Despite the volatilities and uncertainties in the energy market, oil prices remain highly favorable for upstream businesses. Integrated energy companies benefit from their stable midstream operations, which generate consistent fee-based revenues from pipeline and storage assets, bolstering the outlook for the Zacks Oil and Gas Integrated International industry. Additionally, these companies are actively participating in carbon capture and storage (CCS) projects, effectively balancing environmental considerations within the conventional energy sector.

Among the frontrunners in the industry that will likely make the most of the handsome business scenario are Exxon Mobil Corporation XOM, Chevron Corporation CVX, BP plc BP and Vista Energy SAB de CV VIST.

About the Industry

The Zacks Oil and Gas Integrated International industry covers companies primarily involved in upstream, midstream and downstream operations. These companies have upstream businesses in the United States (including prolific shale plays and the deepwater Gulf of Mexico), Asia, South America, Africa, Australia and Europe. Midstream operations of energy companies entail transporting oil, natural gas liquids and refined petroleum products. In downstream businesses, the firms buy raw crude to produce refined petroleum products. The companies’ downstream activities involve chemical businesses that manufacture raw materials for plastics. The integrated players are gradually focusing on renewables, leading to the energy transition. The firms aim to lower emissions from operations and cut the carbon intensity of the products sold.

3 Trends Shaping the Future of the Industry

High Oil Prices: The price of West Texas Intermediate (WTI) crude has surged above $75 per barrel, creating an advantageous climate for exploration and production activities. Similarly, Brent crude is performing well, trading at more than $80 per barrel. The U.S. Energy Information Administration projects the average spot prices for WTI and Brent in 2024 at $83.05 and $87.79 per barrel, respectively. This indicates a favorable upstream business environment for integrated oil companies.

Stable Fee-Based Revenues: The midstream operations of integrated companies are less susceptible to commodity price volatility. This stability arises from the fact that pipeline and storage assets are typically contracted by shippers on a long-term basis, ensuring consistent fee-based revenue streams.

Strong Focus on Lowering Emissions: Integrated industry players operating both within the United States and internationally have acknowledged climate change as a significant risk that must be addressed. These companies are now not only concentrating on lowering greenhouse gas emissions and reducing flaring rates but also actively participating in multiple carbon CCS projects worldwide.

Zacks Industry Rank Indicates Bullish Outlook

The Zacks Oil and Gas Integrated International industry is part of the broader Zacks Oil – Energy sector. It carries a Zacks Industry Rank #101, which places it in the top 40% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bullish near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider, let’s take a look at the industry’s recent stock market performance and valuation picture.

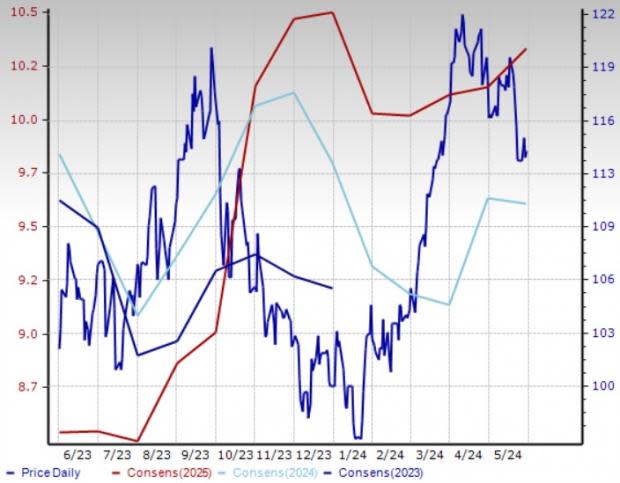

Industry Underperforms Sector and S&P 500

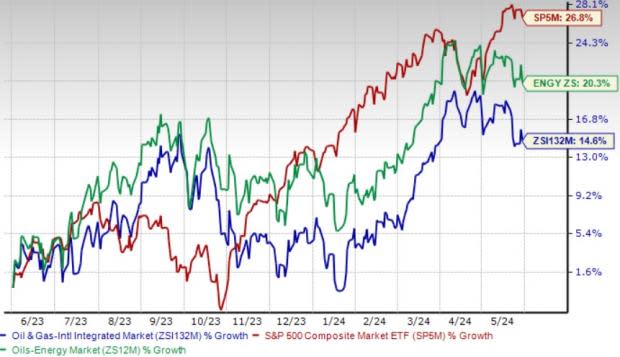

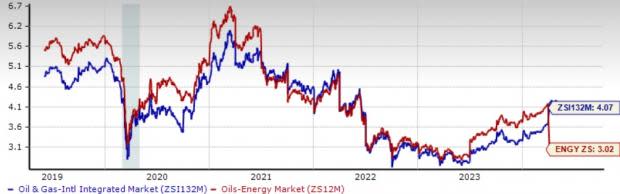

The Zacks Oil and Gas Integrated International industry has underperformed the broader Zacks Oil – Energy sector and the Zacks S&P 500 composite over the past year.

The industry has risen 14.6% over this period, trailing the S&P 500’s rally of 26.8% and the broader sector’s improvement of 20.3%.

One-Year Price Performance

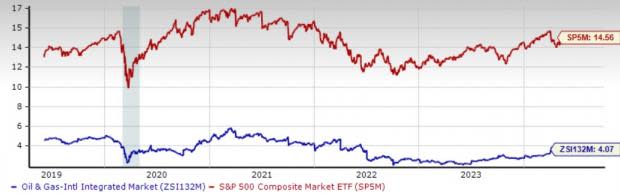

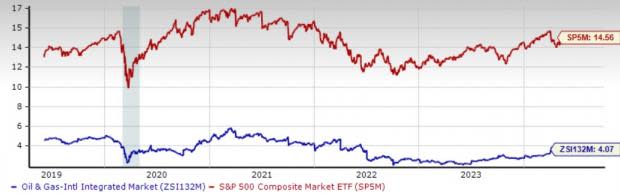

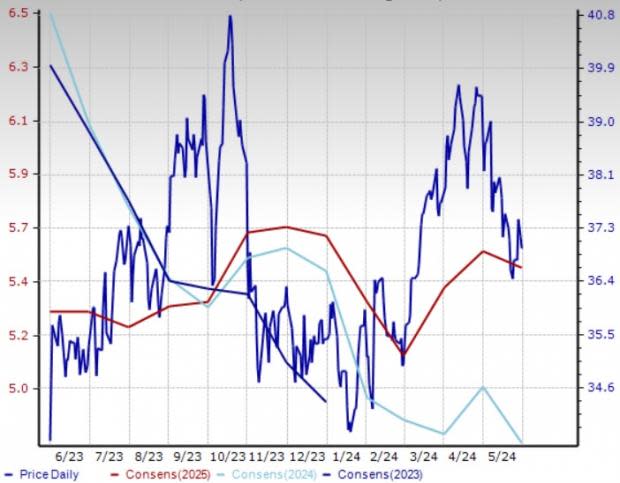

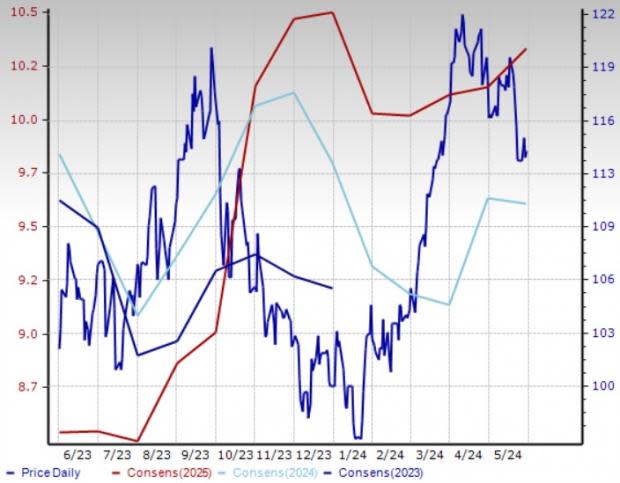

Industry’s Current Valuation

Since oil and gas companies are debt-laden, it makes sense to value them based on the Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA) ratio. This is because the valuation metric takes not just equity into account but also the level of debt.

On the basis of the trailing 12-month EV/EBITDA, the industry is currently trading at 4.07X, lower than the S&P 500’s 14.56X. It is, however, higher than the sector’s trailing 12-month EV/EBITDA of 3.02X.

Over the past five years, the industry has traded as high as 6.07X and as low as 2.57X, with a median of 4.09X.

Trailing 12-Month EV/EBITDA Ratio

4 Integrated International Stocks Moving Ahead of the Pack

BP: The British energy giant plans to become a net-zero emissions player by 2050 or earlier. The integrated company intends to invest and create its renewable energy generation capacity of 20 gigawatts by 2025. The company, currently carrying a Zacks Rank #3 (Hold), has solid upstream and downstream activities. BP also has a strong focus on reducing its debt load and has been returning capital to shareholders through buybacks and dividends.

Price and Consensus: BP

Chevron: It is also a leading integrated energy player with operations across the world. Apart from a strong balance sheet, it has a solid capital discipline that will help it tide over volatile commodity prices. The energy major’s conservative capital spending will probably help CVX generate considerable cash flow, even in an unstable business scenario. The primary growth driver for the #3 Ranked stock, at least in the near to medium term, is its low-cost Permian projects. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: CVX

ExxonMobil: It is among the largest integrated energy companies in the world. The energy major can rely on its strong balance sheet to withstand any business turmoil. ExxonMobil, with a Zacks Rank of 3, is banking on low-cost project pipelines centered around the Permian — the most prolific basin in the United States — and offshore Guyana resources. XOM has a steadfast commitment to reducing greenhouse gas emissions, and actively participating in multiple CCS projects worldwide.

Price and Consensus: XOM

Vista Energy, a leading exploration and production company, has a significant presence in Vaca Muerta, a highly productive shale oil and gas play outside of North America. The company, currently carrying a Zacks Rank #2 (Buy), has set an ambitious goal of achieving net-zero emissions by 2026.

Price and Consensus: VIST

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Vista Oil & Gas, S.A.B. de C.V. Sponsored ADR (VIST) : Free Stock Analysis Report

Source Agencies