The average 30-year fixed mortgage rate dipped back toward 7% this week, settling at 7.09%, according to Freddie Mac. This is the first time the weekly average rate has fallen in over a month.

Recent rate volatility — including this week’s drop from 7.22% and last month’s steady rise — has prompted some financial institutions to modify their mortgage outlook for the rest of 2024.

“An environment where rates continue to hover above 7 percent impacts both sellers and buyers. Many potential sellers remain hesitant to list their home and part with lower mortgage rates from years prior, adversely impacting supply and keeping house prices elevated,” said Sam Khater, Freddie Mac’s chief economist. “These elevated house prices add to the overall affordability challenges that potential buyers face in this high-rate environment.”

Experts adjusting the year-end outlook

Robust economic data and stubborn inflation have driven housing experts to change their forecast of where rates would land at the end of 2024.

Fannie Mae, a government-backed mortgage institution, increased its year-end prediction to 6.4% from 5.9% earlier this year.

“Our … forecast includes the Fed cutting interest rates 25 basis points two times in the fall,” Douglas Duncan, Fannie Mae’s chief economist, told Yahoo Finance.

The Federal Reserve held the federal funds rate steady last week. Meanwhile, mortgage rates — influenced by the Fed’s benchmark — have surged past 7% over the last three weeks.

To land at or near the modified forecast, Duncan said the core personal consumption expenditure (PCE) — the Fed’s preferred gauge for inflation — will need to drop toward 2% for at least three consecutive months. The latest core PCE gained 2.8% in March year-over-year.

The National Association of Realtors (NAR) now expects average rates to settle at 6.5% by year-end, modified from the 6.3% predicted at the beginning of the year.

“The Federal Reserve has delayed rate cuts,” said Lawrence Yun, NAR’s chief economist. “I would have thought that by now, rates would be lower and rate cuts would have begun. Whatever rate cut the Federal Reserve does not do this year will simply get pushed back to 2025. They’re calling for a September rate cut, but we’ll see.”

Homebuyers hesitate amid volatile rates

Higher for longer rates mean homebuyers must shell out more of their monthly paycheck to afford a home.

With this week’s average rate, homebuyers would pay $1,611 monthly on a $300,000 home with a 20% down payment. In contrast, the same house and payment cost $1,004 in the same week in 2021, when the average mortgage rate was 2.94%, according to the Yahoo Finance mortgage calculator.

The national median payment surpassed $2,200 in March from $2,184 the previous month, according to the Mortgage Bankers Association. Monthly mortgage payments have increased more than 5% compared to last March.

The overall climate is creating pessimism about the housing market: Nearly 80% of consumers say now is a bad time to buy a home. Fewer Americans think mortgage rates will fall over the next 12 months.

“[Consumers have] seen over the past six months, a couple of instances where rates ran up significantly, then they came back down, then they went back up,” Duncan said. “If you take the combined uncertainty about whether the Fed will cut rates … it’s easy to see why consumers would be uncertain and probably not take action in the near term.”

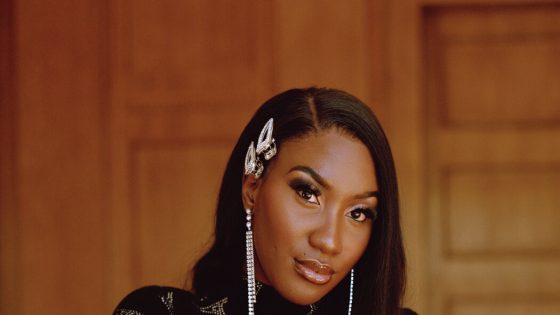

Rebecca Chen is a reporter for Yahoo Finance and previously worked as an investment tax certified public accountant (CPA).

Click here for the latest personal finance news to help you with investing, paying off debt, buying a home, retirement, and more

Read the latest financial and business news from Yahoo Finance

Source Agencies