Cathie Wood is famous for her singular investing style. Favoring high growth and disruptors, she often appears to be throwing caution to the wind and willing to tread where other Wall Street titans may fear to go.

However, outré Wood’s strategy might seem to some, there’s one risk she’s not willing to take. Addressing the recent comeback of meme stocks, the Ark Invest CEO recently issued a warning to investors keen to get in on the action, sensibly warning that it will end badly for many piling into speculative names such as GameStop and AMC.

“Buyer beware, there were a lot of people in the first meme stock craze who got hurt badly,” Wood commented.

That said, it’s not as if Wood has suddenly turned to value investing for inspiration. Still following her playbook of exposure to innovators, we’ve decided to get the lowdown on two of the less lauded names that make up part of her Ark Invest portfolio.

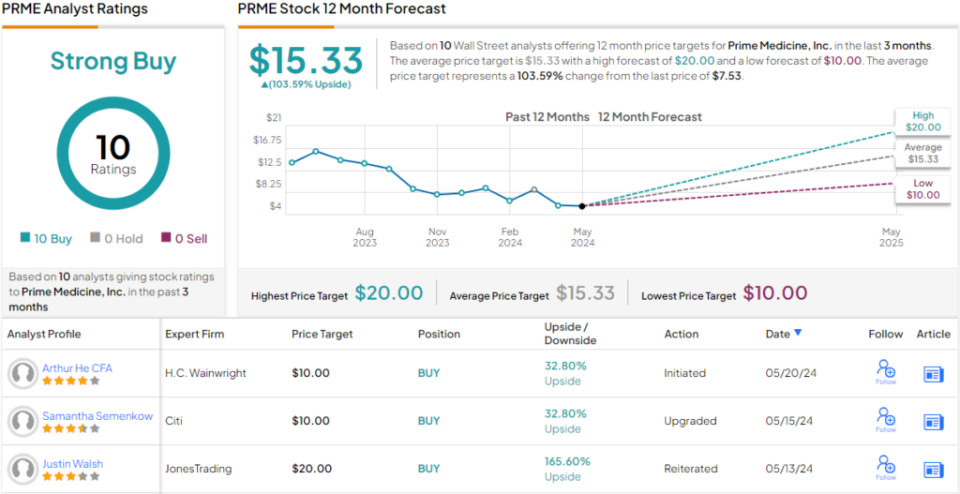

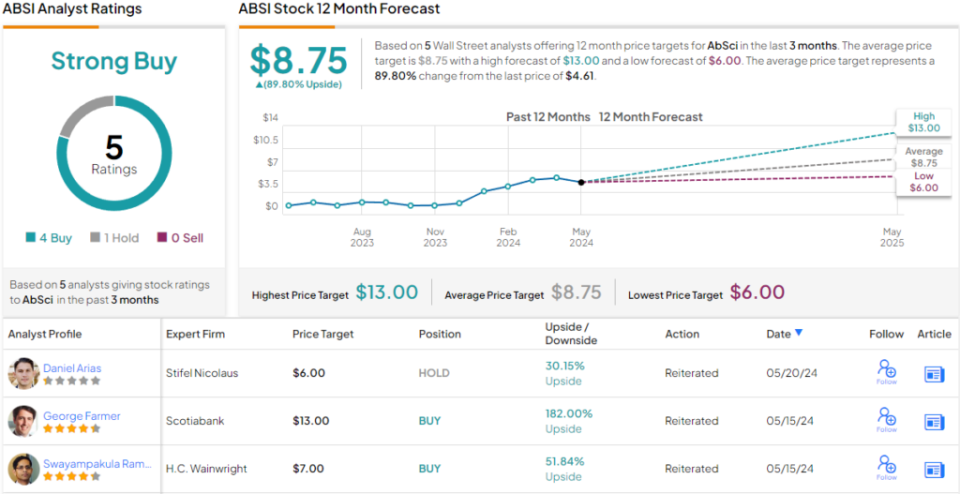

Here it appears that the Street is in sync with the Wood view; according to the TipRanks database, both these stocks are rated as Strong Buys by the analyst consensus. Let’s see why.

Prime Medicine (PRME)

The first Wood-backed stock we’ll look at fits Wood’s innovation-focused investing style perfectly. Prime Medicine is a biotech company operating at the forefront of gene editing. Founded in 2019, the company’s innovative approach centers on its Prime Editing platform, a breakthrough technology that allows for precise and flexible editing of the human genome.

Unlike traditional CRISPR methods, which typically create double-strand breaks in DNA, Prime Editing uses a more refined method involving a ‘search-and-replace’ technique to make specific alterations. This method significantly reduces the risk of unintended mutations, enhancing the safety and effectiveness of genetic therapies.

Prime Medicine’s tech holds promise for treating a wide array of genetic disorders, potentially providing cures for conditions that currently have limited or no treatment options. The company’s development efforts span key strategic areas, including hematology, liver, eye, neuromuscular, and lung, although most of the pipeline is still in the pre-clinical stage. One drug, however, is now advancing to the clinic.

In April, the FDA gave the go-ahead for the company’s IND (investigational new drug) application for PM359, its Prime Editor indicated to treat chronic granulomatous disease (CGD). This is the first-ever Prime Editor product candidate to get this far and Prime plans on initiating a Phase 1/2 trial of the drug with an initial data readout from the study slated for 2025.

Meanwhile, Wood significantly bolstered Ark Invest’s stake in PRME during Q1, acquiring 2.85 million shares. The firm’s total holdings now stand at nearly 5.99 million shares, currently worth $45.13 million.

That will probably be considered a good move by Chardan analyst Geulah Livshits, who also likes the look of what’s on offer here.

“The platform nature of its tech means the company should be able to move more quickly for subsequent programs using the same manufacturing and delivery tech,” explained the 5-star analyst. “Additionally, the current regulatory environment is highly supportive of transformative therapies for rare diseases, with FDA officials repeatedly indicating a desire to accelerate the development of such therapies including via greater engagement, use of surrogate endpoints and flexible trial designs. We believe this these factors can enable Prime to achieve sustained growth by advancing programs across and beyond its current pipeline.”

“With Prime on track to initiate IND-enabling activities for 1+ programs in its in vivo liver franchise and to nominate a DC in for RHO adRP in 2024, we believe the company is positioned for value inflection as it transitions from developing a collection of (interesting) science projects to advancing a product pipeline,” Livshits went on to say.

Bottom-line, Livshits rates PRME shares a Buy, while her $17 price target suggests the stock has room for outsized growth of 140% over the coming year. (To watch Livshits’ track record, click here)

Livshits’ bullish take on PRME is no anomaly. All the 9 other recent analyst reviews are positive, naturally making the consensus view here a Strong Buy. With an average target of $15.33, investors could potentially see returns of ~104% within the next year. (See PRME stock forecast)

AbSci (ABSI)

We’ll stay in the biotech space for Wood’s next pick. AbSci is a company that makes use of the current market’s hottest trend – it utilizes generative AI for drug development.

Describing itself as an AI drug creation company, AbSci’s platform can produce high-affinity antibodies targeting specific epitopes entirely through computer simulations. Reflecting their motto, “the data to train, the AI to create, and the wet lab to validate,” AbSci can generate antibody drug candidates much faster than traditional lab techniques. By streamlining what are traditionally laborious steps, AbSci aims to lower costs and reduce the time-to-market for new biologic drugs, thereby addressing critical needs in healthcare.

This said, the pipeline is still in its early stages. Amongst drugs being developed, the company is working on ABS-101, potentially a best-in-class anti-TL1A antibody for which it initiated IND-enabling studies in February. The company anticipates Phase 1 clinical studies for ABS-101 will kick off early next year with an interim data readout slated for the second half of 2025. Additionally, proof-of-concept results for novel immune-oncology drug candidate ABS-301 are anticipated around mid-2024.

As for Wood’s involvement, her firm, Ark Invest, initiated a new position in ABSI stock during Q1, acquiring nearly 3.28 million shares valued at $14.87 million.

The company also has a fan in Scotiabank’s George Farmer, who thinks investors should clock an opportunity while still in its infancy.

“We recommend buying ABSI shares to capture the value potential of the company’s novel AI based drug development strategy and the early-stage biologics pipeline on which it is based,” Farmer noted. “Why? Preclinical results to date support the competitive advantage that lead asset ABS-101, an AI-optimized anti-TL1A therapeutic, may have over existing agents in clinical development for addressing the massive inflammatory bowel disease (IBD) treatment market.”

To this end, Farmer rates ABSI as an Outperform (i.e., Buy), alongside a $13 price target. The implication for investors? Upside of a handsome 182% from current levels. (To watch Farmer’s track record, click here)

Most of Farmer’s colleagues agree with his assessment. Based on a mix of 4 Buys against 1 Hold, the stock claims a Strong Buy consensus rating. The forecast calls for one-year returns of ~90%, considering the average price target stands at $8.75. (See ABSI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source Agencies