The market is up 1.8% over the last week and has climbed 46% in the past year, with earnings expected to grow by 17% per annum over the next few years. In this favorable environment, identifying growth companies with high insider ownership can be particularly advantageous as it often signals confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

|

Name |

Insider Ownership |

Earnings Growth |

|

Kirloskar Pneumatic (BSE:505283) |

30.4% |

30.1% |

|

Archean Chemical Industries (NSEI:ACI) |

22.9% |

35% |

|

Happiest Minds Technologies (NSEI:HAPPSTMNDS) |

32.5% |

21.8% |

|

Dixon Technologies (India) (NSEI:DIXON) |

24.6% |

36.6% |

|

Jupiter Wagons (NSEI:JWL) |

10.8% |

27.2% |

|

Paisalo Digital (BSE:532900) |

16.3% |

24.8% |

|

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) |

10.4% |

32.3% |

|

Rajratan Global Wire (BSE:517522) |

19.8% |

35.8% |

|

KEI Industries (BSE:517569) |

19.1% |

20.4% |

|

Pricol (NSEI:PRICOLLTD) |

25.5% |

24% |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★★

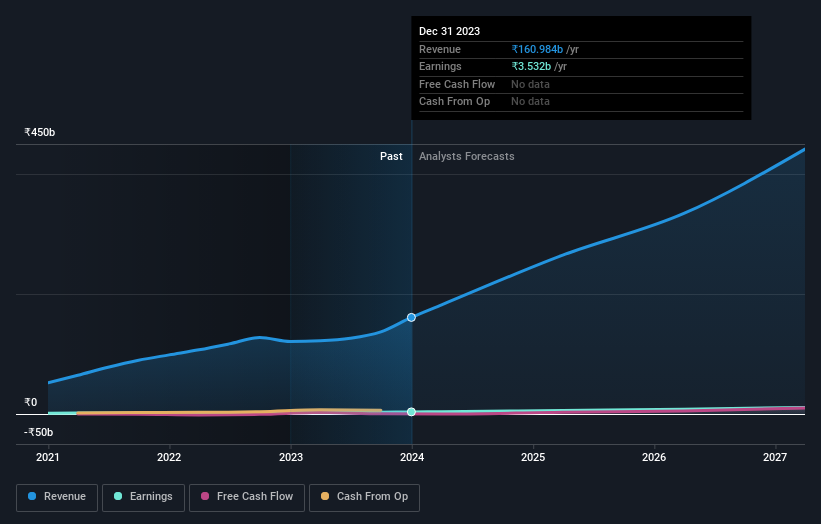

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services in India and has a market cap of ₹794.06 billion.

Operations: Dixon Technologies (India) Limited’s revenue segments include Home Appliances (₹12.51 billion), Lighting Products (₹7.92 billion), Mobile & EMS Division (₹143.16 billion), and Consumer Electronics & Appliances (₹41.21 billion).

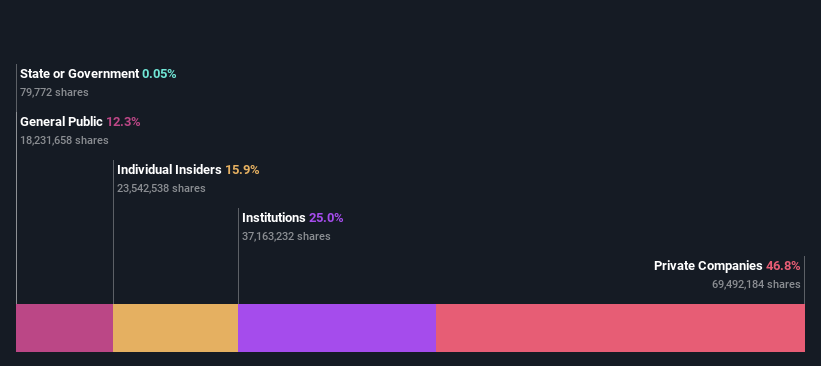

Insider Ownership: 24.6%

Revenue Growth Forecast: 23.6% p.a.

Dixon Technologies (India) exhibits strong growth potential with forecasted revenue growth of 23.6% per year, outpacing the Indian market’s 10%. Its earnings are expected to grow significantly at 36.6% annually over the next three years, surpassing market expectations. Recent Q1 results showed substantial revenue and net income increases compared to last year. The company also appointed Mr. Sunil Ranjhan as Chief Human Resource Officer, enhancing its leadership team with his extensive HR experience across APAC regions.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quess Corp Limited is a business services provider operating in India, South East Asia, the Middle East, and North America with a market cap of ₹108.75 billion.

Operations: The company’s revenue segments include Workforce Management (₹138.44 billion), Operating Asset Management (₹28.43 billion), Global Technology Solutions excluding Product Led Business (₹23.87 billion), and Product Led Business (₹4.29 billion).

Insider Ownership: 15.8%

Revenue Growth Forecast: 13.5% p.a.

Quess Corp Limited shows promising growth with earnings forecasted to grow at 23% annually, outpacing the Indian market’s 17%. Recent Q1 results revealed significant revenue and net income increases, with sales reaching ₹50.03 billion and net income doubling to ₹1.04 billion. The appointment of Gurmeet Chahal as CEO of Quess Global Technology Solutions highlights a strategic focus on AI and digital transformation, potentially enhancing future growth prospects.

Simply Wall St Growth Rating: ★★★★★☆

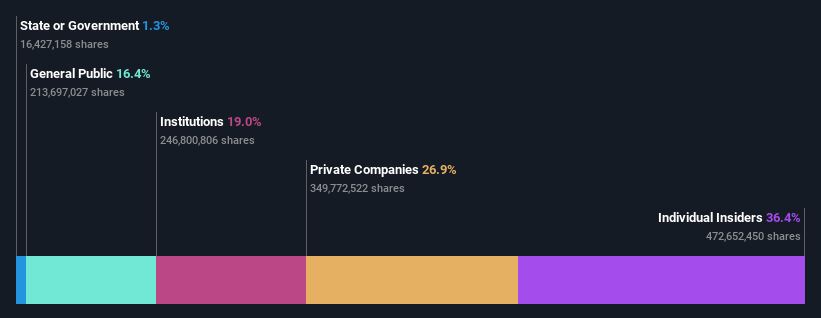

Overview: Varun Beverages Limited, with a market cap of ₹2.06 trillion, operates as the franchisee for PepsiCo’s carbonated soft drinks and non-carbonated beverages.

Operations: Revenue from the manufacturing and sale of beverages amounted to ₹180.52 billion.

Insider Ownership: 36.3%

Revenue Growth Forecast: 15.4% p.a.

Varun Beverages demonstrates strong growth potential with earnings forecasted to grow at 22.27% annually, surpassing the Indian market’s 17%. Recent Q2 results showed substantial revenue and net income increases, with sales reaching ₹73.34 billion and net income rising to ₹12.53 billion. Despite high debt levels, the company maintains a robust Return on Equity forecast of 30.6%. The recent dividend affirmation and changes in capital structure further reflect confidence in sustained growth.

Next Steps

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:DIXON NSEI:QUESS and NSEI:VBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source Agencies