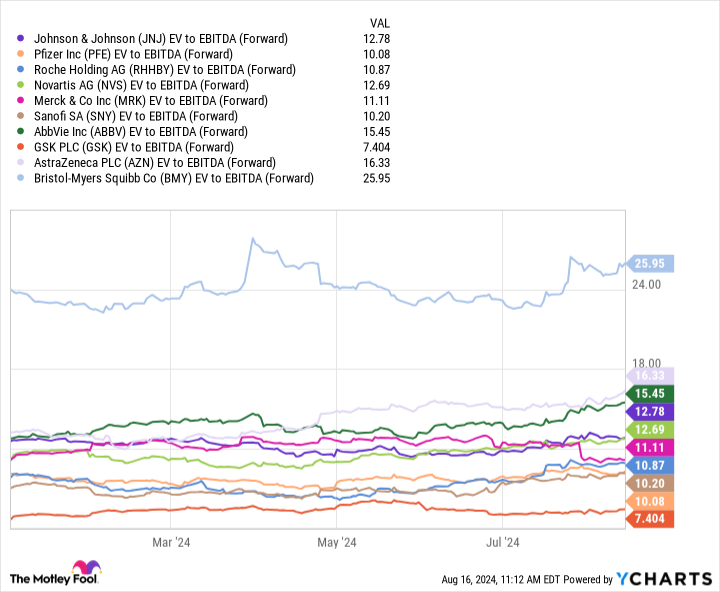

Enterprise-value-to-EBITDA (earnings before interest, taxes, depreciation, and amortization), or EV/EBITDA in short, is a popular alternative to the P/E ratio. EV/EBITDA controls for the impact of corporate debt, which makes it useful for comparing the valuations of businesses that have different capital structures.

Johnson & Johnson falls within the EV/EBITDA range of its pharmaceutical industry peers. The chart below tracks the forward EV/EBITDA of the 10 largest drug companies by revenue over the last 12 months.

Most EV-to-EBITDA ratios in the peer group range from 10 to 16, so Johnson & Johnson’s enterprise value of 12.8 times forward EBITDA appears reasonable at first glance. Long-term investors shouldn’t consider this a discount to other competitors within the industry, but there’s certainly room for modest appreciation.

However, it’s also important to consider the current valuation relative to historical levels. In that sense, Johnson & Johnson stock is relatively cheap compared to prior periods based on several key metrics. It’s closer to the bottom of the five-year range for forward P/E ratio, EV-to-EBITDA, and price-to-free cash flow. The trend is comprehensive — you can buy Johnson & Johnson stock for a cheaper price relative to almost every important business fundamental.

Interest rates play an important role in this trend. Rates are at their highest level in a long time, which is exerting downward pressure on stock prices. High rates encourage investors to buy lower-risk, lower-volatility securities such as corporate bonds and Treasuries. Risk is discouraged, and valuations tend to slump across the stock market.

Of course, that hasn’t been universal for all industries. An artificial intelligence (AI)-fueled tech rally has pushed many stocks into relatively high valuation ranges, so the apparent discount in the pharmaceutical industry is also attributable to momentum and investor hype.

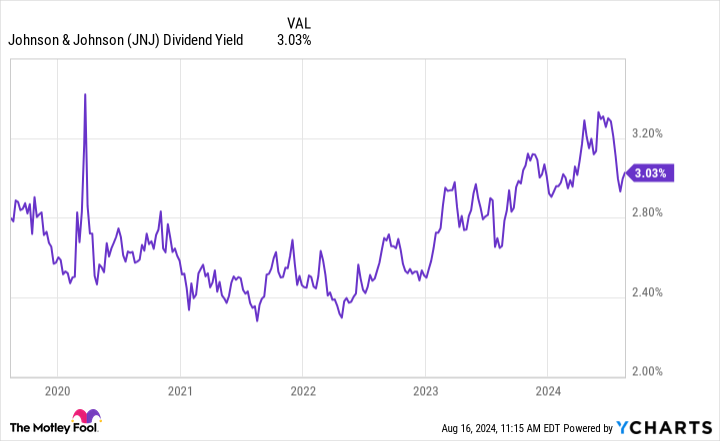

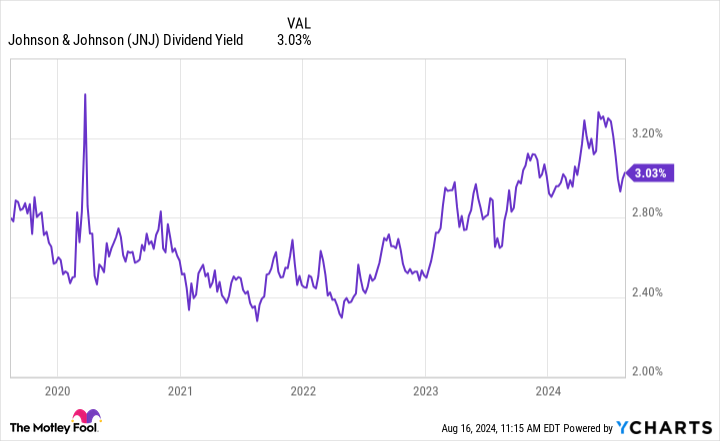

JNJ Dividend Yield data by YCharts.

Forecasting future cash flows and valuations involves a lot of guesswork, so there’s error inherent in determining whether a stock is “cheap” based on the P/E ratio. Dividend yield is a more concrete metric. Johnson & Johnson will provide 3% returns in the form of cash distributions to shareholders as long as something unexpected doesn’t cause the company to reduce its payouts.

Avoiding a value trap

Buying cheap stocks isn’t always a good investment strategy. Discounted valuations often indicate a likelihood that cash flows or dividends are cut in the future.

It doesn’t seem like Johnson & Johnson’s financial performance is under any imminent threat. The company faces loss of patent protection on key products in the coming years, which will challenge sales growth. However, no drug accounted for more than 13% of total sales. Diversification and a huge portfolio prevent any single product from sinking the ship.

Johnson & Johnson’s pipeline of future treatments currently in development also offsets the impact of patent cliffs. The company is often credited with one of the largest, most innovative, and most valuable pipelines In the industry. This should install Johnson & Johnson as a prominent leader for years to come. Its 77% payout ratio suggests that it can sustain its current dividend and maintain its Dividend King status.

The pharmaceutical industry is worth a look for any long-term investors looking for a value stock, and Johnson & Johnson is one of the best in class. Over the past few years, the market moved away from healthcare and pharmaceutical stocks that boomed starting in 2020. AI stocks have caught the headlines over the past few years, causing investors to pile into tech stocks. These trends created enticing valuations for slow and steady stalwarts like Johnson & Johnson.

As for the trillion-dollar threshold, Johnson & Johnson is a good candidate over the long term. Its current value is just under $400 billion, so its market cap needs to expand 160%. The first 30 basis points could come from expanding valuation ratios, but the rest likely depends on growing cash flows and dividends. Investors should expect single-digit annual growth over the long term, so the march to $1 trillion will probably take a decade. It’s more a matter of “when” than “if” — but it will take some time.

This isn’t the right stock for investors seeking a quick buck. It is an attractive investment for people who want stable growth with current income.

Should you invest $1,000 in Johnson & Johnson right now?

Before you buy stock in Johnson & Johnson, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Johnson & Johnson wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Ryan Downie has positions in Johnson & Johnson. The Motley Fool has positions in and recommends Bristol Myers Squibb, Merck, and Pfizer. The Motley Fool recommends AstraZeneca Plc, GSK, Johnson & Johnson, and Roche Ag. The Motley Fool has a disclosure policy.

This Undervalued Stock Could Join the Race With Eli Lilly to the $1 Trillion Club was originally published by The Motley Fool

Source Agencies