Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly known as TSMC, is the world’s largest semiconductor foundry that manufactures chips for fabless semiconductor companies. Its customers include popular names such as Nvidia, Apple, Advanced Micro Devices, Broadcom, Qualcomm, and others.

TSMC controls 62% of the global foundry market, enjoying a significant lead over second-place Samsung, which has a market share of just 13%. So, TSMC is in a solid position to make the most of the secular long-term growth opportunity in the semiconductor market, which is getting a nice boost thanks to a new catalyst in the form of artificial intelligence (AI) that’s positively impacting multiple end markets.

The semiconductor market’s growth potential is encouraging TSMC to boost capital spending

The global semiconductor market’s revenue is expected to cross $1.3 trillion in 2032, up from $547 billion last year. This explains why TSMC is set to spend a lot on enhancing its manufacturing footprint. The company’s board recently approved a $30 billion investment plan to install and upgrade advanced chip manufacturing facilities, construct new fabs, and also shore up its advanced packaging and specialty chip manufacturing abilities.

It is worth noting that TSMC spent a similar amount of money in 2023 on capital expenditure. However, it won’t be surprising to see TSMC gradually increasing its capex levels. The company intends to spend between $30 billion and $32 billion on capital expenditure in 2024 as compared to its earlier estimate of $28 billion to $30 billion. Analysts are expecting its capital expenses to land at the higher end of that range.

More importantly, analysts expect the higher end of TSMC’s capex to hit $37 billion in 2025. On the other hand, The Wall Street Journal recently reported that TSMC and Samsung are considering a $100 billion investment to build huge chipmaking facilities in the Middle East as a part of their global expansion strategy. So, there is a good chance that the spending on semiconductor manufacturing equipment could lead to higher capex by the likes of TSMC and Samsung.

The potential jump in TSMC’s capex suggests that the company will spend more to buy chipmaking equipment, especially high-end equipment so that it can meet the demand for chips made on advanced manufacturing processes such as 3-nanometer (nm) and 2nm nodes.

For instance, the production capacity of TSMC’s 3nm process node is currently full thanks to demand from the likes of Intel and Apple. Meanwhile, Apple is reportedly looking to secure all of TSMC’s 2nm manufacturing capacity for its 2025 iPhones. All of this bodes well for a key TSMC supplier that is vital to its production of these advanced chips — ASML Holding (NASDAQ: ASML).

ASML Holding’s growth is set to accelerate

Dutch semiconductor equipment giant ASML has a monopoly in the market for extreme ultraviolet (EUV) lithography machines that are used for making advanced chips based on small process nodes such as 5nm and 3nm. Not surprisingly, chipmakers such as Samsung, TSMC, and Intel have been lining up to buy ASML’s advanced machines so that they can manufacture faster and more power-efficient chips.

This resulted in ASML reporting a massive order backlog of 39 billion euros, which is higher than the company’s 2024 revenue forecast of 27.5 billion euros. Oddly, ASML expects its revenue to remain flat in 2024 when compared to 2023, but the recent developments concerning the semiconductor industry’s capex suggest that better times lie ahead for the company.

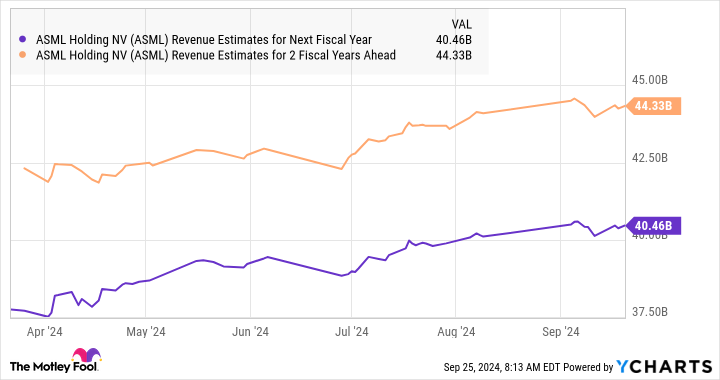

As per consensus estimates, ASML’s revenue in 2024 could rise by 5% to $30.9 billion. However, the forecasts for the next couple of years have been rising and point toward a nice acceleration in its growth.

That won’t be surprising considering the huge sums of money that TSMC and other chipmakers are planning to spend to shore up their production capacities. It is worth noting that ASML got 29% of its revenue from customers based in Taiwan last year, indicating that TSMC is most probably a big customer for the Dutch company.

Investors should also note that South Korean customers accounted for 25% of ASML’s net sales in 2023. So, Samsung’s rumored spending splurge in the Middle East, as mentioned earlier, could be a catalyst for ASML. Additionally, South Korean memory manufacturer SK Hynix is also reportedly in line to purchase ASML’s advanced chipmaking equipment.

All this explains why the market for EUV lithography machines is expected to touch $50 billion by 2039 as compared to $8 billion in 2022. ASML, therefore, could see terrific incremental revenue growth over the next five years as chipmakers pour more money into its offerings to make advanced chips.

That’s why now would be a good time for investors to buy ASML stock as it is trading at 28 times forward earnings, a discount to its five-year average forward earnings multiple of 35 and also to the U.S. technology sector’s earnings ratio of 45. The stock may have underperformed the broader market this year with gains of just 7%, but it could break out of this mediocrity thanks to a bump in capital spending by chipmakers such as TSMC and others.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

1 Top Tech Stock to Buy Hand Over Fist Before TSMC’s Spending Splurge Begins was originally published by The Motley Fool

Source Agencies