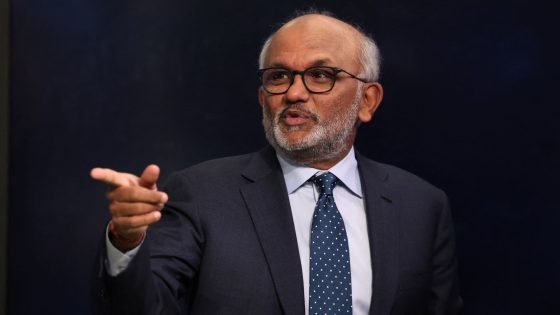

Adobe CEO Shantanu Narayen speaks during an interview with CNBC on the floor at the New York Stock Exchange in New York City, Feb. 20, 2024.

Brendan Mcdermid | Reuters

Shares of Adobe closed down more than 8% on Friday, a day after the software company released third-quarter results that offered worse-than-expected guidance for the fourth quarter.

Adobe reported $5.41 billion in revenue for the quarter, up 11% year over year and above the $5.37 billion expected by analysts according to LSEG. The company’s net income for the period was $1.68 billion, or $3.76 per diluted share, up from $1.40 billion, or $3.05 per share, in the year-ago period.

For its fourth quarter, Adobe said it expects revenue in the range of $5.50 billion and $5.55 billion, and earnings per share between $4.63 and $4.68. Analysts polled by LSEG were expecting a forecast of $5.61 billion in sales and $4.67 in earnings per share.

Goldman Sachs analysts reiterated their buy rating and their $640 price target on the stock. They said they think Adobe’s disappointing outlook overshadowed the strength of its core business, adding that the business is being bolstered by artificial intelligence adoption and its key growth drivers “remain intact.”

“While investors are likely concerned about guidance’s effect on upcoming DM FY25 guidance and hesitant about where we are in the maturity of the business, we believe this reaction is overblown,” they wrote in a note Friday.

Analysts at Bank of America said Adobe reported results and outlook that were somewhat mixed but healthy overall.

They said Adobe is driving “meaningful AI generation,” and they argued that it is the only company aside from Microsoft doing so “at scale at this point in the cycle.”

“No change to our positive view on Adobe,” they wrote in a Friday note. “While we were hoping for a better Q4 digital media outlook, our FY26 estimates still move higher on more balanced creative cloud and document cloud strength.”

UBS analysts said Adobe’s fourth-quarter outlook is “uninspiring” but that the sell-off seems overdone.

“In our view the print was hardly a disaster,” they wrote Friday.

â CNBC’s Michael Bloom and Kif Leswing contributed to this report.

Source Agencies