The Hong Kong market has seen a mix of cautious optimism and strategic positioning, especially as global economic indicators hint at potential rate cuts and evolving investor sentiment. Amidst this backdrop, small-cap stocks have garnered attention for their potential growth opportunities, particularly those with insider buying signaling confidence from within. In such a dynamic environment, identifying undervalued small-cap stocks can be particularly rewarding. The key lies in finding companies that not only show promise through their financials but also exhibit strong internal support from insiders who believe in the company’s future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

|

Name |

PE |

PS |

Discount to Fair Value |

Value Rating |

|---|---|---|---|---|

|

Ever Sunshine Services Group |

5.2x |

0.3x |

30.12% |

★★★★★☆ |

|

Wasion Holdings |

11.6x |

0.8x |

39.14% |

★★★★☆☆ |

|

China Leon Inspection Holding |

9.6x |

0.7x |

37.22% |

★★★★☆☆ |

|

Lion Rock Group |

6.7x |

0.5x |

31.06% |

★★★★☆☆ |

|

Shenzhen International Holdings |

7.8x |

0.7x |

25.70% |

★★★★☆☆ |

|

EEKA Fashion Holdings |

8.1x |

0.8x |

20.77% |

★★★☆☆☆ |

|

Skyworth Group |

5.5x |

0.1x |

-256.27% |

★★★☆☆☆ |

|

Lee & Man Paper Manufacturing |

6.3x |

0.4x |

-28.17% |

★★★☆☆☆ |

|

Cathay Group Holdings |

NA |

1.3x |

10.13% |

★★★☆☆☆ |

|

Jinke Smart Services Group |

NA |

0.8x |

43.75% |

★★★☆☆☆ |

Let’s review some notable picks from our screened stocks.

Simply Wall St Value Rating: ★★★☆☆☆

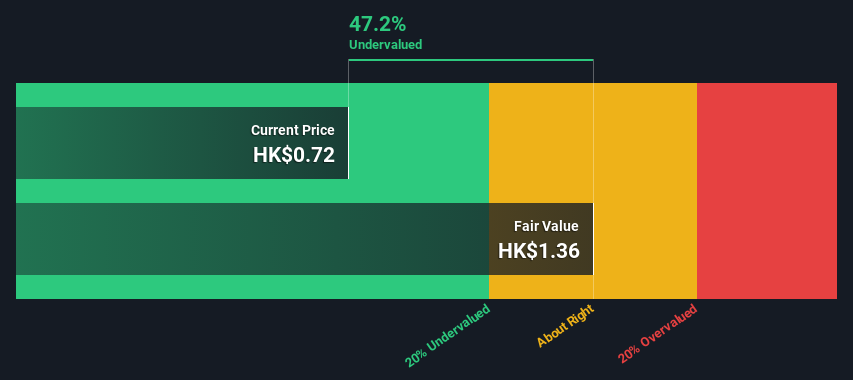

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, with a market capitalization of approximately HK$1.60 billion.

Operations: The company generates revenue primarily from Wireless Telecommunications Network System Equipment and Services (HK$4941.02 million) and Operator Telecommunication Services (HK$156.22 million). For the period ending June 30, 2024, it reported a gross profit of HK$1436.32 million with a gross profit margin of 28.18%.

PE: -11.0x

Comba Telecom Systems Holdings, a smaller Hong Kong-listed company, has seen insider confidence with Tung Ling Fok purchasing 1.83 million shares valued at HK$930,371 in the past year. Despite reporting a decline in earnings by 1.7% annually over the last five years and experiencing high share price volatility recently, the company’s decision to not declare an interim dividend for H1 2024 and projected losses of up to HK$160 million highlight ongoing challenges. However, their recent share repurchase program aims to enhance net assets per share and earnings per share by utilizing available cash flow or working capital facilities.

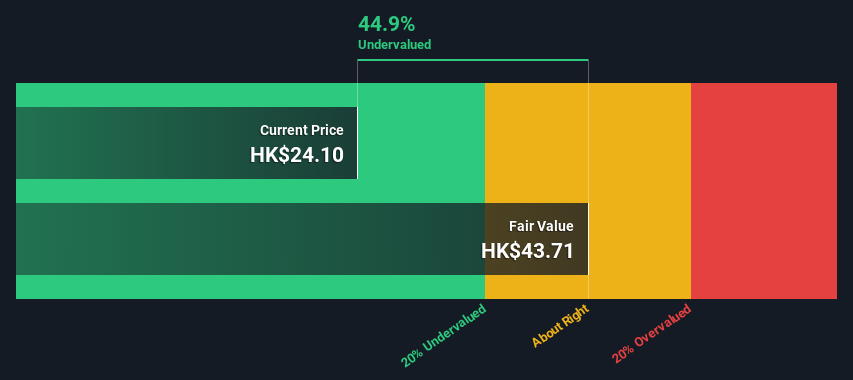

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wasion Holdings is engaged in the production and distribution of advanced metering infrastructure and related solutions, with a market cap of approximately CN¥3.74 billion.

Operations: The company generates revenue primarily from Advanced Distribution Operations, Power Advanced Metering Infrastructure, and Communication and Fluid Advanced Metering Infrastructure. For the period ending 2023-09-30, it reported a gross profit margin of 34.97% on a revenue of CN¥6.89 billion.

PE: 11.6x

Wasion Holdings, a small-cap stock in Hong Kong, has shown promising signs of being undervalued. Recently, the company announced consolidated earnings guidance for the first half of 2024, expecting net profit to exceed RMB 330 million—a significant increase from RMB 213.8 million in the same period last year due to higher sales and effective cost controls. Insider confidence is evident as Wei Ji purchased 500,000 shares worth approximately HK$3.17 million between July and August 2024. Additionally, Wasion secured lucrative smart meter contracts totaling EUR 31.62 million in Hungary and USD 15.16 million across Singapore and Malaysia this year, highlighting its expanding international footprint and client recognition in the smart grid industry.

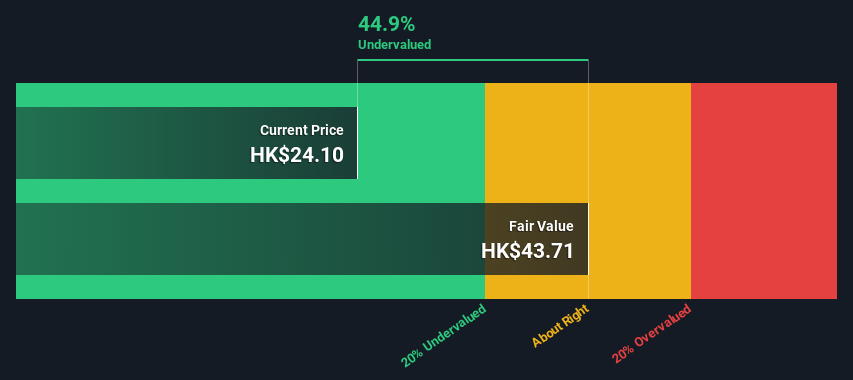

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ferretti is engaged in the design, construction, and marketing of yachts and recreational boats with a market cap of approximately €1.23 billion.

Operations: The company generates revenue from the design, construction, and marketing of yachts and recreational boats, with recent annual revenue reaching €1.23 billion. The cost of goods sold (COGS) was €773.32 million, resulting in a gross profit margin of 37.08%. Operating expenses include general & administrative costs at €253.25 million and depreciation & amortization at €62.91 million. Net income for the latest period was €83.05 million, yielding a net income margin of 6.76%.

PE: 11.2x

Ferretti, a small cap in Hong Kong, recently appointed Mr. Qinggui Hao as joint company secretary and alternate authorized representative. They bring extensive experience from Weichai Power and Shandong Heavy Industry Group. Ferretti’s earnings are forecasted to grow 12.35% annually, indicating potential for future growth. Notably, insider confidence is evident with recent share purchases by executives in the past six months, reflecting their belief in the company’s undervalued status despite higher-risk funding sources from external borrowing only.

Summing It All Up

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:2342 SEHK:3393 and SEHK:9638.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source Agencies