Most investors understand the importance of patience when it comes to buying and holding stocks. Investing isn’t a sprint, after all, it’s a marathon. It’s won by the crowd capable of keeping the bigger picture in mind when short-term noise turns downright distracting.

Still, if you can score some sizable gains in a relatively short period without taking on too much risk, that’s not a bad thing.

Here’s a closer look at three stock prospects with the potential to turn a $1,000 investment now into $5,000 come 2030.

1. DraftKings

Given that more than two-thirds of states now permit sports betting of some sort since the federal ban on such gambling was lifted in 2018, it would be easy to conclude DraftKings‘ (NASDAQ: DKNG) highest-growth phase is in the rearview mirror. Ditto for DraftKings stock.

That’s not likely, however.

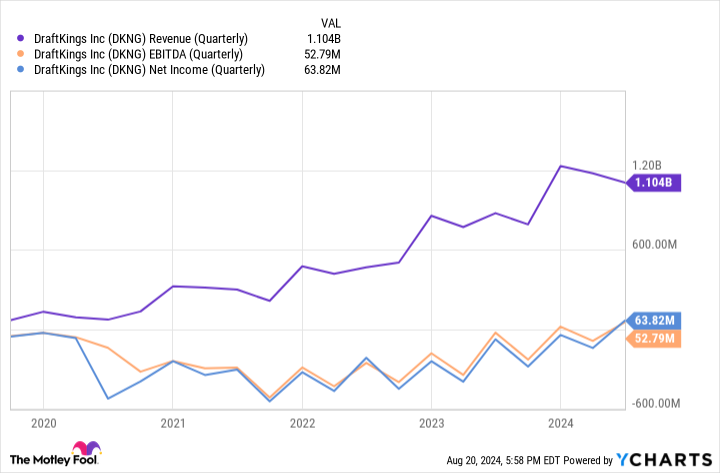

See, not only have states only staggered into the legalization camp since 2018, but it also takes some time for the sports betting industry to fully mature in a particular market once DraftKings sets up shop. In the states where the company first offered access to its sports betting app four years ago, in fact, the company’s still seeing solid annual revenue growth. Profitability also continues to improve the longer DraftKings operates in a particular market.

And it’s worth adding that two of the states that have yet to legalize sports-based wagering are massive Texas and California, which are collectively home to more than 20% of the nation’s population. Legalization proponents have a tougher row to hoe there, but it will be well worth the effort if and when it finally happens in those two states.

Then there’s the overseas opportunity. While CEO Jason Robins isn’t planning a serious international expansion at this time, it’s always a possibility worth considering. Straits Research believes the worldwide online sports betting market is set to grow at an annualized pace of 11.2% through 2032.

Then there’s the less philosophical, simpler reason DraftKings stock’s got a good shot at quintupling in value over the next six years. That is, shares are now down roughly 26% from their March peak for no discernible good reason. Take advantage of this volatility while it’s working in interested investors’ favor.

2. Arm Holdings

When investors think of artificial intelligence (AI)-focused technology stocks, names like Nvidia or maybe C3.ai come to mind. The former manufactures the computing processors found in most AI systems. The latter offers decision-making platforms to the enterprise market. And to be fair, so far names of this ilk have deserved the intense attention they’ve been given.

As we enter the next phase of the AI era, however, the industry’s technological underpinnings are evolving. The chips originally designed for other uses are no longer ideally suited for next-gen AI applications. We need processors that don’t consume massive amounts of electricity, processing solutions that are flexible enough to handle a wide range of artificial intelligence tasks, and low-cost enough to remain marketable.

Enter chipmaker Arm Holdings (NASDAQ: ARM).

OK, it’s not exactly a chipmaker in the same sense that Taiwan Semiconductor Manufacturing or Intel are. It’s more accurate to categorize Arm as a chip designer and then a licensor of chipmaking intellectual property. Apple‘s newest AI-capable smartphones and tablets are built around processors based on Arm’s architecture, for instance.

It’s not just Apple though. Arm’s technology is increasingly found in chips from the aforementioned Nvidia, Intel, and Qualcomm just to name a few. It’s difficult to manufacture a microchip without at least some Arm intellectual property built in.

The kicker: Arm Holdings’ top line is expected to soar nearly 23% this year (despite economic headwinds) before accelerating to a clip of 24% next year. Earnings growth is materializing even faster. Both are expected to continue growing firmly for at least the next several years, too.

3. Dutch Bros

Finally, add coffee drive-thru chain Dutch Bros (NYSE: BROS) to your list of stocks capable of turning $1,000 into $5,000 by 2030.

Some investors will be quick to point out the challenge of penetrating a market that’s already dominated by Starbucks. Whereas Dutch Bros was only operating 912 locales as of the end of June, Starbucks boasts a whopping 16,730 stores in the United States alone. Starbucks shareholders are also excited to know Brian Niccol will be taking the helm as CEO next month. Niccol turned Chipotle Mexican Grill back into a healthy growth name after being named its chief executive in 2018, and Starbucks investors anticipate a similar (and much-needed) reinvigoration.

Dutch Bros offers consumers something Starbucks simply can’t though. That’s casual authenticity — employees are encouraged to make each customer’s experience a personal one. It’s not unusual for a particular kiosk to support locally based causes, for example.

It’s a vibe that’s working, too, particularly with younger consumers. That’s why same-store sales grew another 4.1% last quarter, with new store openings driving the top line 30% higher on a year-over-year basis.

It’s still just the beginning. Chief executive Christine Barone is on board with founders Dane and Travis Boersma’s vision of establishing 4,000 Dutch Bros stores within the next 10 to 15 years. That’s a tall order to be sure. But, given that the company is already profitable and only modestly indebted, it’s certainly doable without putting investors at serious risk.

Just don’t wait too long if you’re interested. Like DraftKings and Arm Holdings, Dutch Bros stock is seeing a bit of volatility and is currently down (off 27% from a recent high), but it’s unlikely to stay that way for very long.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Chipotle Mexican Grill, Nvidia, Qualcomm, Starbucks, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends C3.ai, Dutch Bros, and Intel and recommends the following options: long January 2025 $45 calls on Intel, short August 2024 $35 calls on Intel, and short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

3 Stocks That Could Turn $1,000 Into $5,000 by 2030 was originally published by The Motley Fool

Source Agencies